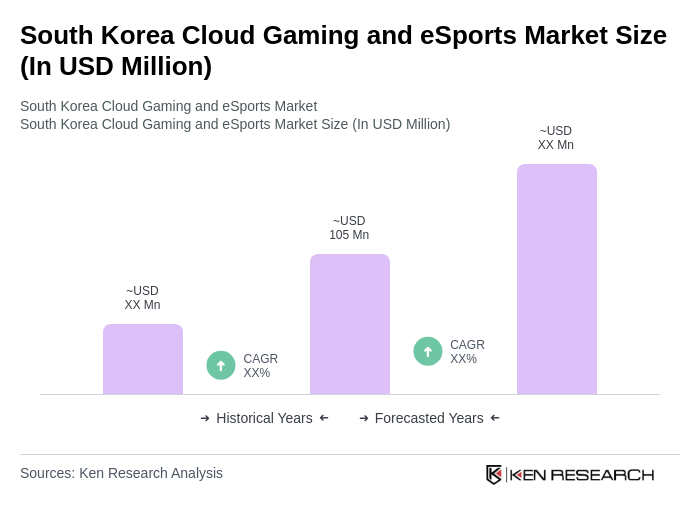

South Korea Cloud Gaming and eSports Market Overview

- The South Korea Cloud Gaming and eSports Market is valued at USD 105 million, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of high-speed internet, the proliferation of mobile devices, and a growing interest in competitive gaming among the youth. The market has seen a surge in cloud gaming services and eSports tournaments, which have attracted significant investments and sponsorships. Notably, cloud gaming in South Korea is experiencing rapid expansion due to the popularity of video streaming and file streaming platforms, as well as the integration of advanced AI and edge-native 5G technologies, which further enhance user experience and accessibility .

- Seoul is the dominant city in the South Korea Cloud Gaming and eSports Market, owing to its advanced technological infrastructure and a vibrant gaming culture. Other notable cities include Busan and Incheon, which host major gaming events and tournaments, further solidifying South Korea's position as a global leader in the gaming industry. The country's strong emphasis on technology and innovation, including government cloud-first initiatives and widespread deployment of 5G networks, also contributes to its market dominance .

- In 2023, the South Korean government implemented regulations to promote the growth of the eSports industry, including the establishment of a legal framework for eSports tournaments and player contracts. The “eSports Industry Promotion Act, 2023” issued by the Ministry of Culture, Sports and Tourism, provides operational guidelines for tournament organizers, mandates standardized player contracts, and sets compliance requirements for prize distribution and event licensing. This initiative aims to enhance the professionalism of the industry, protect players' rights, and attract international events, thereby fostering a more sustainable and competitive environment for eSports in the country .

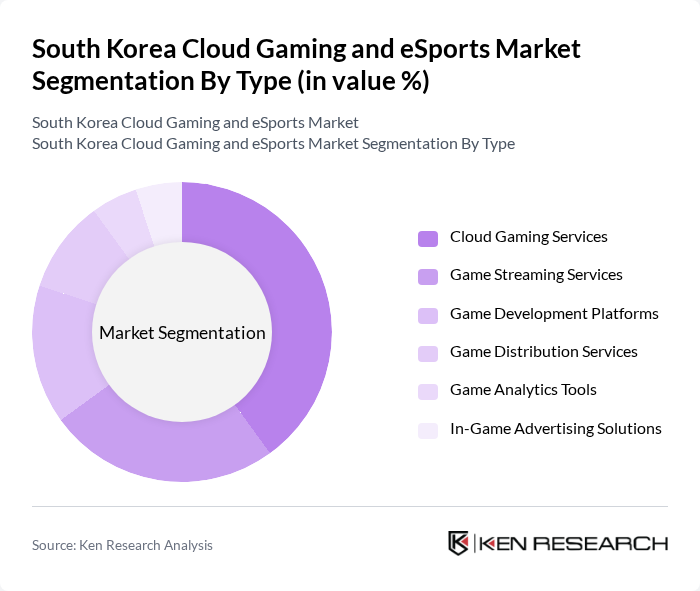

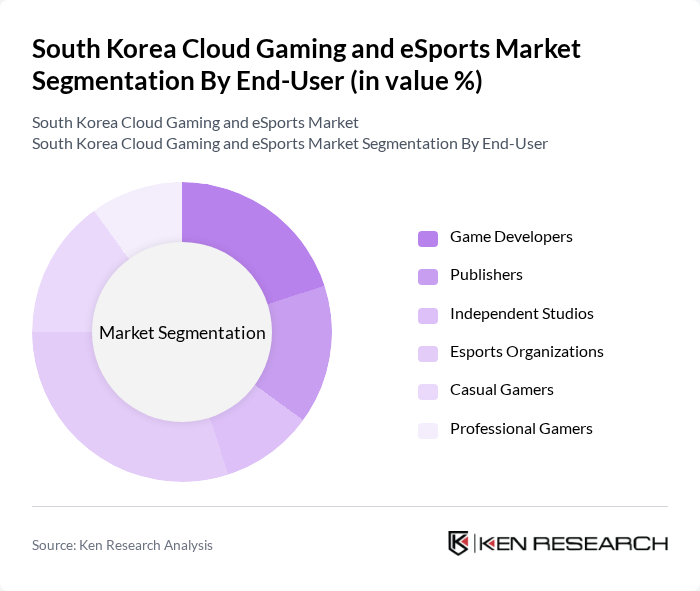

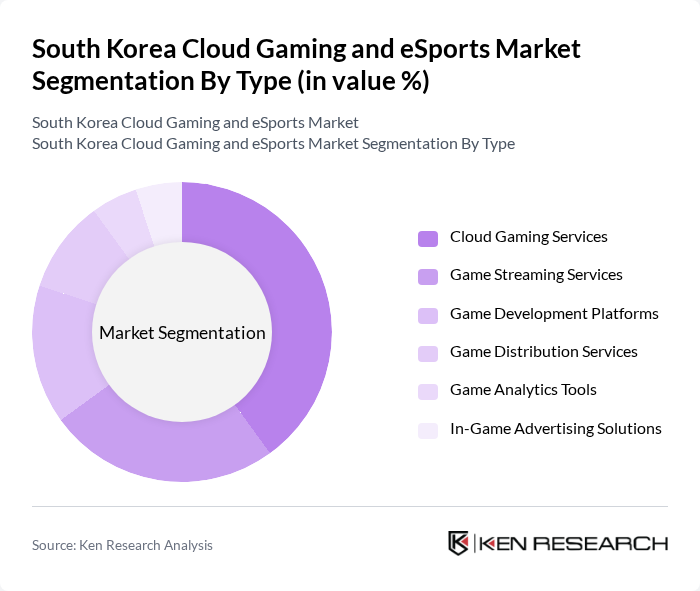

South Korea Cloud Gaming and eSports Market Segmentation

By Type:The market is segmented into various types, including Cloud Gaming Services, Game Streaming Services, Game Development Platforms, Game Distribution Services, Game Analytics Tools, and In-Game Advertising Solutions. Among these, Cloud Gaming Services are leading due to the increasing demand for on-demand gaming experiences without the need for high-end hardware. Game Streaming Services are also gaining traction as they allow gamers to share their gameplay live, enhancing community engagement. Video streaming platforms currently hold the largest revenue share among cloud gaming types, reflecting strong consumer preference for interactive and real-time content .

By End-User:The end-user segmentation includes Game Developers, Publishers, Independent Studios, Esports Organizations, Casual Gamers, and Professional Gamers. The segment of Esports Organizations is currently dominating the market, driven by the increasing popularity of competitive gaming and the rise of professional gaming leagues. Casual Gamers are also a significant segment, as they contribute to the overall gaming ecosystem through participation in various gaming platforms. The market is further supported by the expansion of mobile gaming and the integration of cloud-based analytics tools, which enable enhanced user engagement and monetization strategies .

South Korea Cloud Gaming and eSports Market Competitive Landscape

The South Korea Cloud Gaming and eSports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nexon Co., Ltd., NCSoft Corporation, Krafton, Inc., Smilegate Holdings, Inc., Netmarble Corporation, Com2uS Corp., Gamevil Inc., Pearl Abyss Corporation, Kakao Games Corp., HanbitSoft Inc., WeMade Co., Ltd., T1 Entertainment & Sports contribute to innovation, geographic expansion, and service delivery in this space.

South Korea Cloud Gaming and eSports Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:South Korea boasts an internet penetration rate of approximately99%, one of the highest globally. This extensive connectivity facilitates seamless access to cloud gaming platforms, enabling users to engage in high-quality gaming experiences without the need for powerful hardware. The country's robust digital infrastructure, supported by over22 million fixed broadband subscriptions, further enhances the appeal of cloud gaming, driving user adoption and engagement in this rapidly evolving market.

- Rise of Mobile Gaming:The mobile gaming sector in South Korea generated revenues exceedingUSD 6.5 billionin future, reflecting a significant shift in consumer preferences towards mobile platforms. With over34 million mobile gamers, the demand for cloud gaming services that cater to mobile devices is surging. This trend is bolstered by the increasing availability of high-performance smartphones, which allows gamers to enjoy immersive experiences on-the-go, thus expanding the overall market reach.

- Popularity of eSports Events:The eSports industry in South Korea is thriving, with an estimated audience ofover 10 million regular viewersfor major tournaments. Events like the League of Legends World Championship attract significant attention, driving interest in cloud gaming platforms that offer access to competitive gaming. The government's support for eSports, including funding and infrastructure development, further solidifies its position as a growth driver, encouraging more players to participate and engage with cloud gaming services.

Market Challenges

- High Competition Among Providers:The South Korean cloud gaming market is characterized by intense competition, with major players like NVIDIA GeForce NOW and Google Stadia vying for market share. This saturation leads to aggressive pricing strategies and marketing efforts, which can strain profit margins. As companies invest heavily in technology and user acquisition, maintaining a competitive edge becomes increasingly challenging, potentially impacting long-term sustainability in the market.

- Data Privacy Concerns:With the rise of cloud gaming, data privacy has emerged as a significant challenge. South Korea's Personal Information Protection Act mandates strict compliance, requiring companies to implement robust data security measures. Violations can result in hefty fines, with penalties reaching up tothree percent of a company's annual revenue. As consumers become more aware of data privacy issues, companies must prioritize transparency and security to build trust and retain users in this competitive landscape.

South Korea Cloud Gaming and eSports Market Future Outlook

The South Korean cloud gaming and eSports market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As 5G networks expand, they will enhance the gaming experience, reducing latency and improving accessibility. Additionally, the integration of virtual reality into cloud gaming platforms is expected to create immersive experiences, attracting a broader audience. These trends indicate a dynamic future, where innovation and user engagement will play crucial roles in shaping the market landscape.

Market Opportunities

- Expansion of 5G Networks:The rollout of 5G technology in South Korea is projected to reachover 90% population coverage in future, significantly enhancing cloud gaming experiences. This high-speed connectivity will enable seamless gameplay, attracting more users to cloud platforms and fostering growth in the gaming sector. The improved network infrastructure will also facilitate real-time interactions, making cloud gaming more appealing to competitive players.

- Partnerships with Game Developers:Collaborations between cloud gaming providers and game developers are on the rise, withnumerous partnerships established in future. These alliances enable exclusive game releases on cloud platforms, driving user engagement and expanding the gaming library. By leveraging developer expertise, cloud gaming services can enhance their offerings, attracting a diverse audience and increasing market penetration.