Germany Online Loan and P2P Lending Market Overview

- The Germany Online Loan and P2P Lending Market is valued at approximately USD 25 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, a rise in consumer demand for alternative lending solutions, and the rapid advancement of financial technology innovations, such as artificial intelligence and machine learning, which enhance user experience, operational efficiency, and accessibility .

- Key cities such as Berlin, Frankfurt, and Munich continue to dominate the market due to their robust financial ecosystems, high concentration of tech startups, and a large pool of potential borrowers. These urban centers are also home to numerous fintech companies and neobanks that facilitate online lending and P2P platforms, making them pivotal in shaping market dynamics .

- In 2023, the German government implemented the "Consumer Credit Directive Implementation Act (Verbraucherkreditrichtlinie-Umsetzungsgesetz)," issued by the Federal Ministry of Justice, which mandates that all online lending platforms comply with strict consumer protection laws. These requirements include transparent disclosure of loan terms, interest rates, and standardized information sheets, aiming to enhance consumer trust and ensure fair lending practices across the industry .

Germany Online Loan and P2P Lending Market Segmentation

By Type:The market is segmented into various types of loans, including personal loans, business loans, student loans, home improvement loans, debt consolidation loans, auto loans, home equity loans, credit lines, and others. Each type serves distinct consumer needs, with personal loans being particularly popular due to their flexibility, ease of access, and the widespread adoption of digital application processes .

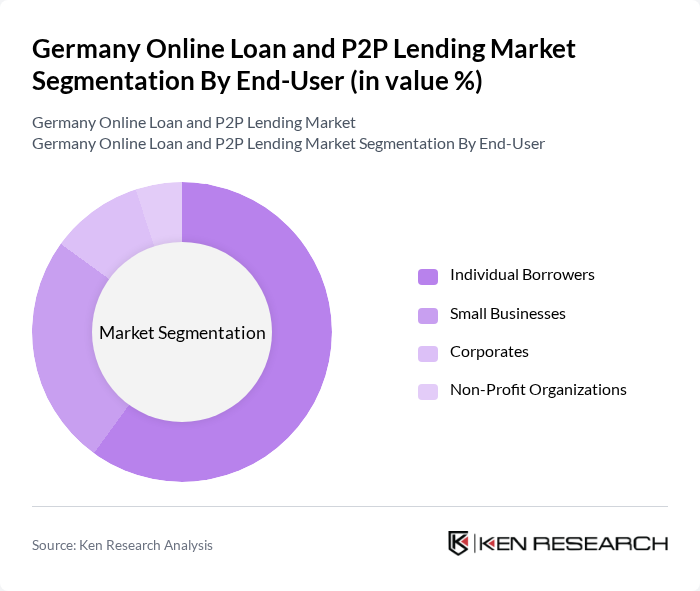

By End-User:The end-user segmentation includes individual borrowers, small businesses, corporates, and non-profit organizations. Individual borrowers represent the largest segment, driven by the increasing need for personal financing solutions, the convenience of online applications, and the growing penetration of digital banking services in Germany .

Germany Online Loan and P2P Lending Market Competitive Landscape

The Germany Online Loan and P2P Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Auxmoney GmbH, Funding Circle GmbH, Smava GmbH, Lendico GmbH, Kapilendo AG, Kreditech Holding SSL GmbH, N26 GmbH, Vivid Money GmbH, Solarisbank AG, Fidor Bank AG, ING-DiBa AG, Deutsche Bank AG, Commerzbank AG, Zencap GmbH, Monzo Bank Ltd., Revolut Ltd., Bondora AS, Mintos UAB, PeerBerry UAB contribute to innovation, geographic expansion, and service delivery in this space.

Germany Online Loan and P2P Lending Market Industry Analysis

Growth Drivers

- Increasing Digitalization of Financial Services:The digitalization of financial services in Germany is accelerating, with over 80% of adults using online banking. This trend is supported by a forecast indicating that approximately 70% of consumers prefer digital channels for loan applications. The rise of fintech companies has further enhanced accessibility, with over 1,000 fintech startups operating in Germany, driving innovation and competition in the online loan and P2P lending sectors.

- Rising Demand for Alternative Financing Options:The demand for alternative financing options has surged, with P2P lending platforms witnessing a significant increase in loan origination compared to the previous year. SMEs in Germany account for 99.6% of all businesses, seeking flexible funding solutions. The total value of loans disbursed through P2P platforms is estimated at over €1 billion, reflecting a robust shift towards alternative financing.

- Enhanced Consumer Awareness and Financial Literacy:Consumer awareness regarding financial products has improved, with financial literacy programs reaching millions of individuals in Germany. This increase in knowledge has led to a greater understanding of P2P lending benefits, with over half of consumers aware of these platforms. The number of active users on P2P lending sites is estimated at over 1 million, indicating a strong shift towards informed borrowing choices and increased market participation.

Market Challenges

- High Competition Among Lending Platforms:The online loan and P2P lending market in Germany is characterized by intense competition, with over 100 active platforms vying for market share. This saturation has led to aggressive pricing strategies, reducing profit margins for many lenders. The average interest rate for P2P loans is estimated at around 6% to 7%, as platforms compete to attract borrowers, creating a challenging environment for sustainable growth.

- Regulatory Compliance Costs:Compliance with evolving regulations poses a significant challenge for P2P lending platforms in Germany. The implementation of the EU Crowdfunding Regulation is expected to increase operational costs by up to 15%, as platforms invest in compliance infrastructure. Additionally, the need for robust data protection measures under GDPR adds further financial strain, with estimated costs reaching hundreds of thousands of EUR for mid-sized platforms to ensure adherence to these regulations.

Germany Online Loan and P2P Lending Market Future Outlook

The future of the online loan and P2P lending market in Germany appears promising, driven by technological advancements and evolving consumer preferences. As digitalization continues to reshape financial services, platforms are expected to leverage AI and machine learning for enhanced credit assessments. Furthermore, the growing emphasis on sustainable finance will likely lead to increased demand for ethical lending practices, positioning P2P platforms as key players in promoting socially responsible investment opportunities in the future.

Market Opportunities

- Expansion into Underserved Demographics:There is a significant opportunity for P2P lending platforms to target underserved demographics, particularly younger consumers and those with limited credit histories. With approximately 20% of the population aged 18-34 lacking access to traditional credit, platforms can tailor products to meet their needs, potentially increasing market penetration and fostering financial inclusion.

- Technological Innovations in Lending Platforms:The integration of advanced technologies such as blockchain and AI presents substantial opportunities for P2P lending platforms. By enhancing transparency and efficiency in transactions, these innovations can attract a broader customer base. Investments in fintech technology are estimated to exceed €1 billion, indicating a strong trend towards modernization and improved user experiences in the lending sector.