Region:Middle East

Author(s):Rebecca Mary Reji

Product Code:KRAB5386

Pages:83

Published On:October 2025

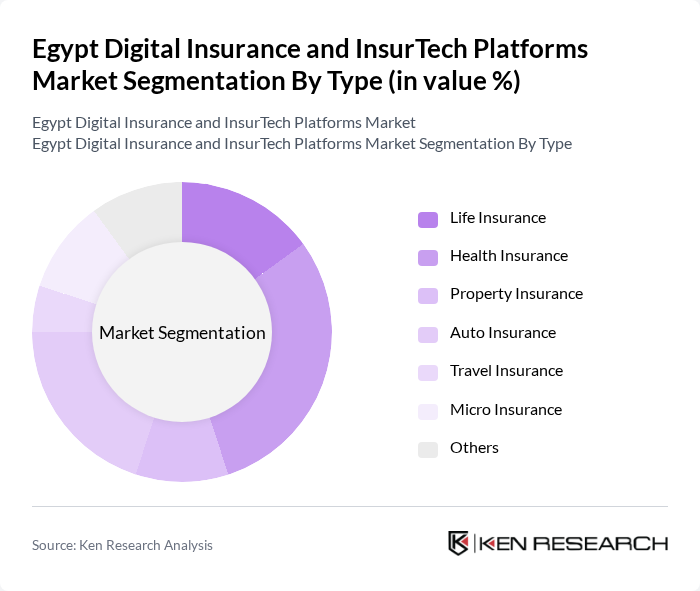

By Type:The market is segmented into various types of insurance products, including Life Insurance, Health Insurance, Property Insurance, Auto Insurance, Travel Insurance, Micro Insurance, and Others. Among these, Health Insurance is currently the leading segment, driven by the increasing awareness of health-related issues and the rising costs of healthcare services. Consumers are increasingly seeking comprehensive health coverage, which has led to a surge in demand for digital health insurance solutions.

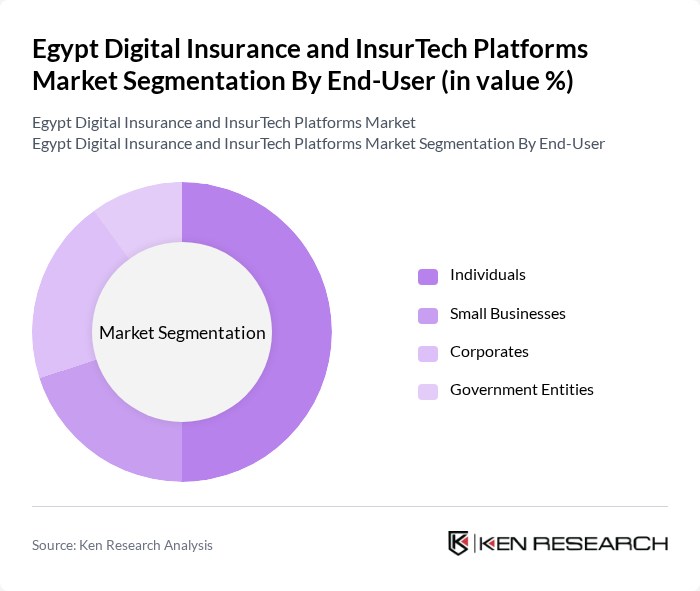

By End-User:The market is segmented by end-users, including Individuals, Small Businesses, Corporates, and Government Entities. The Individuals segment is the most significant contributor to the market, as the growing middle class in Egypt is increasingly seeking insurance products to protect their assets and health. This trend is further supported by the rise of digital platforms that make it easier for individuals to access and purchase insurance products.

The Egypt Digital Insurance and InsurTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz Egypt, MetLife Egypt, AXA Egypt, Bupa Egypt, Nile Insurance Company, Misr Insurance Company, Arab Misr Insurance Group, Pharos Insurance, Delta Insurance Company, Suez Canal Insurance, Egyptian Takaful Insurance, AIG Egypt, Zurich Egypt, Trust Insurance, Watania Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egypt Digital Insurance and InsurTech Platforms market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more consumers are likely to embrace online insurance solutions. Additionally, the integration of artificial intelligence and big data analytics will enhance risk assessment and customer engagement. The collaboration between InsurTech firms and traditional insurers is expected to foster innovation, leading to the development of more tailored products that meet the diverse needs of the Egyptian market.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Health Insurance Property Insurance Auto Insurance Travel Insurance Micro Insurance Others |

| By End-User | Individuals Small Businesses Corporates Government Entities |

| By Distribution Channel | Direct Sales Online Platforms Brokers and Agents Partnerships with Financial Institutions |

| By Customer Segment | Retail Customers Institutional Clients High Net-Worth Individuals |

| By Product Complexity | Simple Products Complex Products |

| By Payment Model | Subscription-Based Pay-Per-Use One-Time Payment |

| By Policy Duration | Short-Term Policies Long-Term Policies Renewable Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Insurance Adoption | 150 | Insurance Executives, IT Managers |

| Consumer Insights on InsurTech | 200 | Policyholders, Potential Customers |

| Market Trends in Health Insurance | 100 | Health Insurance Specialists, Brokers |

| Regulatory Impact Assessment | 80 | Regulatory Officials, Compliance Officers |

| Investment Trends in InsurTech | 70 | Venture Capitalists, Financial Analysts |

The Egypt Digital Insurance and InsurTech Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital technologies and increasing consumer demand for personalized insurance products.