Region:Europe

Author(s):Geetanshi

Product Code:KRAA3254

Pages:85

Published On:September 2025

By Type:The market is segmented into various types of advertising, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Native Advertising, Affiliate Marketing, Sponsored Products, Retailer-Owned Media Networks, Third-Party Media Networks, Integrated Media Platforms, and Others. Among these, Display Advertising and Social Media Advertising are particularly prominent due to their effectiveness in reaching targeted audiences and driving engagement. Display ads hold the largest segment share, reflecting the strong demand for visually engaging formats, while social media advertising benefits from the high penetration of platforms among German consumers .

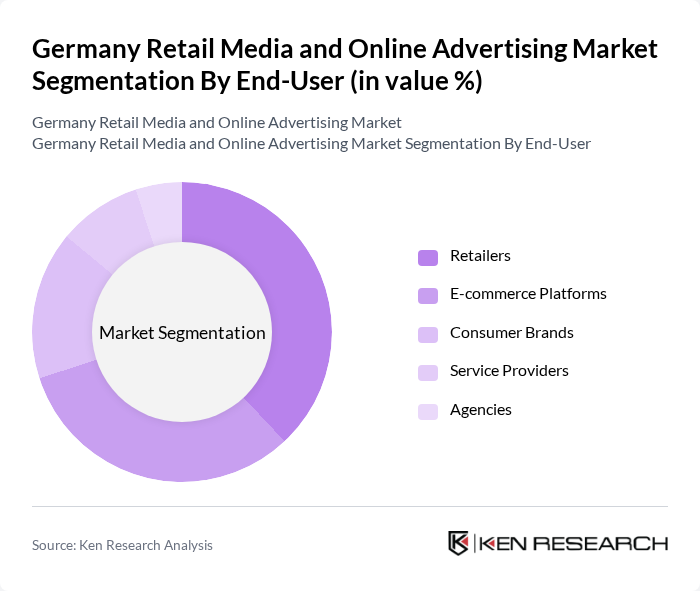

By End-User:The end-user segmentation includes Retailers, E-commerce Platforms, Consumer Brands, Service Providers, and Agencies. Retailers and E-commerce Platforms are the leading segments, as they heavily invest in online advertising to drive sales and enhance customer experience. Retailers are increasingly leveraging in-store digital signage and omnichannel strategies, while e-commerce platforms focus on personalized and data-driven campaigns .

The Germany Retail Media and Online Advertising Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Advertising, Google Ads, Meta Ads (Facebook & Instagram), Criteo, Adform, Rakuten Advertising, Awin, TradeDoubler, Outbrain, Taboola, MediaMath, Sizmek, AdRoll, Verve Group, Quantcast, Schwarz Media (Schwarz Gruppe), Otto Advertising, Zalando Marketing Services, Kaufland Marketing Services, Rewe Media, OBI First Media Group, Mirakl, CitrusAd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German retail media and online advertising market appears promising, driven by technological advancements and evolving consumer preferences. As brands increasingly adopt omnichannel strategies, the integration of AI and machine learning will enhance personalization and targeting capabilities. Furthermore, the growing emphasis on sustainability in advertising will shape brand narratives, appealing to environmentally conscious consumers. These trends indicate a dynamic market landscape, fostering innovation and collaboration among stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Native Advertising Affiliate Marketing Sponsored Products Retailer-Owned Media Networks Third-Party Media Networks Integrated Media Platforms Others |

| By End-User | Retailers E-commerce Platforms Consumer Brands Service Providers Agencies |

| By Sales Channel | Online Marketplaces Direct Sales Third-Party Platforms Brick-and-Mortar Retailers Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Retargeting |

| By Campaign Objective | Brand Awareness Lead Generation Customer Acquisition Customer Retention |

| By Format | Banner Ads Sponsored Content Pop-up Ads Shoppable Media Others |

| By Industry Vertical | Fashion and Apparel Electronics Food and Beverage Health and Beauty Automotive Travel and Tourism Home Improvement & DIY Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Media Strategies | 100 | Marketing Directors, Brand Managers |

| Online Advertising Effectiveness | 80 | Digital Marketing Specialists, Analytics Managers |

| Consumer Engagement with Retail Ads | 60 | Market Researchers, Consumer Insights Analysts |

| Trends in E-commerce Advertising | 90 | E-commerce Managers, Digital Strategy Leads |

| Impact of Social Media on Retail | 70 | Social Media Managers, Content Strategists |

The Germany Retail Media and Online Advertising Market is valued at approximately USD 2.7 billion, reflecting a significant shift of advertising budgets from traditional media to digital platforms, driven by the growth of e-commerce and mobile shopping.