Region:Europe

Author(s):Geetanshi

Product Code:KRAA4786

Pages:82

Published On:September 2025

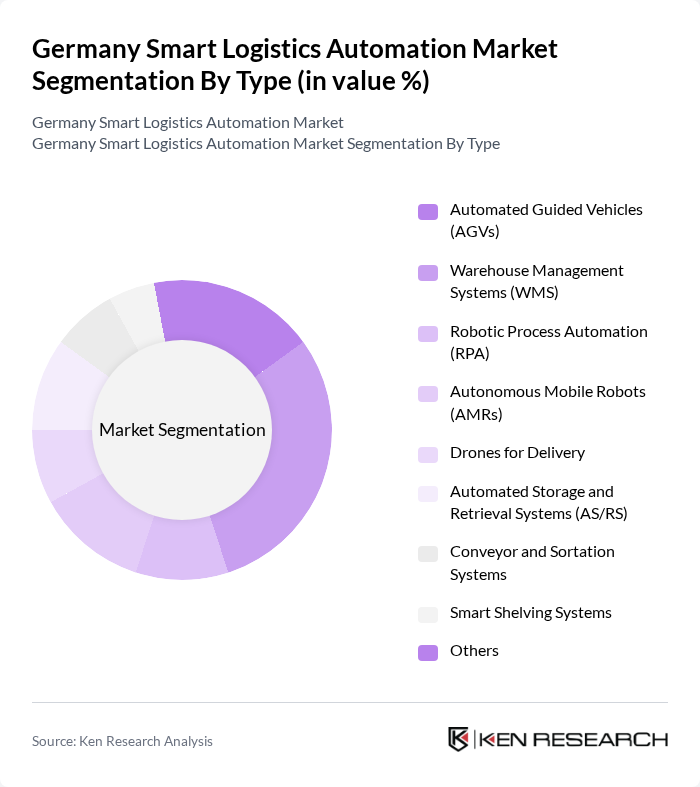

By Type:The market is segmented into various types of smart logistics automation technologies, each catering to specific operational needs. The subsegments include Automated Guided Vehicles (AGVs), Warehouse Management Systems (WMS), Robotic Process Automation (RPA), Autonomous Mobile Robots (AMRs), Drones for Delivery, Automated Storage and Retrieval Systems (AS/RS), Conveyor and Sortation Systems, Smart Shelving Systems, and Others. Among these, Warehouse Management Systems (WMS) are currently leading the market due to their critical role in optimizing inventory management and order fulfillment processes. The adoption of AGVs and AMRs is also accelerating, driven by the need for flexible and scalable automation in both new and retrofitted warehouse environments. Hardware solutions, including AS/RS and conveyor systems, represent a substantial portion of the market, reflecting ongoing investments in physical automation infrastructure .

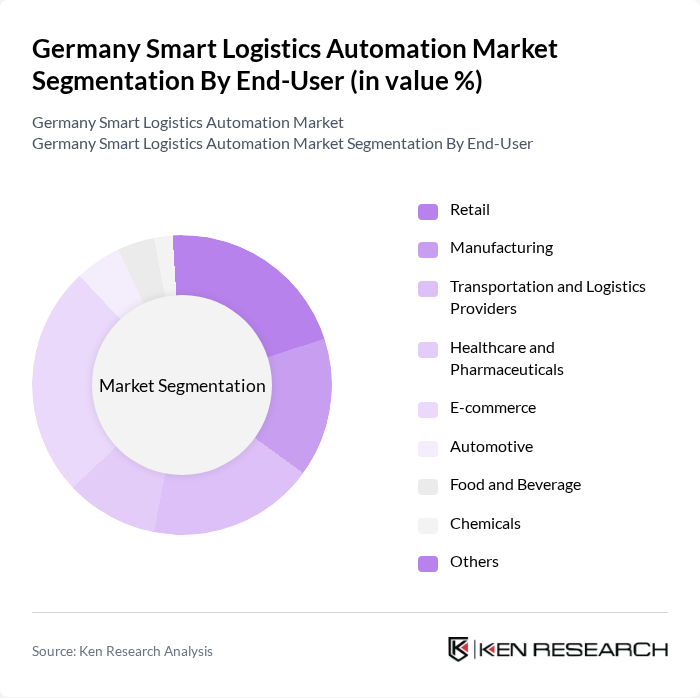

By End-User:The end-user segmentation includes various industries that utilize smart logistics automation technologies. The primary segments are Retail, Manufacturing, Transportation and Logistics Providers, Healthcare and Pharmaceuticals, E-commerce, Automotive, Food and Beverage, Chemicals, and Others. The E-commerce sector is currently the dominant end-user, driven by the need for rapid order fulfillment and efficient inventory management to meet consumer demands. Retail and manufacturing sectors are also experiencing robust adoption of automation solutions, particularly in response to labor shortages and the need for operational resilience. The chemicals and pharmaceuticals industry is increasingly investing in specialized automation for sensitive and high-value materials, ensuring compliance and safety in logistics operations .

The Germany Smart Logistics Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, KION Group AG, Jungheinrich AG, Dematic GmbH, Swisslog Holding AG, Vanderlande Industries B.V., Honeywell International Inc., Zebra Technologies Corporation, Amazon Robotics (Amazon.com, Inc.), Beumer Group GmbH & Co. KG, Knapp AG, Kardex Holding AG, SSI Schäfer Group, SAP SE, Bosch Rexroth AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart logistics automation market in Germany appears promising, driven by technological advancements and increasing demand for efficiency. As companies continue to adopt IoT and AI technologies, the logistics landscape will evolve, emphasizing real-time data utilization and automation. Furthermore, the push towards sustainability will likely shape investment strategies, with firms seeking eco-friendly solutions. The integration of autonomous vehicles and advanced analytics will also play a crucial role in enhancing operational efficiency and customer satisfaction in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Warehouse Management Systems (WMS) Robotic Process Automation (RPA) Autonomous Mobile Robots (AMRs) Drones for Delivery Automated Storage and Retrieval Systems (AS/RS) Conveyor and Sortation Systems Smart Shelving Systems Others |

| By End-User | Retail Manufacturing Transportation and Logistics Providers Healthcare and Pharmaceuticals E-commerce Automotive Food and Beverage Chemicals Others |

| By Application | Inventory Management Order Fulfillment Transportation Management Supply Chain Visibility Last-Mile Delivery Predictive Maintenance Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Sales |

| By Distribution Mode | Road Rail Air Sea |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Logistics Automation | 60 | Logistics Managers, Supply Chain Managers |

| E-commerce Fulfillment Automation | 50 | Operations Managers, IT Managers |

| Warehouse Management Systems | 40 | Warehouse Managers, Technology Managers |

| Retail Supply Chain Automation | 45 | Procurement Managers, Retail Operations Managers |

| Smart Transportation Solutions | 35 | Fleet Managers, Logistics Coordinators |

The Germany Smart Logistics Automation Market is valued at approximately USD 4.5 billion, reflecting significant growth driven by the demand for efficiency in supply chain operations, advancements in technology, and the rise of e-commerce.