Region:Europe

Author(s):Dev

Product Code:KRAB5420

Pages:96

Published On:October 2025

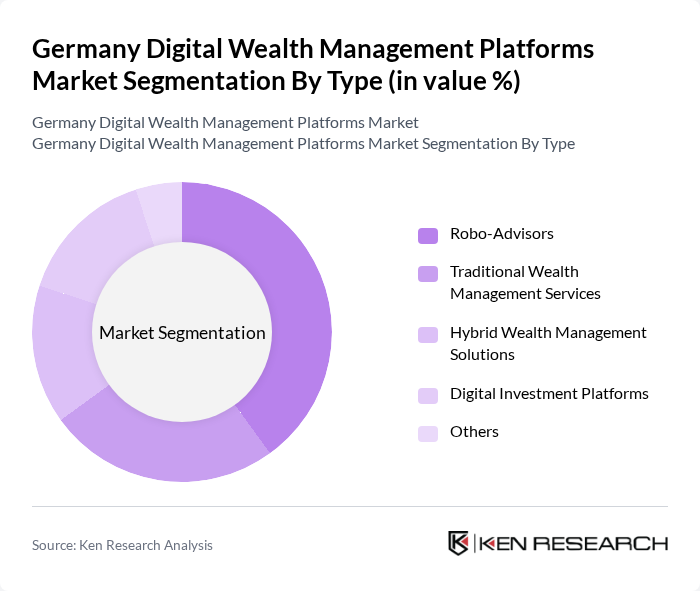

By Type:The market is segmented into various types, including Robo-Advisors, Traditional Wealth Management Services, Hybrid Wealth Management Solutions, Digital Investment Platforms, and Others. Among these, Robo-Advisors have gained significant traction due to their cost-effectiveness and accessibility, appealing particularly to younger investors who prefer automated solutions for wealth management.

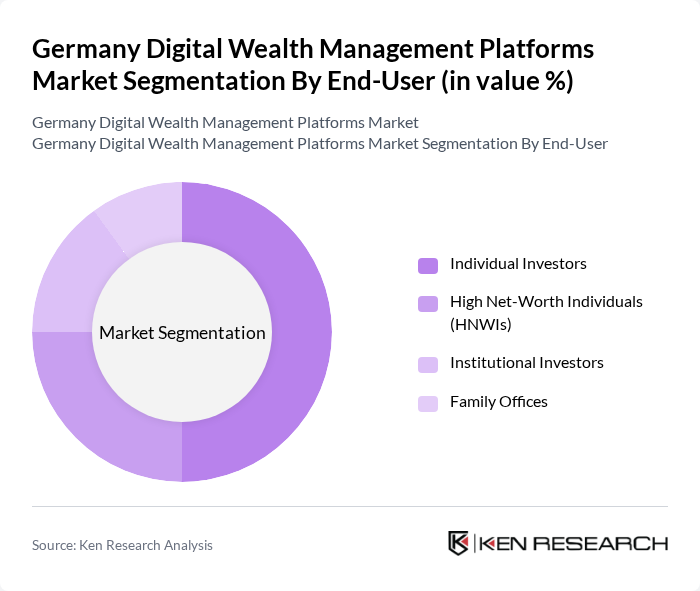

By End-User:The end-user segmentation includes Individual Investors, High Net-Worth Individuals (HNWIs), Institutional Investors, and Family Offices. Individual Investors dominate the market, driven by the increasing trend of self-investment and the availability of user-friendly digital platforms that cater to their needs.

The Germany Digital Wealth Management Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as N26, Scalable Capital, Wealthsimple, Comdirect, Raisin, Trade Republic, Robinhood, Fidor Bank, OnVista Bank, Deutsche Bank Wealth Management, UBS Wealth Management, DWS Group, BlackRock, Allianz Global Investors, ING-DiBa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital wealth management market in Germany appears promising, driven by technological advancements and evolving consumer preferences. As more individuals seek efficient and personalized investment solutions, platforms that leverage artificial intelligence and machine learning are likely to gain traction. Additionally, the integration of sustainable investment options will resonate with socially conscious investors, further shaping the market landscape. The focus on enhancing user experience through mobile platforms will also play a crucial role in attracting a broader demographic.

| Segment | Sub-Segments |

|---|---|

| By Type | Robo-Advisors Traditional Wealth Management Services Hybrid Wealth Management Solutions Digital Investment Platforms Others |

| By End-User | Individual Investors High Net-Worth Individuals (HNWIs) Institutional Investors Family Offices |

| By Investment Strategy | Passive Investment Strategies Active Investment Strategies Tactical Asset Allocation Others |

| By Service Model | Subscription-Based Services Commission-Based Services Fee-Only Services Others |

| By Distribution Channel | Direct Online Platforms Financial Advisors Mobile Applications Others |

| By Customer Segment | Millennials Gen X Baby Boomers Others |

| By Regulatory Compliance | MiFID II Compliant Platforms Non-Compliant Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| High-Net-Worth Individuals | 150 | Wealth Managers, Financial Advisors |

| Millennial Investors | 100 | Young Professionals, Digital Natives |

| Financial Institutions | 80 | Banking Executives, Investment Analysts |

| Regulatory Bodies | 50 | Compliance Officers, Regulatory Analysts |

| Technology Providers | 70 | Product Managers, Software Developers |

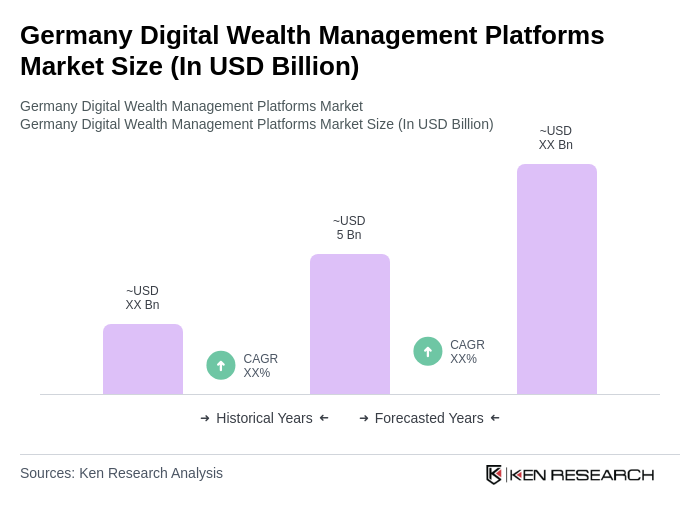

The Germany Digital Wealth Management Platforms Market is valued at approximately USD 5 billion, reflecting a significant growth trend driven by the increasing adoption of digital financial services and a rise in disposable income among consumers.