Region:Middle East

Author(s):Dev

Product Code:KRAE0262

Pages:97

Published On:December 2025

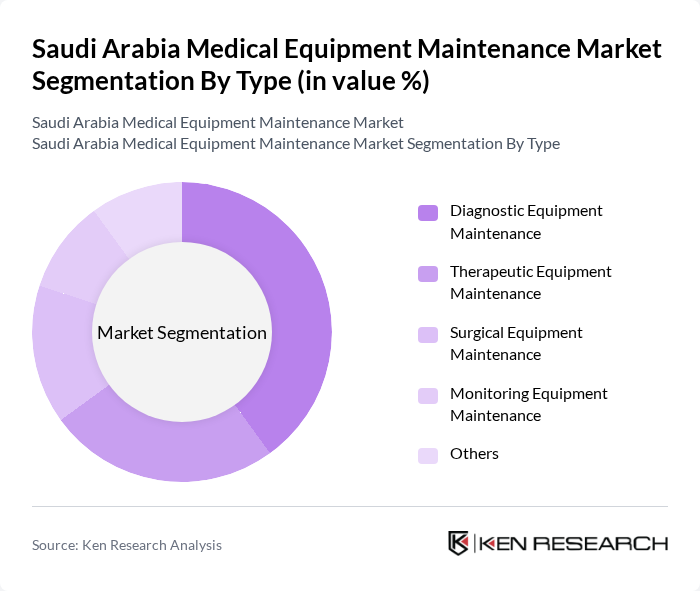

By Type:The market is segmented into various types of medical equipment maintenance services, including diagnostic, therapeutic, surgical, monitoring, and others. Among these, diagnostic equipment maintenance is the most significant segment due to the critical nature of diagnostic devices in patient care and the complexity involved in their upkeep. The increasing reliance on advanced imaging technologies and the need for regular calibration and servicing to ensure accuracy further drive this segment's growth.

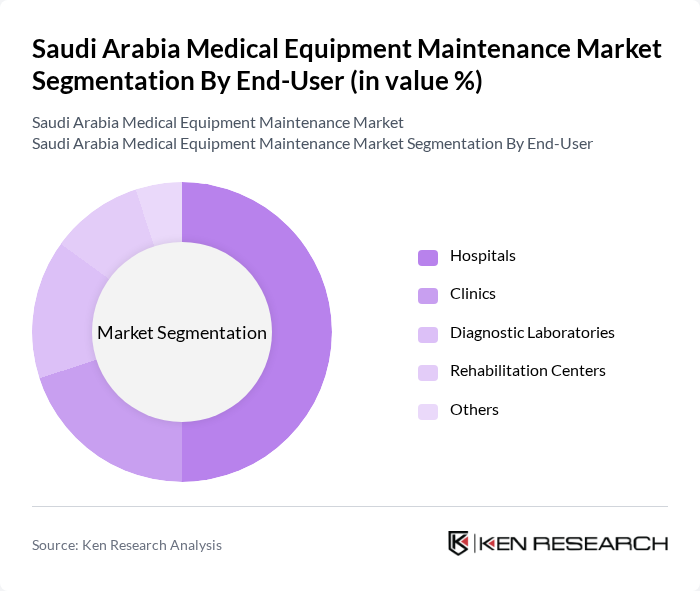

By End-User:The end-user segment includes hospitals, clinics, diagnostic laboratories, rehabilitation centers, and others. Hospitals dominate this segment due to their extensive use of various medical equipment and the critical need for regular maintenance to ensure patient safety and operational efficiency. The increasing number of hospitals and healthcare facilities in Saudi Arabia, driven by government initiatives, further supports the growth of this segment.

The Saudi Arabia Medical Equipment Maintenance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Medtronic, Johnson & Johnson, Canon Medical Systems, Fujifilm Medical Systems, Hitachi Medical Systems, Toshiba Medical Systems, Agfa HealthCare, Mindray Medical International, Stryker Corporation, Varian Medical Systems, Carestream Health, B. Braun Melsungen AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia medical equipment maintenance market appears promising, driven by technological advancements and increased healthcare investments. The integration of IoT technologies is expected to enhance equipment monitoring and predictive maintenance capabilities, reducing downtime and costs. Additionally, the expansion of telemedicine services will necessitate reliable medical equipment, further driving demand for maintenance. As the government continues to prioritize healthcare infrastructure, opportunities for growth in maintenance services will likely increase, fostering innovation and efficiency in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Equipment Maintenance Therapeutic Equipment Maintenance Surgical Equipment Maintenance Monitoring Equipment Maintenance Others |

| By End-User | Hospitals Clinics Diagnostic Laboratories Rehabilitation Centers Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Equipment Age | New Equipment Refurbished Equipment Legacy Equipment |

| By Service Type | Preventive Maintenance Corrective Maintenance Predictive Maintenance Others |

| By Contract Type | Service Contracts Time and Material Contracts Managed Services Others |

| By Technology Used | Traditional Maintenance Techniques Advanced Diagnostic Tools Remote Monitoring Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Equipment Maintenance | 150 | Maintenance Managers, Biomedical Engineers |

| Diagnostic Equipment Services | 100 | Service Technicians, Equipment Suppliers |

| Imaging Equipment Maintenance | 80 | Radiology Department Heads, Equipment Managers |

| Patient Monitoring Systems | 70 | Clinical Engineers, IT Managers |

| Laboratory Equipment Maintenance | 60 | Lab Managers, Quality Assurance Officers |

The Saudi Arabia Medical Equipment Maintenance Market is valued at approximately USD 600 million. This valuation reflects the growing demand for maintenance services driven by increased healthcare investments and the rising prevalence of chronic diseases in the country.