Region:Europe

Author(s):Shubham

Product Code:KRAB3182

Pages:84

Published On:October 2025

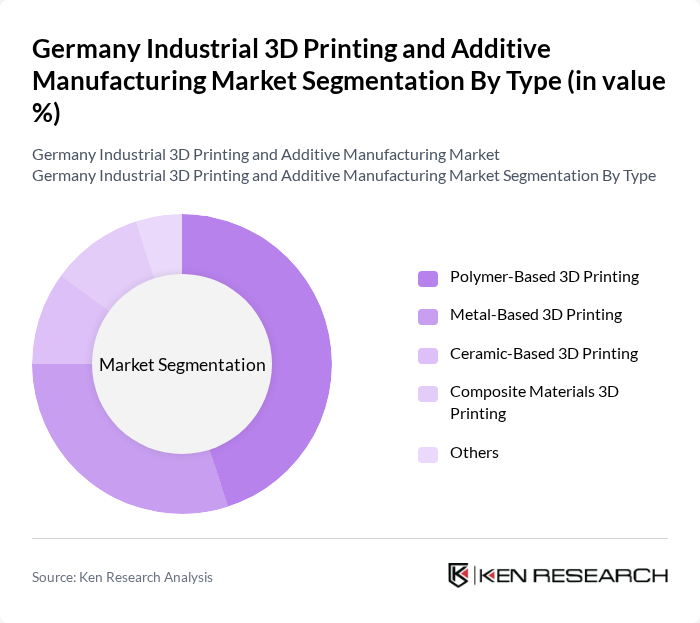

By Type:The market is segmented into various types of 3D printing technologies, including polymer-based, metal-based, ceramic-based, composite materials, and others. Among these, polymer-based 3D printing is the most widely adopted due to its versatility, cost-effectiveness, and ease of use. It is extensively utilized in industries such as consumer goods and healthcare for producing prototypes and end-use parts. Metal-based 3D printing is also gaining traction, particularly in aerospace and automotive sectors, where high strength and durability are required.

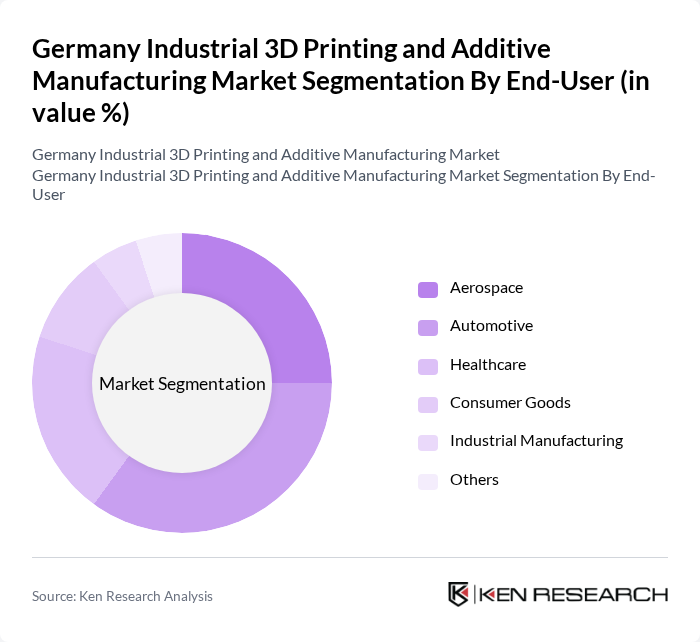

By End-User:The end-user segmentation includes aerospace, automotive, healthcare, consumer goods, industrial manufacturing, and others. The automotive sector is the leading end-user of 3D printing technologies, leveraging them for rapid prototyping and production of complex components. The aerospace industry follows closely, utilizing additive manufacturing for lightweight parts that enhance fuel efficiency. The healthcare sector is also emerging as a significant user, particularly in the production of customized implants and prosthetics.

The Germany Industrial 3D Printing and Additive Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as EOS GmbH, Stratasys Ltd., 3D Systems Corporation, Materialise NV, SLM Solutions Group AG, Renishaw plc, HP Inc., Ultimaker B.V., GE Additive, Arcam AB, Xometry Inc., Formlabs Inc., Desktop Metal Inc., Carbon, Inc., Markforged, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial 3D printing market in Germany appears promising, driven by technological advancements and increasing integration with Industry 4.0. As companies embrace digital transformation, the demand for on-demand manufacturing and hybrid production techniques is expected to rise. Furthermore, the focus on sustainability will likely lead to innovations in eco-friendly materials and processes. By future, the market is anticipated to witness significant growth, fueled by these trends and the ongoing evolution of manufacturing practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Polymer-Based 3D Printing Metal-Based 3D Printing Ceramic-Based 3D Printing Composite Materials 3D Printing Others |

| By End-User | Aerospace Automotive Healthcare Consumer Goods Industrial Manufacturing Others |

| By Application | Prototyping Tooling Production Parts Customization Others |

| By Material | Thermoplastics Metals Ceramics Composites Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | B2B B2C C2C Others |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Adoption | 100 | Manufacturing Engineers, Production Managers |

| Aerospace Component Manufacturing | 80 | R&D Directors, Quality Assurance Managers |

| Healthcare Device Prototyping | 70 | Medical Device Engineers, Product Development Leads |

| Consumer Goods Production | 90 | Product Managers, Supply Chain Analysts |

| Educational Institutions and Research Labs | 60 | Academic Researchers, Lab Managers |

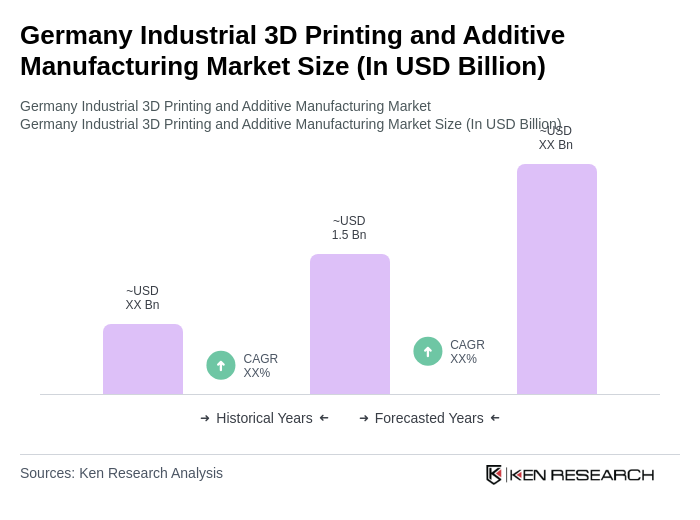

The Germany Industrial 3D Printing and Additive Manufacturing Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by technological advancements and increasing demand for customized products across various industries such as automotive, aerospace, and healthcare.