Region:Europe

Author(s):Geetanshi

Product Code:KRAB5753

Pages:82

Published On:October 2025

By Type:The market is segmented into various types of cybersecurity solutions, including Endpoint Security, Network Security, Application Security, Cloud Security, Identity and Access Management, Data Loss Prevention, Integrated Risk Management, Infrastructure Protection, and Other Solution Types. Among these,Endpoint Securityis currently the leading sub-segment due to the increasing number of remote workers and the need to secure devices against malware and phishing attacks. The rise in mobile device usage and the growing trend of Bring Your Own Device (BYOD) policies in organizations further contribute to the demand for endpoint security solutions. The rapid adoption of cloud services and the proliferation of IoT devices are also driving growth in Cloud Security and Network Security segments .

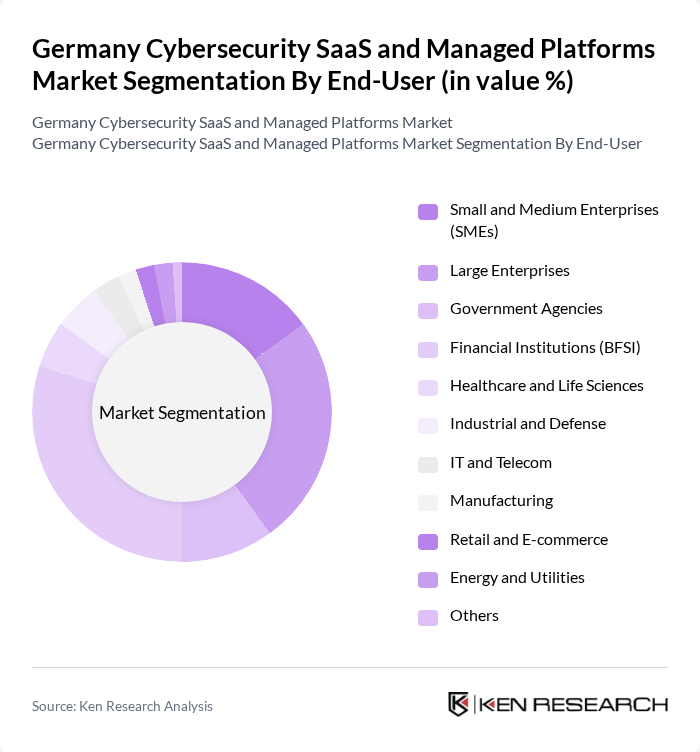

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, Financial Institutions (BFSI), Healthcare and Life Sciences, Industrial and Defense, IT and Telecom, Manufacturing, Retail and E-commerce, Energy and Utilities, and Others. TheBFSI sectoris the dominant end-user due to stringent regulatory requirements and the critical need for data protection against cyber threats. The increasing digitization of banking services and the rise in online transactions further amplify the demand for cybersecurity solutions in this sector. Other sectors such as healthcare and manufacturing are also experiencing increased demand for cybersecurity due to rising cyber incidents and regulatory compliance needs .

The Germany Cybersecurity SaaS and Managed Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Deutsche Telekom AG (T-Systems), Atos SE, Secunet Security Networks AG, Infineon Technologies AG, Trend Micro Incorporated, Check Point Software Technologies Ltd., Palo Alto Networks, Inc., Fortinet, Inc., McAfee Corp., IBM Corporation, Cisco Systems, Inc., CrowdStrike Holdings, Inc., FireEye, Inc., NortonLifeLock Inc., Microsoft Corporation, Accenture Security, NTT Security (Germany) GmbH, Rohde & Schwarz Cybersecurity GmbH, Computacenter AG & Co. oHG contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cybersecurity SaaS and managed platforms market in Germany appears promising, driven by increasing investments in advanced technologies and a heightened focus on data protection. As organizations continue to adapt to evolving cyber threats, the integration of artificial intelligence and machine learning into cybersecurity solutions will become more prevalent. Additionally, the ongoing emphasis on regulatory compliance will further propel the demand for innovative cybersecurity services, ensuring that businesses remain resilient against potential attacks while safeguarding sensitive information.

| Segment | Sub-Segments |

|---|---|

| By Type | Endpoint Security Network Security Application Security Cloud Security Identity and Access Management Data Loss Prevention Integrated Risk Management Infrastructure Protection Other Solution Types |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Financial Institutions (BFSI) Healthcare and Life Sciences Industrial and Defense IT and Telecom Manufacturing Retail and E-commerce Energy and Utilities Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premises |

| By Service Model | Software as a Service (SaaS) Managed Security Services Professional Services |

| By Industry Vertical | Banking, Financial Services, and Insurance (BFSI) Government Healthcare and Life Sciences Aerospace and Defence Manufacturing IT and Telecom Retail and E-commerce Energy and Utilities Others |

| By Compliance Standards | ISO 27001 PCI DSS HIPAA NIST |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing Usage-Based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cybersecurity | 85 | IT Security Managers, Compliance Officers |

| Healthcare Data Protection | 75 | Chief Information Officers, Data Protection Officers |

| Manufacturing Cybersecurity Solutions | 65 | Operations Managers, IT Directors |

| Retail Sector Cybersecurity Strategies | 80 | Security Analysts, IT Managers |

| SME Cybersecurity Adoption | 55 | Business Owners, IT Consultants |

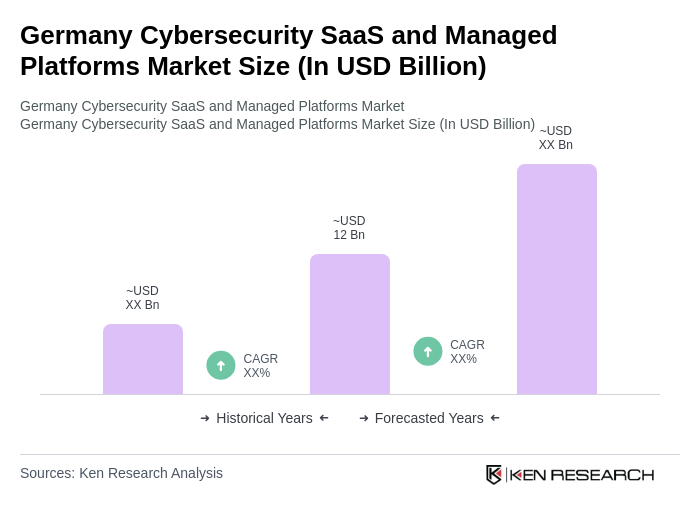

The Germany Cybersecurity SaaS and Managed Platforms Market is valued at approximately USD 12 billion, reflecting significant growth driven by increasing cyber threats, the need for data protection, and the adoption of cloud-based solutions among enterprises.