Vietnam Online Loan and P2P Lending Market Overview

- The Vietnam Online Loan and P2P Lending Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, a growing middle class, and the rising demand for quick and accessible credit solutions. The market has seen a significant influx of technology-driven platforms that cater to the needs of both borrowers and lenders, enhancing the overall efficiency of the lending process.

- Key cities such as Ho Chi Minh City and Hanoi dominate the market due to their high population density, economic activity, and technological infrastructure. These urban centers are hubs for startups and fintech companies, which have proliferated in recent years, offering innovative lending solutions that appeal to a tech-savvy consumer base. The concentration of financial institutions and investment in digital platforms further solidifies their dominance in the online loan and P2P lending landscape.

- In 2023, the Vietnamese government implemented a regulatory framework aimed at enhancing consumer protection in the online lending sector. This framework includes measures to ensure transparency in lending practices, limit interest rates, and establish a licensing system for P2P lending platforms. These regulations are designed to foster a safer borrowing environment and promote responsible lending practices among financial service providers.

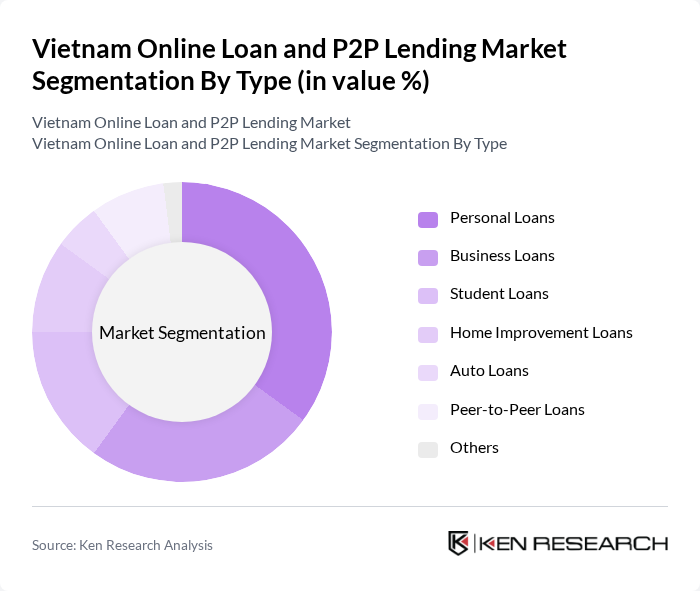

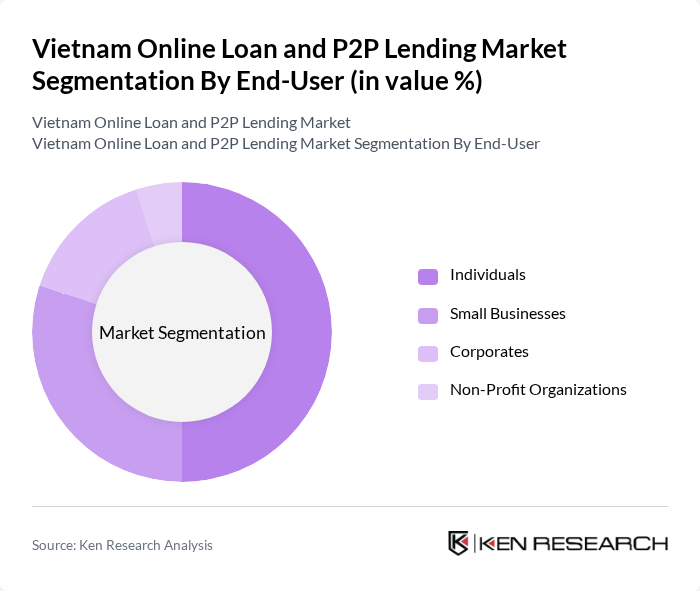

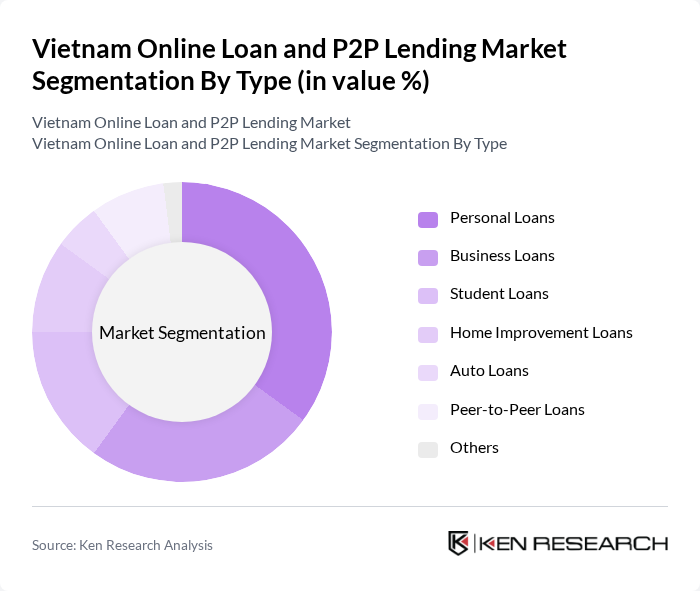

Vietnam Online Loan and P2P Lending Market Segmentation

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Student Loans, Home Improvement Loans, Auto Loans, Peer-to-Peer Loans, and Others. Personal Loans are particularly popular due to their flexibility and ease of access, catering to a wide range of consumer needs. Business Loans are also significant, driven by the growing number of startups and small businesses seeking funding for expansion. The demand for Student Loans is increasing as more individuals pursue higher education, while Home Improvement and Auto Loans are gaining traction as consumers invest in property and vehicles. Peer-to-Peer Loans are emerging as a viable alternative to traditional banking, appealing to both borrowers and investors looking for better returns.

By End-User:The end-user segmentation includes Individuals, Small Businesses, Corporates, and Non-Profit Organizations. Individuals represent the largest segment, driven by the increasing need for personal financing options. Small Businesses are also a significant user group, as they often require quick access to funds for operational expenses and growth initiatives. Corporates utilize loans for larger projects and expansions, while Non-Profit Organizations seek funding for various initiatives. The trend towards digital lending has made it easier for all these segments to access necessary funds efficiently.

Vietnam Online Loan and P2P Lending Market Competitive Landscape

The Vietnam Online Loan and P2P Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as MoMo, Tima, VayMuon, Trusting Social, Lendbiz, Finhay, VNDIRECT, Moca, ZaloPay, Home Credit Vietnam, VPBank, TPBank, BIDV, Agribank, VietinBank contribute to innovation, geographic expansion, and service delivery in this space.

Vietnam Online Loan and P2P Lending Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:As of future, Vietnam's smartphone penetration rate is projected to reach 85%, with approximately 80 million smartphone users. This surge facilitates easier access to online loan platforms, enabling users to apply for loans anytime and anywhere. The World Bank reports that mobile internet usage has increased by 30% in the last two years, further driving the adoption of digital financial services. This trend is crucial for the growth of the online loan and P2P lending market.

- Rising Demand for Quick Access to Credit:In future, the demand for quick credit solutions is expected to rise, with an estimated 60% of Vietnamese consumers seeking loans for urgent needs. The average loan processing time has decreased to just 24 hours, making online loans more appealing. According to the State Bank of Vietnam, the number of online loan applications has increased by 40% year-on-year, reflecting a significant shift towards digital lending solutions that cater to immediate financial needs.

- Expansion of Digital Payment Systems:Vietnam's digital payment systems are projected to grow by 25% in future, driven by increased e-commerce activities and consumer preference for cashless transactions. The government aims to have 50% of all transactions conducted digitally by future. This expansion supports the online loan market by providing seamless payment options for borrowers, enhancing the overall user experience and encouraging more individuals to engage with P2P lending platforms.

Market Challenges

- High Default Rates:The online lending sector in Vietnam faces significant challenges due to high default rates, which are estimated to be around 15% in future. This figure poses a risk to lenders and investors, as it affects profitability and sustainability. The lack of comprehensive credit histories for many borrowers complicates risk assessment, leading to cautious lending practices and potentially limiting the growth of the P2P lending market.

- Regulatory Uncertainties:The regulatory landscape for online loans and P2P lending in Vietnam remains uncertain, with new regulations expected to be introduced in future. Currently, there are no standardized guidelines for P2P platforms, leading to inconsistencies in operations. This uncertainty can deter potential investors and hinder the growth of innovative lending solutions, as companies may hesitate to enter a market with unclear legal frameworks and compliance requirements.

Vietnam Online Loan and P2P Lending Market Future Outlook

The future of Vietnam's online loan and P2P lending market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more individuals will likely engage with online lending platforms. Additionally, the integration of AI in credit scoring will enhance risk assessment, potentially reducing default rates. The market is expected to witness increased collaboration between fintech companies and traditional banks, fostering innovation and expanding access to credit for underserved populations.

Market Opportunities

- Untapped Rural Markets:Approximately 70% of Vietnam's population resides in rural areas, where access to traditional banking services is limited. This presents a significant opportunity for online lending platforms to cater to these underserved communities. By offering tailored loan products, companies can tap into a market with high demand for accessible credit solutions, potentially increasing their customer base and revenue.

- Innovative Lending Products:The growing trend of personalized financial services opens avenues for innovative lending products, such as microloans and flexible repayment options. With an estimated 30% of the population engaged in informal employment, these products can address specific financial needs. By leveraging technology, lenders can create customized solutions that enhance customer satisfaction and drive market growth.