United States Industrial 3D Printing and Additive Manufacturing Market Overview

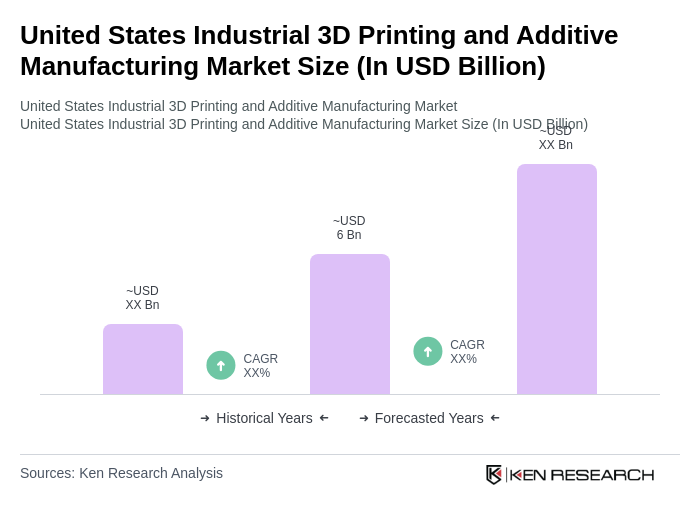

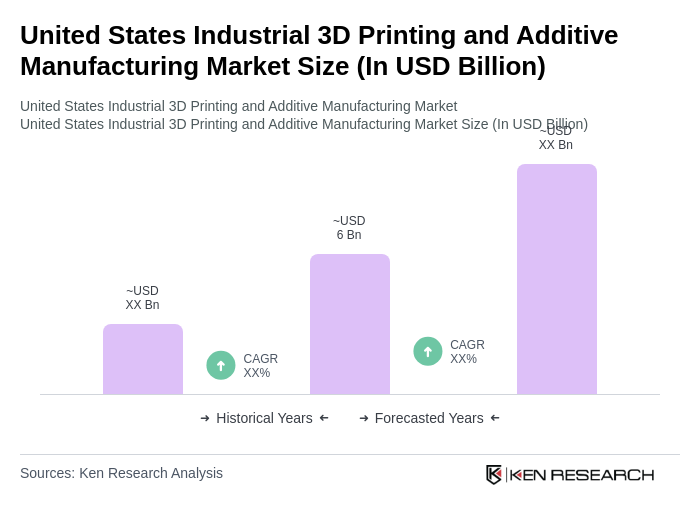

- The United States Industrial 3D Printing and Additive Manufacturing Market is valued at USD 6 billion, based on a five-year historical analysis. This growth is primarily driven by rapid technological advancements, increasing adoption across automotive, aerospace, healthcare, and consumer goods industries, and a rising demand for customized and complex manufacturing solutions. The market has seen a significant rise in applications from prototyping to end-use production, reflecting the versatility and efficiency of additive manufacturing processes. Companies are investing in advanced printers, materials, and software integration to scale up production while ensuring precision and cost efficiency. Government initiatives promoting smart manufacturing and Industry 4.0 frameworks are further strengthening adoption .

- Key players in this market are concentrated in major cities such as San Francisco, New York, and Chicago, which dominate due to their robust industrial bases, access to advanced research institutions, and a concentration of technology companies. These regions foster innovation and collaboration, making them attractive hubs for 3D printing and additive manufacturing initiatives .

- The National Defense Authorization Act for Fiscal Year 2023, issued by the United States Congress, includes provisions to promote the use of additive manufacturing technologies in defense and aerospace sectors. This legislation mandates funding for research and development, encourages the adoption of advanced manufacturing processes by defense contractors, and sets compliance requirements for supply chain security and domestic sourcing in critical applications .

United States Industrial 3D Printing and Additive Manufacturing Market Segmentation

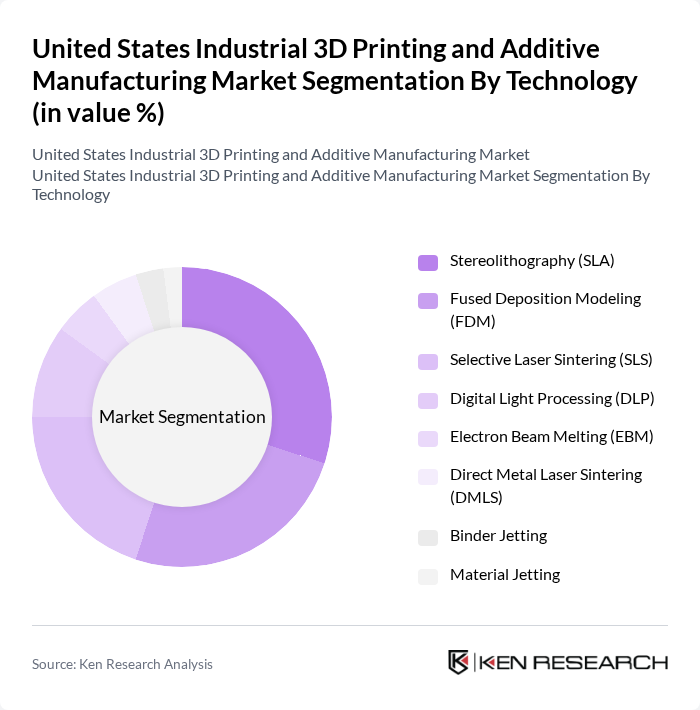

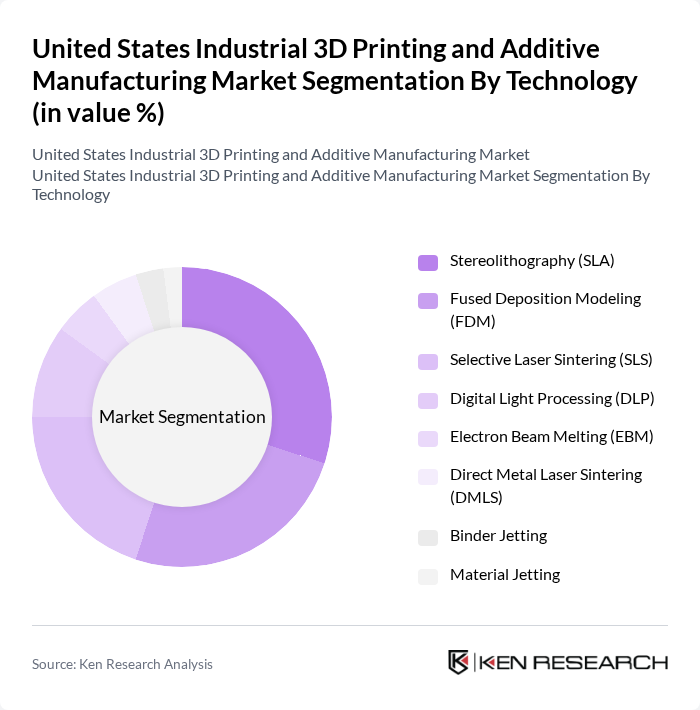

By Technology:The technology segment of the market includes various methods of 3D printing, each with unique advantages and applications. The leading technologies are Stereolithography (SLA), Fused Deposition Modeling (FDM), and Selective Laser Sintering (SLS). SLA is favored for its precision and surface finish, while FDM is popular for its cost-effectiveness and ease of use. SLS is preferred for producing complex geometries and functional parts, making it a dominant choice in industrial applications. Stereolithography currently accounts for the largest share of the U.S. market, followed by FDM and SLS, with other technologies such as DLP, EBM, DMLS, Binder Jetting, and Material Jetting contributing to specialized applications .

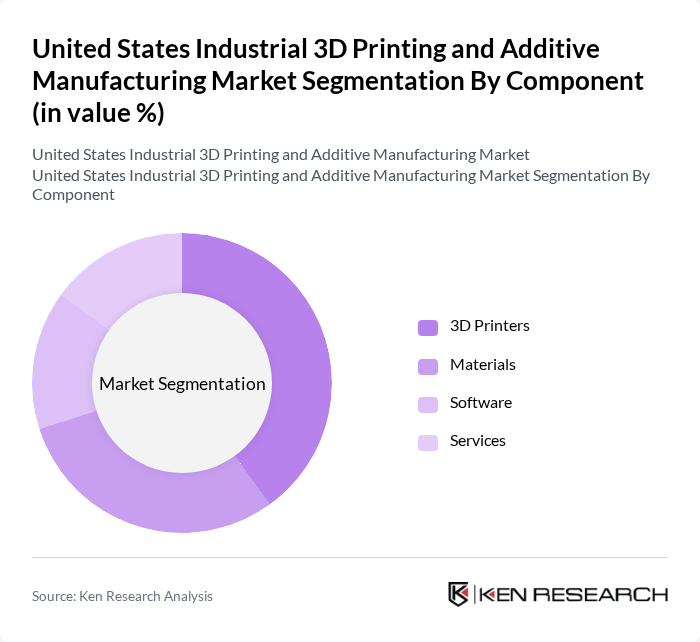

By Component:The component segment encompasses the essential elements required for 3D printing, including 3D printers, materials, software, and services. 3D printers represent the largest share of the market, driven by ongoing advancements in printer technology and capabilities. Materials, particularly polymers and metals, are critical for producing high-quality prints, while software solutions are increasingly important for design optimization and workflow automation. Services, including maintenance, consulting, and training, are gaining traction as more companies adopt additive manufacturing and require operational support .

United States Industrial 3D Printing and Additive Manufacturing Market Competitive Landscape

The United States Industrial 3D Printing and Additive Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stratasys Ltd., 3D Systems Corporation, HP Inc., GE Additive, Desktop Metal, Inc., Formlabs, Inc., Carbon, Inc., Markforged, Inc., Xometry, Inc., Proto Labs, Inc., Materialise NV, EOS North America, SLM Solutions North America, Renishaw Inc., Ultimaker North America contribute to innovation, geographic expansion, and service delivery in this space.

United States Industrial 3D Printing and Additive Manufacturing Market Industry Analysis

Growth Drivers

- Increasing Demand for Customization:The U.S. industrial 3D printing market is experiencing a surge in demand for customized products, driven by consumer preferences for personalized solutions. In future, the customization market is projected to reach $1.5 billion, reflecting a 20% increase from the previous year. This trend is particularly evident in sectors like consumer goods and fashion, where tailored designs are becoming essential. Companies are leveraging 3D printing to meet these demands efficiently, enhancing customer satisfaction and loyalty.

- Advancements in Material Technologies:The development of advanced materials is a key growth driver in the industrial 3D printing sector. In future, the market for innovative materials, including bio-based and high-performance polymers, is expected to exceed $800 million. These materials enable manufacturers to produce stronger, lighter, and more durable products, expanding the range of applications. The introduction of new materials is crucial for industries such as aerospace and automotive, where performance and safety are paramount.

- Cost Reduction in Prototyping:The ability to reduce prototyping costs significantly is propelling the adoption of 3D printing technologies. In future, companies are projected to save approximately $500 million collectively through rapid prototyping processes. This cost efficiency allows businesses to iterate designs quickly, reducing time-to-market for new products. As firms increasingly recognize the financial benefits of 3D printing, investment in these technologies is expected to rise, further driving market growth.

Market Challenges

- High Initial Investment Costs:One of the primary challenges facing the industrial 3D printing market is the high initial investment required for advanced printing technologies. In future, the average cost of industrial 3D printers is estimated to be around $250,000, which can deter small and medium-sized enterprises from adopting these technologies. This financial barrier limits market penetration and slows down the overall growth of the industry, particularly among startups and smaller manufacturers.

- Limited Material Options:Despite advancements, the range of materials available for industrial 3D printing remains limited, posing a challenge for manufacturers. In future, only about 30 different materials are widely used in industrial applications, which restricts design flexibility and innovation. This limitation can hinder the ability of companies to meet specific industry requirements, particularly in sectors like healthcare and aerospace, where material properties are critical for performance and safety.

United States Industrial 3D Printing and Additive Manufacturing Market Future Outlook

The future of the U.S. industrial 3D printing market appears promising, driven by technological advancements and increasing adoption across various sectors. As companies continue to explore innovative applications, the integration of artificial intelligence and IoT technologies is expected to enhance production efficiency. Furthermore, the focus on sustainability will likely lead to the development of eco-friendly materials, aligning with global environmental goals. These trends indicate a dynamic market landscape poised for significant transformation in the coming years.

Market Opportunities

- Growth in Aerospace and Automotive Sectors:The aerospace and automotive industries are increasingly adopting 3D printing for lightweight components and complex geometries. In future, these sectors are expected to contribute over $1 billion to the 3D printing market, driven by the need for efficiency and performance. This growth presents significant opportunities for manufacturers to innovate and expand their product offerings.

- Development of Sustainable Materials:The push for sustainability is creating opportunities for the development of bio-based and recyclable materials in 3D printing. By future, the market for sustainable materials is projected to reach $600 million, as companies seek to reduce their environmental footprint. This trend not only aligns with consumer preferences but also meets regulatory demands, positioning businesses favorably in a competitive landscape.