Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3074

Pages:98

Published On:October 2025

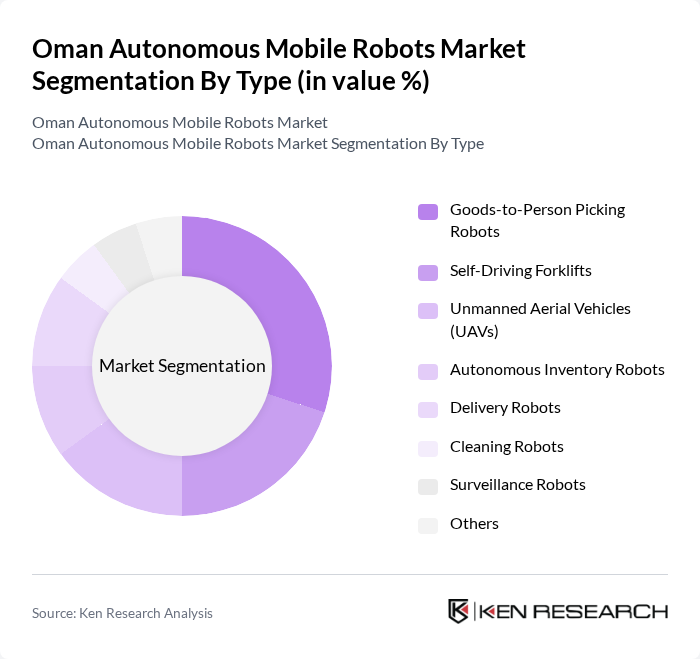

By Type:The market is segmented into various types of autonomous mobile robots, each serving distinct functions across different industries. The subsegments include Goods-to-Person Picking Robots, Self-Driving Forklifts, Unmanned Aerial Vehicles (UAVs), Autonomous Inventory Robots, Delivery Robots, Cleaning Robots, Surveillance Robots, and Others. Among these, Goods-to-Person Picking Robots are leading the market due to their efficiency in warehouse operations, significantly reducing order fulfillment times and labor costs.

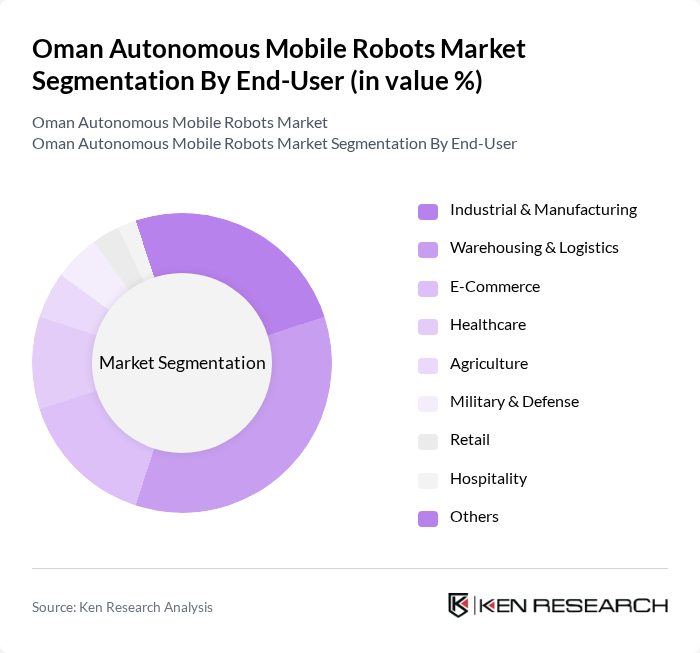

By End-User:The end-user segmentation includes Industrial & Manufacturing, Warehousing & Logistics, E-Commerce, Healthcare, Agriculture, Military & Defense, Retail, Hospitality, and Others. The Warehousing & Logistics sector is currently the dominant segment, driven by the increasing need for automation in supply chain management and the growing e-commerce industry, which demands efficient order processing and inventory management.

The Oman Autonomous Mobile Robots Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omron Robotics and Automation, Mobile Industrial Robots (MiR), Geekplus Technology Co., Ltd., Locus Robotics, Fetch Robotics (now Zebra Technologies), Clearpath Robotics, Boston Dynamics, Savioke, GreyOrange, Yaskawa Electric Corporation, Aethon, Robotnik Automation, PAL Robotics, Hikrobot, OTSAW Digital Pte Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the autonomous mobile robots market in Oman appears promising, driven by technological advancements and increasing demand for automation across various sectors. As businesses recognize the potential of AMRs to enhance efficiency and reduce costs, adoption rates are expected to rise. Furthermore, the integration of AI and machine learning into AMRs will likely lead to more sophisticated applications, making them indispensable in logistics, healthcare, and retail. This trend will foster a more competitive landscape, encouraging innovation and collaboration among industry players.

| Segment | Sub-Segments |

|---|---|

| By Type | Goods-to-Person Picking Robots Self-Driving Forklifts Unmanned Aerial Vehicles (UAVs) Autonomous Inventory Robots Delivery Robots Cleaning Robots Surveillance Robots Others |

| By End-User | Industrial & Manufacturing Warehousing & Logistics E-Commerce Healthcare Agriculture Military & Defense Retail Hospitality Others |

| By Application | Material Handling Inventory Management Sorting Pick & Place Tugging Delivery Services Surveillance and Security Cleaning and Maintenance Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Outlets Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Autonomous Navigation Remote Control Hybrid Systems Vision Guidance Laser/LiDAR Navigation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics and Warehousing | 60 | Warehouse Managers, Operations Directors |

| Manufacturing Automation | 50 | Production Managers, Engineering Heads |

| Healthcare Robotics | 40 | Healthcare Administrators, Facility Managers |

| Retail Automation | 45 | Retail Operations Managers, Supply Chain Coordinators |

| Research and Development | 40 | R&D Managers, Technology Officers |

The Oman Autonomous Mobile Robots Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This growth is driven by increased automation adoption across sectors like logistics and healthcare, enhancing operational efficiency and reducing labor costs.