Region:Europe

Author(s):Geetanshi

Product Code:KRAB5189

Pages:98

Published On:October 2025

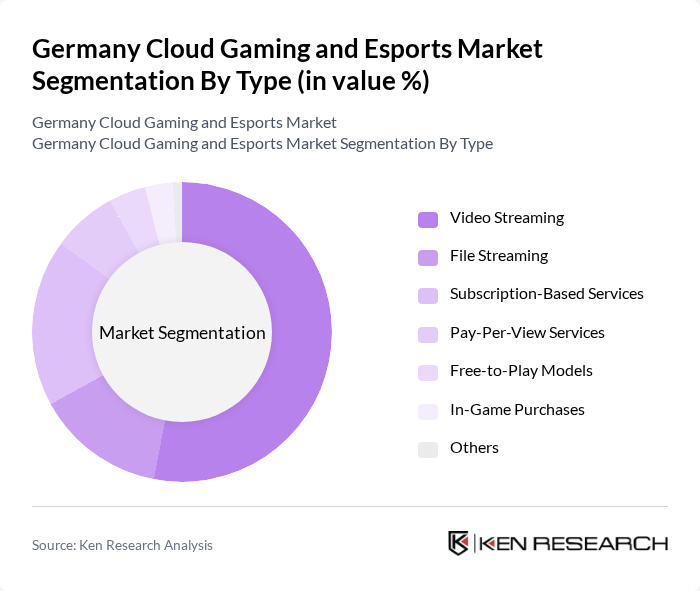

By Type:The cloud gaming and esports market is segmented into video streaming, file streaming, subscription-based services, pay-per-view services, free-to-play models, in-game purchases, and others. Video streaming remains the leading segment, driven by the growing demand for live gaming content and esports events. The popularity of platforms such as Twitch and YouTube Gaming has accelerated this trend, attracting millions of viewers and generating new revenue streams for both content creators and game developers .

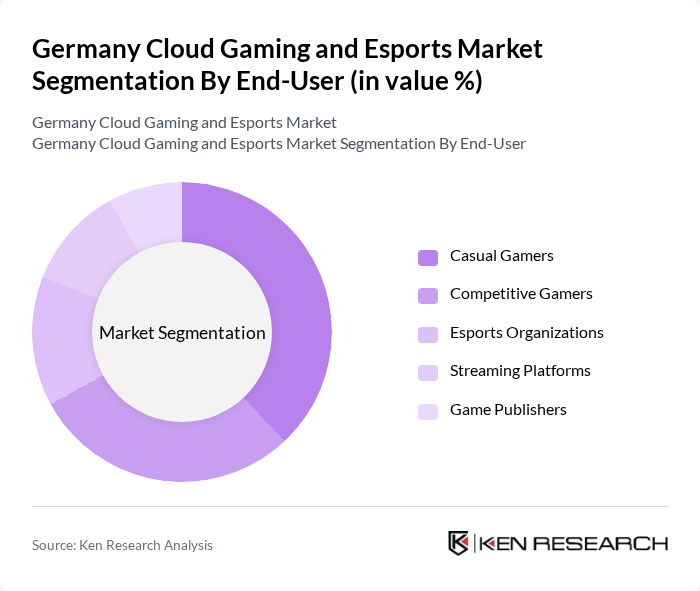

By End-User:The end-user segmentation includes casual gamers, competitive gamers, esports organizations, streaming platforms, and game publishers. Casual gamers form the largest segment, supported by the accessibility and convenience of cloud gaming. Competitive gamers also represent a significant portion, driven by the increasing popularity of esports tournaments and leagues. This segment is characterized by a dedicated audience investing in high-performance gaming equipment and premium services, further fueling the esports ecosystem .

The Germany Cloud Gaming and Esports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ubisoft Entertainment S.A., Electronic Arts Inc., Activision Blizzard, Inc., Riot Games, Inc., Tencent Holdings Limited, Epic Games, Inc., Valve Corporation, Bandai Namco Entertainment Inc., Take-Two Interactive Software, Inc., Square Enix Holdings Co., Ltd., SEGA Sammy Holdings Inc., Paradox Interactive AB, THQ Nordic AB (Embracer Group), 505 Games S.p.A., Plaion GmbH (formerly Koch Media GmbH), ESL FACEIT Group, Freaks 4U Gaming GmbH, Gameforge AG, Deutsche Telekom AG (MagentaGaming), NVIDIA Corporation (GeForce NOW) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cloud gaming and esports market in Germany appears promising, driven by technological advancements and evolving consumer preferences. The integration of 5G technology is expected to enhance gaming experiences, reducing latency and improving accessibility. Additionally, the rise of hybrid gaming platforms that combine traditional and cloud gaming is likely to attract a diverse audience. As user engagement strategies evolve, companies will focus on community building, further solidifying their market presence and fostering loyalty among gamers.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Streaming File Streaming Subscription-Based Services Pay-Per-View Services Free-to-Play Models In-Game Purchases Others |

| By End-User | Casual Gamers Competitive Gamers Esports Organizations Streaming Platforms Game Publishers |

| By Distribution Channel | Online Platforms Telecom Bundles Retail Outlets Direct Sales Others |

| By Game Genre | Action Strategy Sports Role-Playing Games (RPG) Simulation Racing Others |

| By Age Group | Children (Under 12) Teenagers (13-19) Young Adults (20-35) Adults (36 and above) |

| By Payment Model | One-Time Purchase Subscription Freemium In-App Purchases Others |

| By Device Type | PC Console Mobile Smart TV Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Gaming Users | 100 | Casual Gamers, Hardcore Gamers |

| Esports Viewers | 80 | Esports Fans, Event Attendees |

| Game Developers | 60 | Indie Developers, Large Studios |

| Esports Organizations | 40 | Team Managers, Marketing Directors |

| Cloud Service Providers | 40 | Product Managers, Technical Leads |

The Germany Cloud Gaming and Esports Market is valued at approximately USD 1.05 billion, reflecting significant growth driven by increased internet adoption, the rise of 5G networks, and the popularity of esports among younger demographics.