Region:Asia

Author(s):Dev

Product Code:KRAB0487

Pages:95

Published On:August 2025

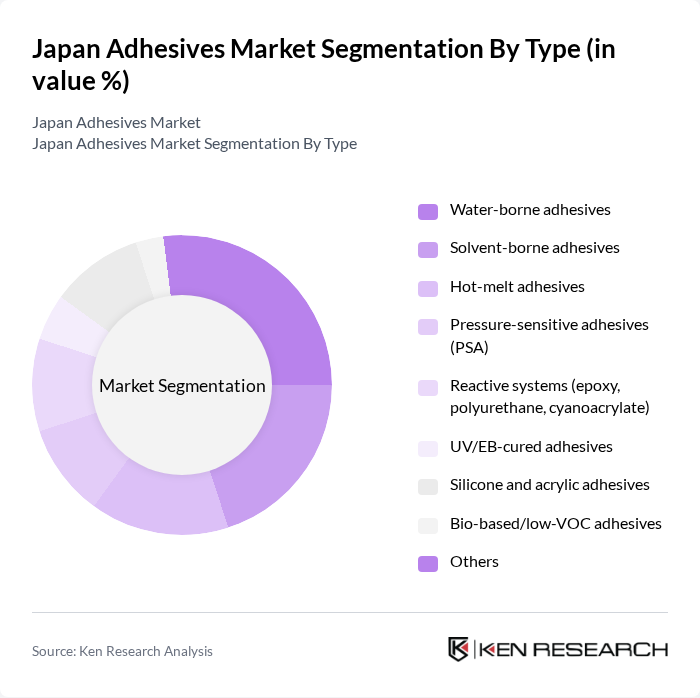

By Type:The adhesives market can be segmented into various types, including water-borne adhesives, solvent-borne adhesives, hot-melt adhesives, pressure-sensitive adhesives (PSA), reactive systems (epoxy, polyurethane, cyanoacrylate), UV/EB-cured adhesives, silicone and acrylic adhesives, bio-based/low-VOC adhesives, and others. Each type serves distinct applications across multiple industries, catering to specific bonding requirements.

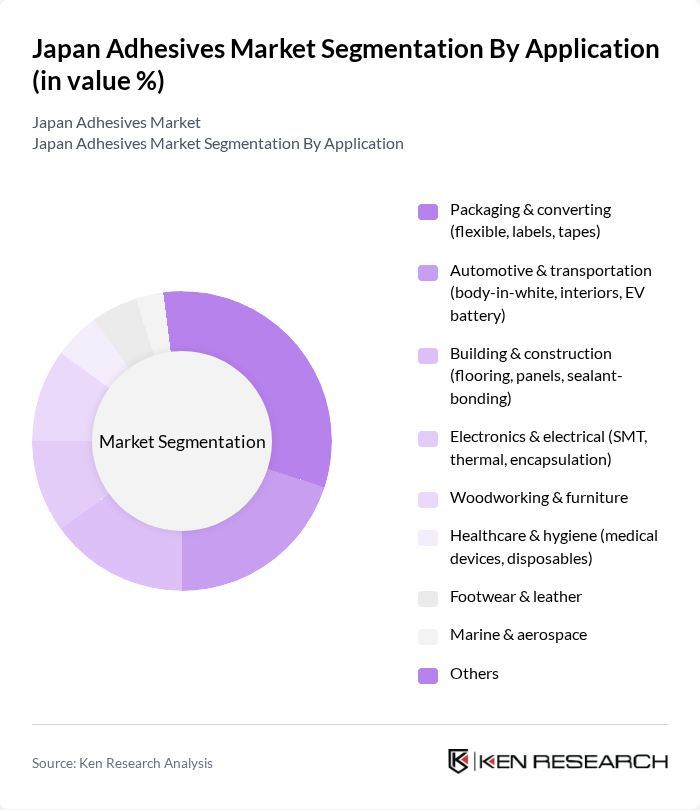

By Application:The adhesives market is also segmented by application, which includes packaging & converting (flexible, labels, tapes), automotive & transportation (body-in-white, interiors, EV battery), building & construction (flooring, panels, sealant-bonding), electronics & electrical (SMT, thermal, encapsulation), woodworking & furniture, healthcare & hygiene (medical devices, disposables), footwear & leather, marine & aerospace, and others. Each application area has unique requirements that drive the demand for specific adhesive types.

The Japan Adhesives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, 3M Company, Sika AG, H.B. Fuller Company, Bostik (Arkema Group), Ashland Inc., Dow Inc., Mitsubishi Chemical Group Corporation, Toyochem Co., Ltd. (Toyobo Group), Nitto Denko Corporation, Cemedine Co., Ltd., Aica Kogyo Co., Ltd. (AICA Group), Yokohama Rubber Co., Ltd. (adhesive tapes/industrial materials), Shin-Etsu Chemical Co., Ltd. (silicone adhesives), and Konishi Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Japan adhesives market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The shift towards sustainable and eco-friendly products is expected to reshape product offerings, with manufacturers increasingly focusing on bio-based and low-VOC adhesives. Additionally, the integration of digital technologies in manufacturing processes will enhance efficiency and customization capabilities, allowing companies to meet diverse customer needs. As the market adapts to these trends, innovative applications will emerge, fostering growth and competitiveness in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-borne adhesives Solvent-borne adhesives Hot-melt adhesives Pressure-sensitive adhesives (PSA) Reactive systems (epoxy, polyurethane, cyanoacrylate) UV/EB-cured adhesives Silicone and acrylic adhesives Bio-based/low-VOC adhesives Others |

| By Application | Packaging & converting (flexible, labels, tapes) Automotive & transportation (body-in-white, interiors, EV battery) Building & construction (flooring, panels, sealant-bonding) Electronics & electrical (SMT, thermal, encapsulation) Woodworking & furniture Healthcare & hygiene (medical devices, disposables) Footwear & leather Marine & aerospace Others |

| By End-User | Industrial manufacturing Automotive OEMs and Tier suppliers Construction contractors and prefab manufacturers Electronics and semiconductor manufacturers Packaging converters and FMCG Healthcare and hygiene product manufacturers Others |

| By Distribution Channel | Direct (key accounts/OEM) Industrial distributors E-commerce/online B2B Retail/DIY Others |

| By Region | Kanto Kansai Chubu Kyushu Hokkaido Shikoku Tohoku Chugoku Okinawa |

| By Price Range | Economy Mid-range Premium Others |

| By Packaging Type | Bulk (drums, IBCs, tankers) Industrial packs (pails, cartridges, sausage packs) Retail/DIY packs (tubes, sticks, aerosols) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Adhesives | 100 | Product Engineers, Procurement Managers |

| Construction Adhesives | 120 | Project Managers, Site Supervisors |

| Packaging Adhesives | 80 | Packaging Designers, Supply Chain Coordinators |

| Consumer Adhesives | 90 | Marketing Managers, Retail Buyers |

| Industrial Adhesives | 70 | Operations Managers, Quality Control Specialists |

The Japan Adhesives Market is valued at approximately USD 4 billion, driven by demand from sectors such as automotive, construction, packaging, and electronics. This growth reflects a five-year historical analysis highlighting the market's expansion and technological advancements.