Region:Europe

Author(s):Rebecca

Product Code:KRAC0323

Pages:82

Published On:August 2025

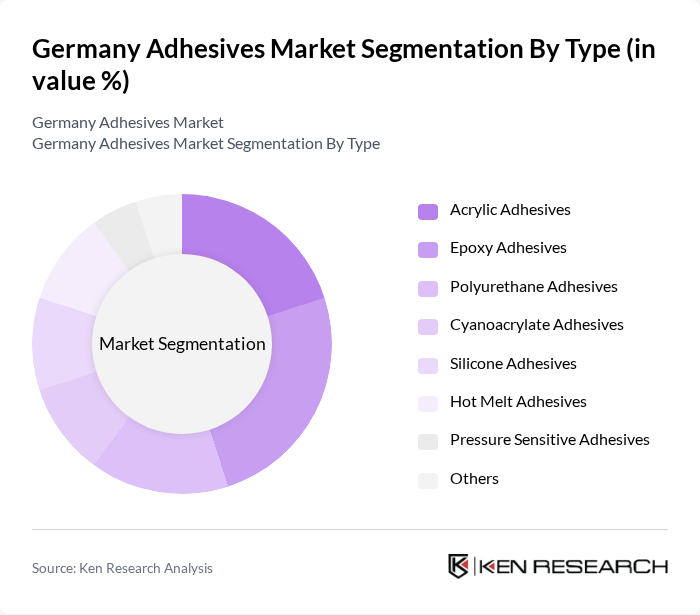

By Type:The adhesive market is segmented into Acrylic Adhesives, Epoxy Adhesives, Polyurethane Adhesives, Cyanoacrylate Adhesives, Silicone Adhesives, Hot Melt Adhesives, Pressure Sensitive Adhesives, and Others. Each type addresses specific industrial needs: acrylic adhesives offer versatility and fast curing, epoxy adhesives provide high strength and chemical resistance, polyurethane adhesives are valued for flexibility and durability, cyanoacrylates deliver rapid bonding, silicone adhesives excel in high-temperature applications, hot melt adhesives are favored for packaging and assembly, and pressure-sensitive adhesives are used in tapes and labels .

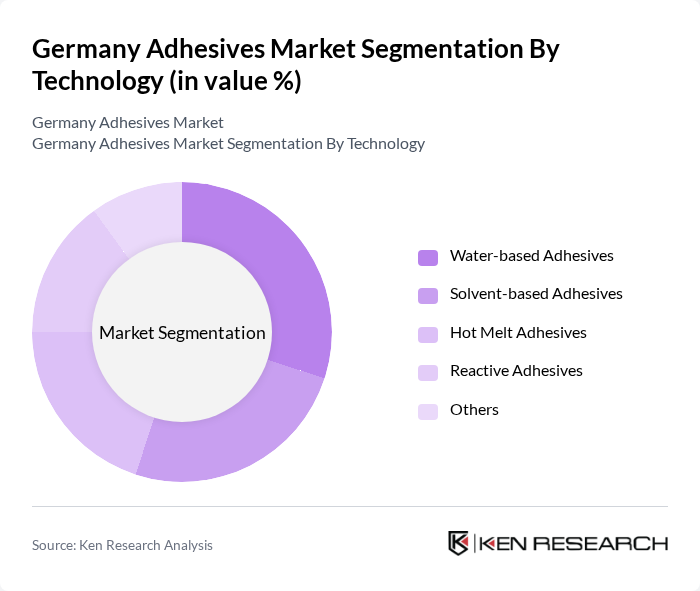

By Technology:The adhesives market is also categorized by technology, including Water-based Adhesives, Solvent-based Adhesives, Hot Melt Adhesives, Reactive Adhesives, and Others. Water-based adhesives are preferred for their low VOC emissions and environmental safety, solvent-based adhesives are used where high performance is needed, hot melt adhesives are popular in packaging and product assembly, and reactive adhesives are increasingly adopted for industrial and construction applications due to their strong bonding and chemical resistance .

The Germany Adhesives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, BASF SE, Sika AG, 3M Deutschland GmbH, Bostik SA, H.B. Fuller Company, Dow Inc., Evonik Industries AG, RPM International Inc., Jowat SE, Tesa SE, KRAHN Chemie GmbH, Mapei S.p.A., Wacker Chemie AG, and Soudal N.V. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Germany adhesives market appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly prioritize eco-friendly solutions, the demand for bio-based and low-VOC adhesives is expected to rise. Additionally, the integration of digital technologies in manufacturing processes will enhance efficiency and customization capabilities, allowing companies to meet specific customer needs. These trends indicate a dynamic market landscape poised for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Acrylic Adhesives Epoxy Adhesives Polyurethane Adhesives Cyanoacrylate Adhesives Silicone Adhesives Hot Melt Adhesives Pressure Sensitive Adhesives Others |

| By Technology | Water-based Adhesives Solvent-based Adhesives Hot Melt Adhesives Reactive Adhesives Others |

| By End-User Industry | Automotive Construction Packaging Electronics Medical Furniture Others |

| By Application | Bonding and Assembly Sealing and Gasketing Laminating and Coating Packaging and Labeling Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Adhesives | 100 | Project Managers, Procurement Officers |

| Automotive Adhesives | 80 | Manufacturing Engineers, Quality Control Managers |

| Packaging Adhesives | 90 | Product Development Managers, Supply Chain Coordinators |

| Consumer Adhesives | 60 | Retail Buyers, Marketing Managers |

| Industrial Adhesives | 50 | Operations Managers, Technical Sales Representatives |

The Germany Adhesives Market is valued at approximately USD 3.4 billion, driven by demand from industries such as automotive, construction, and packaging, particularly due to the growth of e-commerce and food sectors.