Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4508

Pages:93

Published On:October 2025

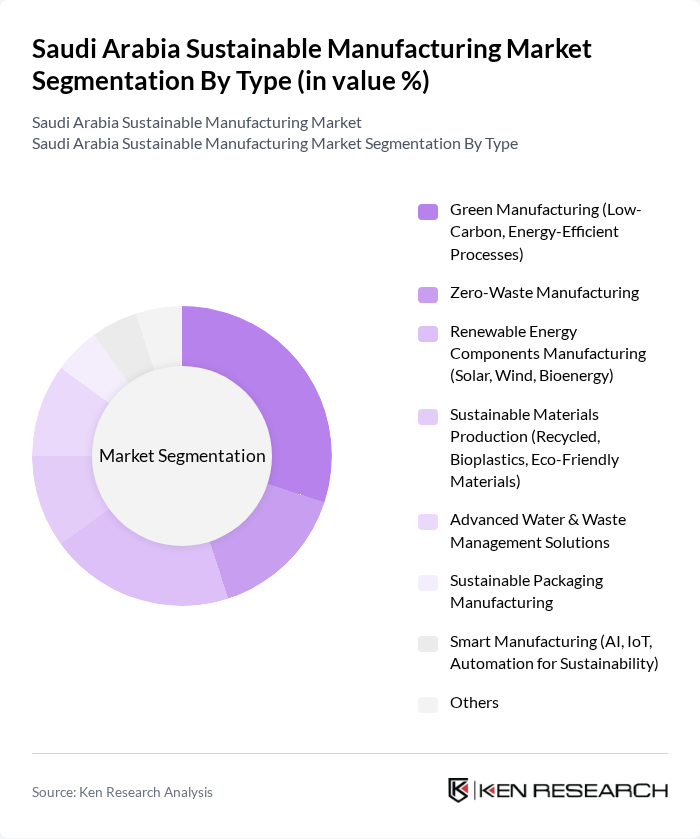

By Type:The market is segmented into various types, including Green Manufacturing, Zero-Waste Manufacturing, Renewable Energy Components Manufacturing, Sustainable Materials Production, Advanced Water & Waste Management Solutions, Sustainable Packaging Manufacturing, Smart Manufacturing, and Others. Each of these sub-segments plays a crucial role in promoting sustainability and reducing environmental impact. The adoption of digital technologies such as AI, IoT, and automation is accelerating smart and green manufacturing, while circular economy practices are increasingly embedded in materials production and waste management .

By End-User:The end-user segmentation includes Oil & Gas and Petrochemicals, Construction & Real Estate, Automotive & Mobility Components, Consumer Goods & Electronics, Food & Beverage Processing, Healthcare & Pharmaceuticals, Government, Defense & Utilities, Mining & Metals, Logistics & Packaging, and Others. Each sector has unique sustainability needs and contributes to the overall market growth. The oil and gas sector is a major adopter of sustainable manufacturing, driven by regulatory compliance and international ESG standards, while construction and automotive industries are increasingly integrating green materials and energy-efficient processes .

The Saudi Arabia Sustainable Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, SABIC, ACWA Power, National Industrialization Company (Tasnee), Alfanar, Advanced Petrochemical Company, Ma’aden (Saudi Arabian Mining Company), Siemens, GE Renewable Energy, First Solar, JinkoSolar, Trina Solar, Canadian Solar, Enel Green Power, Vestas Wind Systems, Schneider Electric, Desert Technologies, Almarai (Sustainable Food Processing), Al Kifah Holding Company, and Aljomaih Energy & Water contribute to innovation, geographic expansion, and service delivery in this space. These companies are at the forefront of integrating sustainable practices, investing in R&D, and partnering with government initiatives to advance the sector’s transformation .

The future of sustainable manufacturing in Saudi Arabia appears promising, driven by a combination of government initiatives and evolving consumer preferences. As the nation continues to invest in renewable energy and green technologies, the market is expected to witness significant growth. By 2025, the integration of AI and IoT in manufacturing processes will likely enhance operational efficiency, while the adoption of circular economy principles will further support sustainability goals. Collaborative efforts between public and private sectors will be crucial in overcoming existing challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Green Manufacturing (Low-Carbon, Energy-Efficient Processes) Zero-Waste Manufacturing Renewable Energy Components Manufacturing (Solar, Wind, Bioenergy) Sustainable Materials Production (Recycled, Bioplastics, Eco-Friendly Materials) Advanced Water & Waste Management Solutions Sustainable Packaging Manufacturing Smart Manufacturing (AI, IoT, Automation for Sustainability) Others |

| By End-User | Oil & Gas and Petrochemicals Construction & Real Estate Automotive & Mobility Components Consumer Goods & Electronics Food & Beverage Processing Healthcare & Pharmaceuticals Government, Defense & Utilities Mining & Metals Logistics & Packaging Others |

| By Application | Energy Generation (Solar, Wind, Bioenergy) Waste Management & Recycling Water Treatment & Conservation Sustainable Packaging Solutions Eco-Friendly Construction Materials Sustainable Mobility & Transport Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes & Incentives |

| By Policy Support | Subsidies for Green Technologies Tax Exemptions for Sustainable Practices Renewable Energy Certificates (RECs) Compliance Incentives |

| By Distribution Mode | Direct Sales Online Sales Distributors and Resellers Retail Outlets |

| By Price Range | Budget-Friendly Options Mid-Range Products Premium Offerings |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Sustainability Practices | 100 | Production Managers, Sustainability Directors |

| Textile Industry Eco-Friendly Innovations | 60 | Product Development Managers, Compliance Officers |

| Electronics Manufacturing Waste Management | 50 | Operations Managers, Environmental Health & Safety Officers |

| Food Processing Sustainable Practices | 40 | Quality Assurance Managers, Supply Chain Coordinators |

| Construction Sector Green Building Initiatives | 70 | Project Managers, Sustainability Consultants |

The Saudi Arabia Sustainable Manufacturing Market is valued at approximately USD 5.3 billion, driven by government initiatives, increasing demand for energy-efficient processes, and investments in renewable energy and digital technologies.