Region:Middle East

Author(s):Rebecca

Product Code:KRAC1162

Pages:80

Published On:October 2025

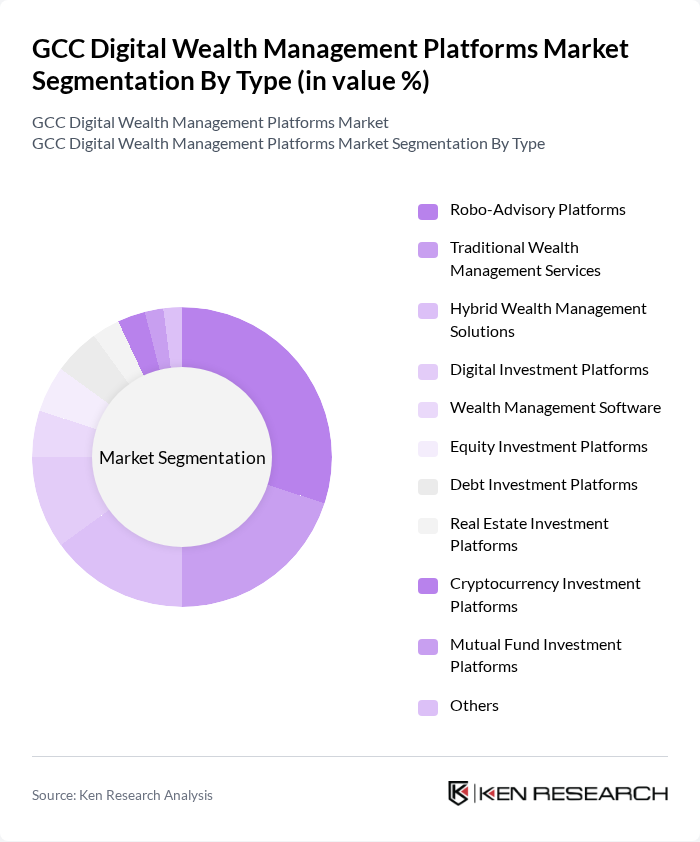

By Type:The market is segmented into various types of digital wealth management platforms, including Robo-Advisory Platforms, Traditional Wealth Management Services, Hybrid Wealth Management Solutions, Digital Investment Platforms, Wealth Management Software, Equity Investment Platforms, Debt Investment Platforms, Real Estate Investment Platforms, Cryptocurrency Investment Platforms, Mutual Fund Investment Platforms, and Others. Among these, Robo-Advisory Platforms are gaining significant traction due to their cost-effectiveness and accessibility, appealing particularly to tech-savvy millennials and Gen Z investors. The integration of AI and automation in robo-advisory services is driving adoption, with cloud-based and mobile-first solutions becoming industry standards .

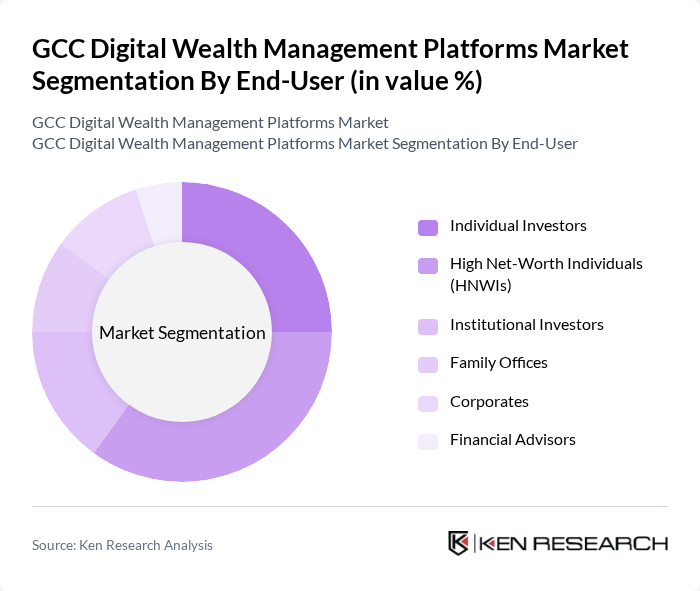

By End-User:The end-user segmentation includes Individual Investors, High Net-Worth Individuals (HNWIs), Institutional Investors, Family Offices, Corporates, and Financial Advisors. High Net-Worth Individuals (HNWIs) are the leading segment, driven by their need for personalized investment strategies and wealth preservation, which digital platforms are increasingly able to provide through tailored services and advanced analytics. The demand for digital platforms among HNWIs is further supported by the growing emphasis on transparency, risk management, and access to global investment opportunities .

The GCC Digital Wealth Management Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Abu Dhabi Commercial Bank, Qatar National Bank (QNB), Al Rajhi Bank, National Bank of Kuwait, Dubai Islamic Bank, Gulf Bank, Bank of Bahrain and Kuwait, Mashreq Bank, Saudi National Bank, First Abu Dhabi Bank, Arab Bank, Qatar Islamic Bank, Bank Al Jazira, Alinma Bank, HSBC Middle East, BNP Paribas Middle East, Saxo Bank, Morgan Stanley Middle East, Standard Chartered Bank, UBS Middle East, Citigroup Middle East, Riyad Bank, Temenos, FIS, Finastra contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC digital wealth management platforms market appears promising, driven by technological innovations and evolving consumer preferences. As firms increasingly adopt AI-driven tools, the personalization of investment strategies will enhance client engagement. Additionally, the integration of blockchain technology is expected to streamline operations and improve transparency. With a growing focus on sustainable investments, platforms that align with ESG principles will likely attract a more conscientious investor base, further shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Robo-Advisory Platforms Traditional Wealth Management Services Hybrid Wealth Management Solutions Digital Investment Platforms Wealth Management Software Equity Investment Platforms Debt Investment Platforms Real Estate Investment Platforms Cryptocurrency Investment Platforms Mutual Fund Investment Platforms Others |

| By End-User | Individual Investors High Net-Worth Individuals (HNWIs) Institutional Investors Family Offices Corporates Financial Advisors |

| By Distribution Channel | Direct Sales Online Platforms Financial Advisors Partnerships with Banks |

| By Investment Strategy | Active Management Passive Management Tactical Asset Allocation Strategic Asset Allocation |

| By Customer Segment | Millennials Gen X Baby Boomers |

| By Service Type | Financial Planning Investment Management Tax Optimization Portfolio Management Retirement Planning |

| By Geographic Focus | GCC Countries International Markets Regional Focus Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| High-Net-Worth Individuals | 100 | Wealth Managers, Financial Advisors |

| Mass Affluent Clients | 80 | Investment Consultants, Financial Planners |

| Digital Wealth Management Platforms | 50 | Product Managers, Technology Officers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Financial Institutions | 60 | Banking Executives, Investment Analysts |

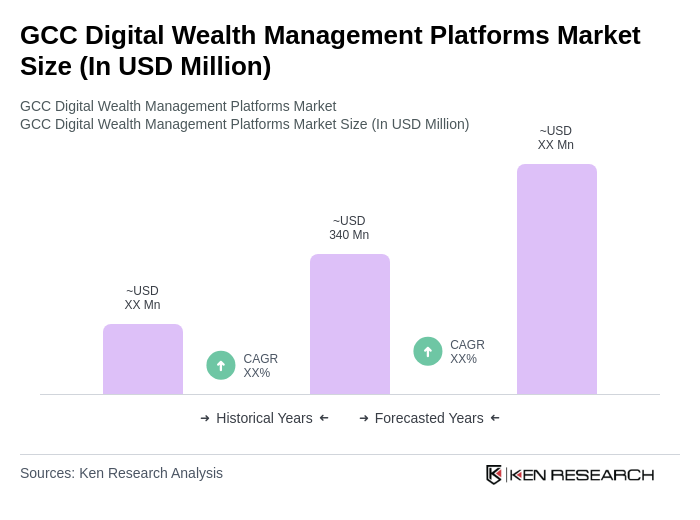

The GCC Digital Wealth Management Platforms Market is valued at approximately USD 340 million, reflecting significant growth driven by the adoption of digital technologies and increasing awareness of investment opportunities among the population.