Region:Europe

Author(s):Dev

Product Code:KRAB3109

Pages:100

Published On:October 2025

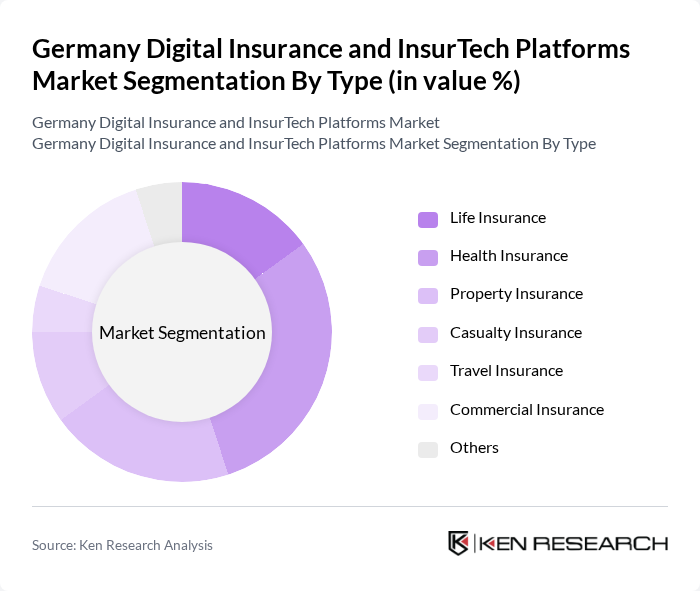

By Type:The market is segmented into various types of insurance products, including Life Insurance, Health Insurance, Property Insurance, Casualty Insurance, Travel Insurance, Commercial Insurance, and Others. Among these, Health Insurance is currently the leading sub-segment, driven by the increasing healthcare costs and a growing awareness of health-related issues among consumers. The demand for comprehensive health coverage has surged, particularly in the wake of the COVID-19 pandemic, leading to a significant market share for this segment.

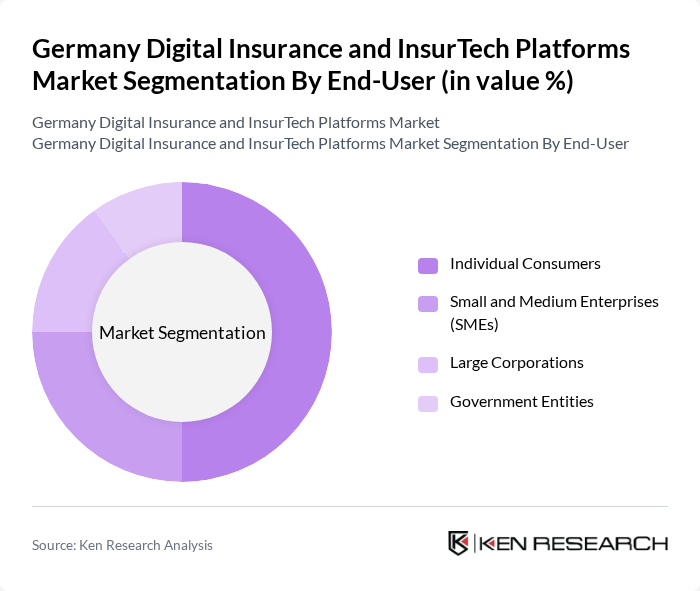

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers dominate the market, driven by the increasing need for personal insurance products and the growing trend of online purchasing. The rise of digital platforms has made it easier for individuals to compare and purchase insurance, leading to a significant market share for this segment.

The Germany Digital Insurance and InsurTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz SE, Munich Re, AXA Germany, ERGO Group AG, HUK-COBURG, Gothaer Versicherung, Signal Iduna, Wüstenrot & Württembergische AG, DEVK Versicherungen, R+V Versicherung AG, Axa Partners, Talanx AG, Baloise Holding AG, Zurich Insurance Group, Wefox Group AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital insurance and InsurTech market in Germany appears promising, driven by technological advancements and evolving consumer preferences. As the market matures, we expect a greater emphasis on integrating AI and machine learning into underwriting processes, enhancing efficiency and accuracy. Additionally, the rise of on-demand insurance products will cater to the growing demand for flexibility among consumers, allowing them to purchase coverage tailored to their specific needs, thus reshaping the insurance landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Health Insurance Property Insurance Casualty Insurance Travel Insurance Commercial Insurance Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Online Platforms Insurance Brokers Agents |

| By Product Offering | Standard Insurance Products Customized Insurance Solutions Bundled Insurance Packages |

| By Customer Segment | Millennials Gen X Baby Boomers |

| By Geographic Coverage | Urban Areas Rural Areas |

| By Policy Duration | Short-Term Policies Long-Term Policies Annual Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Digital Platforms | 150 | Product Managers, Marketing Directors |

| Auto Insurance Digital Solutions | 120 | Operations Managers, Customer Experience Leads |

| Property Insurance Tech Innovations | 100 | Underwriters, Risk Assessment Analysts |

| InsurTech Startups Insights | 80 | Founders, CTOs, Business Development Managers |

| Consumer Attitudes towards Digital Insurance | 200 | End-users, Policyholders, Prospective Customers |

The Germany Digital Insurance and InsurTech Platforms Market is valued at approximately USD 15 billion, reflecting significant growth driven by digital technology adoption and consumer demand for personalized insurance products.