Region:Middle East

Author(s):Dev

Product Code:KRAC1262

Pages:93

Published On:October 2025

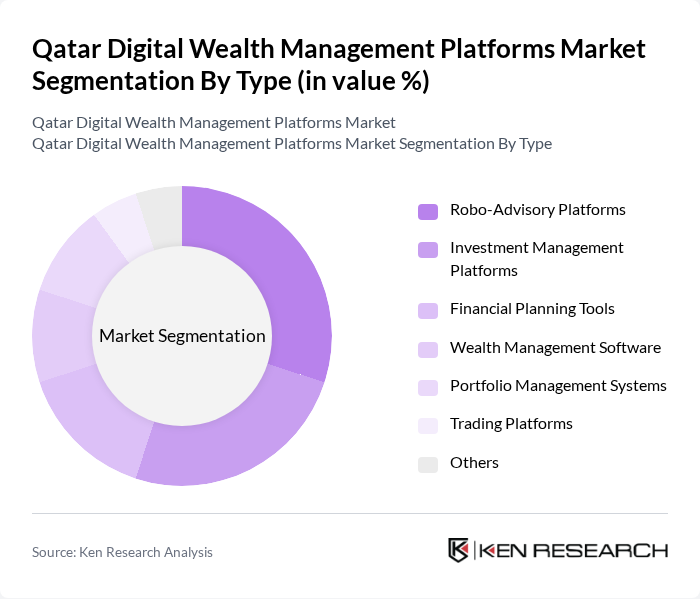

By Type:The market is segmented into various types of digital wealth management platforms, including Robo-Advisory Platforms, Investment Management Platforms, Financial Planning Tools, Wealth Management Software, Portfolio Management Systems, Trading Platforms, and Others. Robo-Advisory Platforms are gaining significant traction due to their cost-effectiveness and accessibility for individual investors. Investment Management Platforms and Financial Planning Tools are increasingly adopted by institutional and retail clients seeking automated portfolio management and holistic financial planning. Wealth Management Software and Portfolio Management Systems support advisory firms and banks in delivering scalable, compliant solutions, while Trading Platforms enable direct market access for active investors.

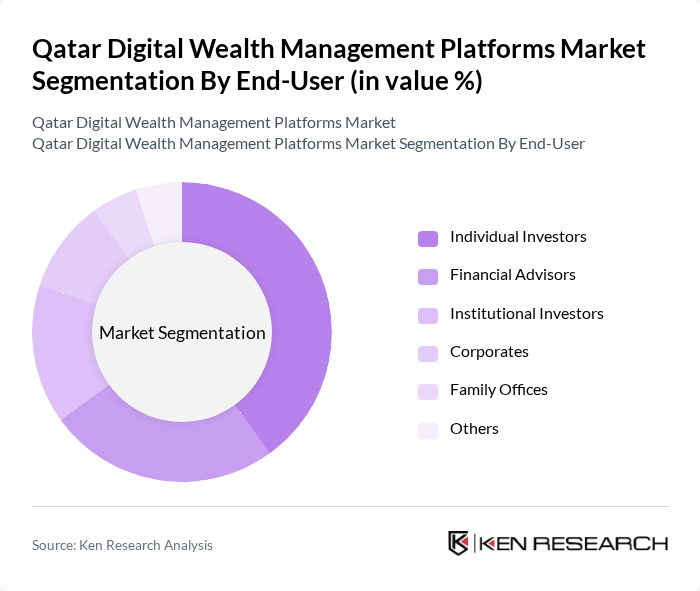

By End-User:The end-user segmentation includes Individual Investors, Financial Advisors, Institutional Investors, Corporates, Family Offices, and Others. Individual Investors represent the largest segment, driven by the rise of mobile investment applications and online trading platforms, which have made wealth management services more accessible. Financial Advisors and Institutional Investors leverage digital platforms for portfolio optimization and regulatory compliance. Corporates and Family Offices utilize these solutions for treasury management, succession planning, and diversified investment strategies.

The Qatar Digital Wealth Management Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Bank, Doha Bank, Qatar Islamic Bank, Commercial Bank of Qatar, Masraf Al Rayan, Al Khaliji Commercial Bank, QInvest, Amwal, Dlala Brokerage and Investment Holding Company, Qatar Financial Centre, QNB Financial Services, Barwa Bank, Al Rayan Investment, Qatar Investment Authority, Qatar Development Bank, Investment House, Qatar Insurance Company, Qatar Stock Exchange contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar digital wealth management market appears promising, driven by technological innovations and evolving consumer preferences. As platforms increasingly adopt AI and machine learning, they will enhance service personalization and efficiency. Additionally, the growing interest in sustainable investments is likely to shape product offerings, attracting a new demographic of socially conscious investors. Overall, the market is poised for significant transformation, with advancements in technology and changing investor behaviors paving the way for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Robo-Advisory Platforms Investment Management Platforms Financial Planning Tools Wealth Management Software Portfolio Management Systems Trading Platforms Others |

| By End-User | Individual Investors Financial Advisors Institutional Investors Corporates Family Offices Others |

| By Service Model | Subscription-Based Services Commission-Based Services Fee-Only Services Hybrid Models Others |

| By Investment Type | Equities Fixed Income Real Estate Commodities Cryptocurrencies Others |

| By Distribution Channel | Direct Sales Online Platforms Financial Intermediaries Partnerships with Banks Others |

| By Customer Segment | High-Net-Worth Individuals (HNWIs) Mass Affluent Retail Investors Institutional Clients Others |

| By Geographic Focus | Domestic Market International Markets Emerging Markets Developed Markets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| High-Net-Worth Individuals | 50 | Wealth Managers, Financial Advisors |

| Retail Investors | 100 | Individual Investors, Financial Planners |

| Fintech Service Providers | 60 | Product Managers, Technology Officers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Industry Experts and Analysts | 50 | Market Analysts, Academic Researchers |

The Qatar Digital Wealth Management Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital financial services and the rise in high-net-worth individuals seeking personalized investment solutions.