Region:Asia

Author(s):Dev

Product Code:KRAB5472

Pages:98

Published On:October 2025

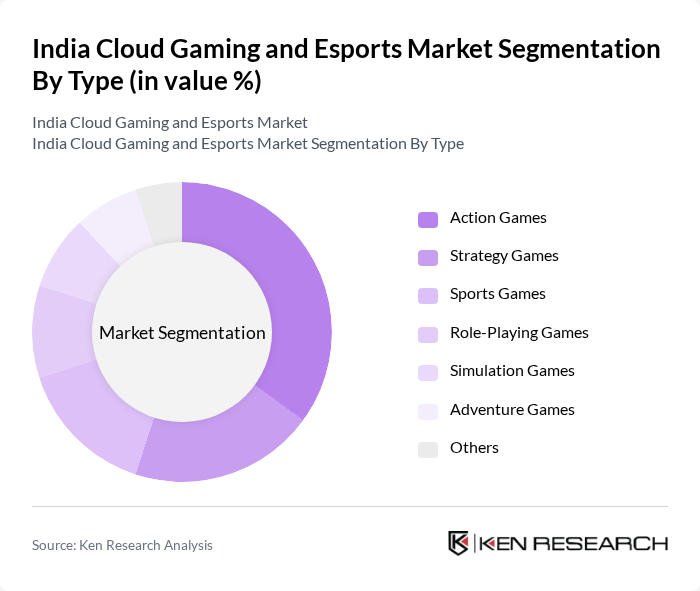

By Type:The market is segmented into various types of games, including Action Games, Strategy Games, Sports Games, Role-Playing Games, Simulation Games, Adventure Games, and Others. Among these, Action Games have emerged as the dominant segment, driven by their engaging gameplay and competitive nature. The increasing popularity of mobile gaming has further fueled the demand for action-oriented titles, appealing to a broad audience.

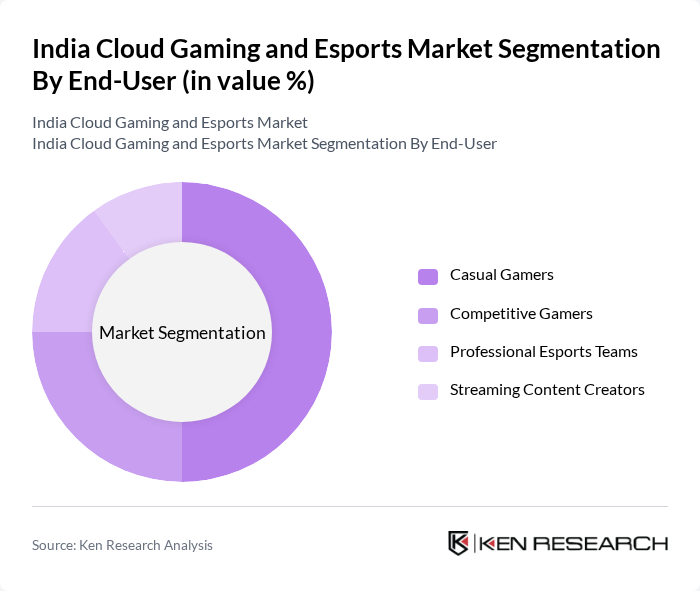

By End-User:The market is categorized into Casual Gamers, Competitive Gamers, Professional Esports Teams, and Streaming Content Creators. Casual Gamers represent the largest segment, as they engage in gaming for entertainment and relaxation. The rise of mobile gaming has made it accessible to a wider audience, contributing to the growth of this segment.

The India Cloud Gaming and Esports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nazara Technologies, Dream11, MPL (Mobile Premier League), Paytm First Games, Loco, Gamerji, Rooter, NODWIN Gaming, JetSynthesys, Games2win, 8bit Creatives, RummyCircle, A23 Rummy, Esports Club, The Esports League contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India cloud gaming and esports market appears promising, driven by technological advancements and increasing consumer interest. The integration of 5G technology is expected to enhance gaming experiences, reducing latency and improving graphics quality. Additionally, the rise of localized content tailored to Indian audiences will likely attract more players. As the esports ecosystem matures, we can anticipate a surge in professional leagues and tournaments, further solidifying India's position as a key player in the global gaming landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Action Games Strategy Games Sports Games Role-Playing Games Simulation Games Adventure Games Others |

| By End-User | Casual Gamers Competitive Gamers Professional Esports Teams Streaming Content Creators |

| By Region | North India South India East India West India |

| By Platform | Mobile PC Console |

| By Distribution Channel | Online Platforms Retail Stores Direct Sales |

| By Pricing Model | Free-to-Play Subscription-Based Pay-to-Play |

| By Game Genre | Multiplayer Online Battle Arena (MOBA) First-Person Shooter (FPS) Battle Royale Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Gaming Users | 150 | Casual Gamers, Hardcore Gamers |

| Esports Participants | 100 | Professional Gamers, Team Managers |

| Game Developers | 80 | Game Designers, Product Managers |

| Streaming Platform Subscribers | 120 | Content Creators, Viewers |

| Industry Experts | 50 | Analysts, Consultants, Academics |

The India Cloud Gaming and Esports Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased smartphone penetration, high-speed internet access, and a rising interest in online gaming and esports among the youth.