Region:Europe

Author(s):Geetanshi

Product Code:KRAB3427

Pages:88

Published On:October 2025

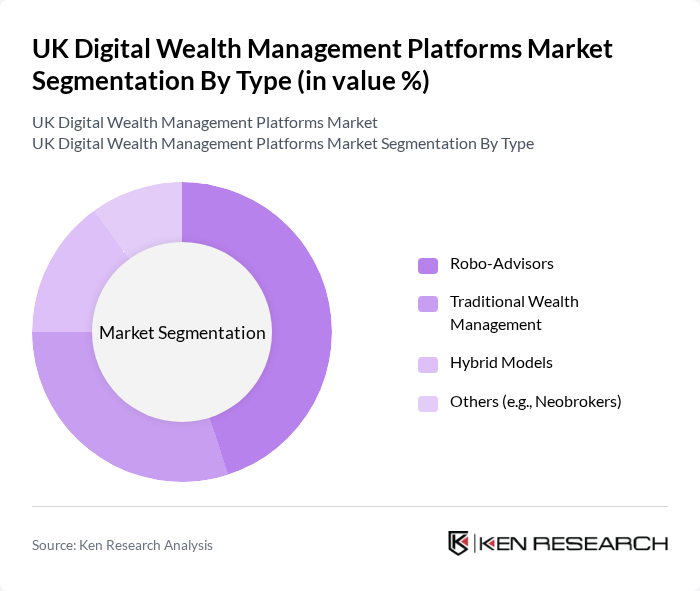

By Type:The market is segmented into various types, including Robo-Advisors, Traditional Wealth Management, Hybrid Models, and Others (e.g., Neobrokers). Among these, Robo-Advisors are gaining significant traction due to their cost-effectiveness and accessibility, appealing particularly to younger investors who prefer automated solutions. The robo-advisor segment is experiencing substantial growth with realized annual rates of +50% as digital wealth managers expand their service offerings. Traditional Wealth Management remains relevant for high-net-worth individuals seeking personalized services, while Hybrid Models combine the best of both worlds, catering to a diverse clientele.

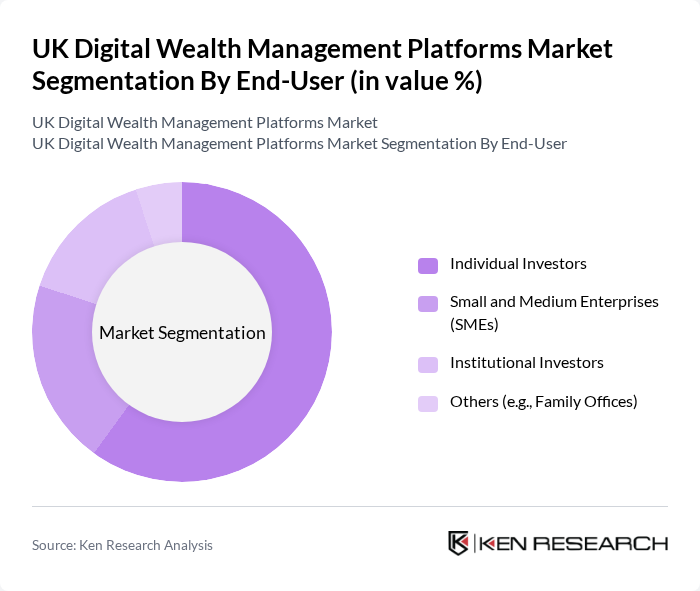

By End-User:The end-user segmentation includes Individual Investors, Small and Medium Enterprises (SMEs), Institutional Investors, and Others (e.g., Family Offices). Individual Investors dominate the market, driven by the increasing number of retail investors entering the market, particularly through digital platforms. The UK's addressable wealth management market serves approximately 30% of its over GBP 2 trillion market through the financial advice sector. SMEs are also becoming significant users of wealth management services as they seek to optimize their financial strategies, while institutional investors continue to leverage these platforms for efficient asset management.

The UK Digital Wealth Management Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nutmeg, Wealthsimple, Moneyfarm, Scalable Capital, Hargreaves Lansdown, AJ Bell, Interactive Investor, Charles Stanley, Fidelity International, Vanguard, BlackRock, Schroders, Standard Life, Tilney Smith & Williamson, Brewin Dolphin contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK digital wealth management market appears promising, driven by technological advancements and evolving consumer preferences. As platforms increasingly integrate artificial intelligence and machine learning, they will enhance user experience and investment strategies. Additionally, the growing focus on sustainable investments will likely attract a broader demographic, particularly younger investors. These trends suggest a dynamic market landscape, with opportunities for innovation and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Robo-Advisors Traditional Wealth Management Hybrid Models Others (e.g., Neobrokers) |

| By End-User | Individual Investors Small and Medium Enterprises (SMEs) Institutional Investors Others (e.g., Family Offices) |

| By Investment Strategy | Passive Investment Active Investment Tactical Asset Allocation Others (e.g., Impact Investing) |

| By Service Model | Full-Service Platforms Self-Service Platforms Advisory-Only Platforms Others (e.g., Hybrid Advisory) |

| By Pricing Model | Flat Fee Percentage of Assets Under Management (AUM) Performance-Based Fees Others (e.g., Tiered Pricing) |

| By Geographic Focus | UK Domestic Market International Markets Regional Focus (Scotland, Wales, Northern Ireland) Others (e.g., Cross-Border Services) |

| By Customer Segment | High Net Worth Individuals (HNWIs) Mass Affluent Retail Investors Others (e.g., Ultra High Net Worth Individuals) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| High-Net-Worth Individuals | 60 | Wealth Managers, Financial Advisors |

| Millennial Investors | 50 | Young Professionals, Digital Natives |

| Institutional Investors | 40 | Portfolio Managers, Investment Analysts |

| Financial Technology Experts | 40 | Fintech Specialists, Regulatory Analysts |

| Retail Investors | 70 | Individual Investors, DIY Traders |

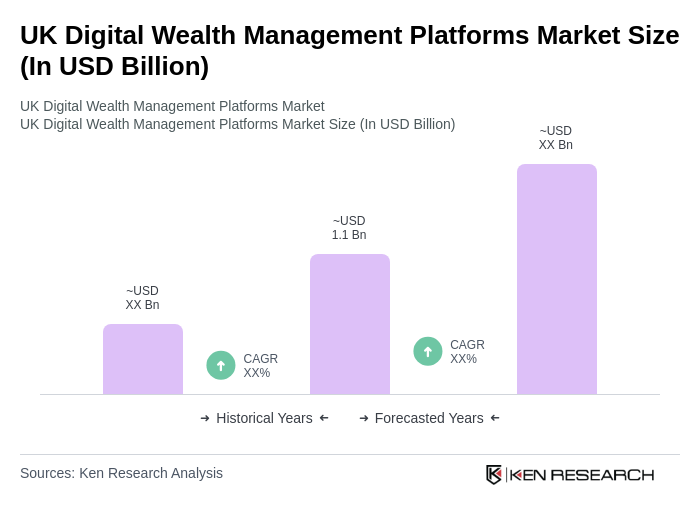

The UK Digital Wealth Management Platforms Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by technological adoption in financial services and increasing demand for personalized investment options.