Region:Global

Author(s):Rebecca

Product Code:KRAD7533

Pages:96

Published On:December 2025

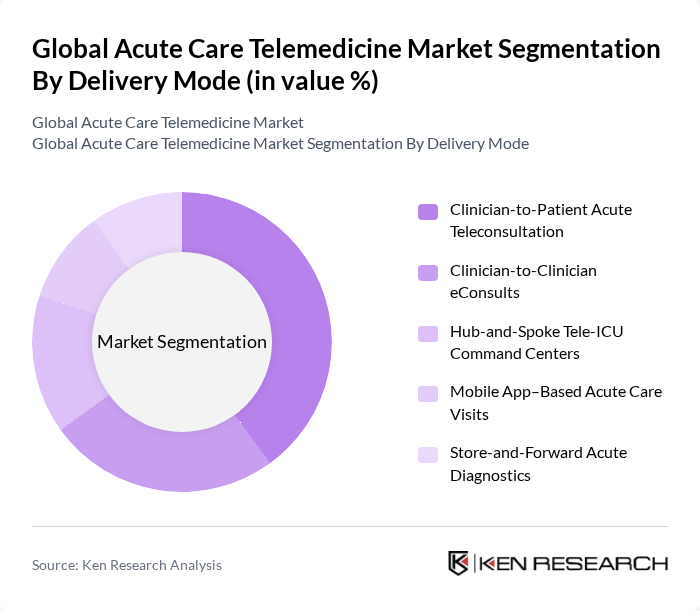

By Delivery Mode:The delivery mode segment includes various methods through which acute care telemedicine services are provided. The subsegments are Clinician-to-Patient Acute Teleconsultation, Clinician-to-Clinician eConsults, Hub-and-Spoke Tele-ICU Command Centers, Mobile App–Based Acute Care Visits, and Store-and-Forward Acute Diagnostics. Clinician-to-Patient Acute Teleconsultation is currently the leading subsegment in terms of encounter volumes and revenue, supported by the expansion of virtual urgent care, emergency tele-triage, and on-demand video visits for acute but non-life-threatening conditions. Clinician-to-Clinician eConsults and tele-ICU hub?and?spoke command centers are also growing rapidly as hospitals leverage remote intensivists and specialists to manage capacity constraints and staff shortages in critical care and emergency departments.

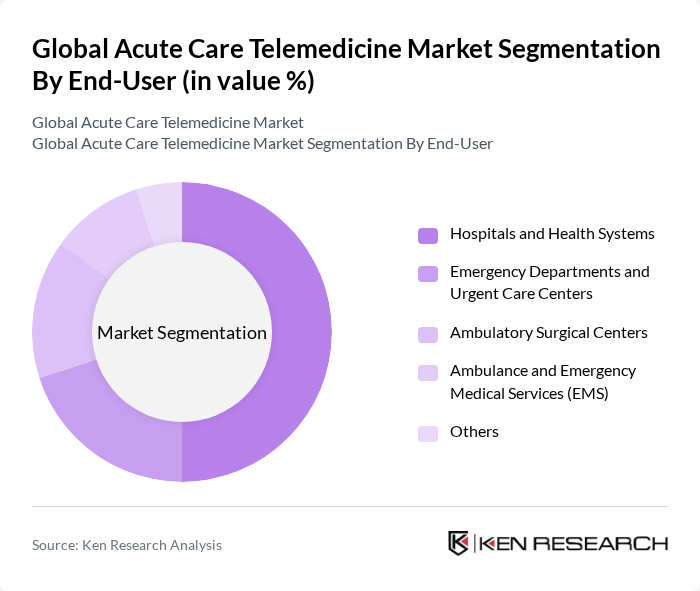

By End-User:The end-user segment encompasses various healthcare settings that utilize acute care telemedicine services. This includes Hospitals and Health Systems, Emergency Departments and Urgent Care Centers, Ambulatory Surgical Centers, Ambulance and Emergency Medical Services (EMS), and Others. Hospitals and Health Systems dominate this segment due to their extensive inpatient, ICU, and emergency department infrastructure and their role as primary adopters of tele?ICU, telestroke, telepsychiatry, and hospital?at?home acute programs. Growing adoption among ambulatory surgical centers, urgent care chains, and EMS providers is supported by use of teleconsults for pre?operative assessments, rapid specialist input, and real?time guidance during emergency transport.

The Global Acute Care Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teladoc Health, Inc., American Well Corporation (Amwell), SOC Telemed (a part of Patient Square Capital), GE HealthCare Technologies Inc. (Tele-ICU Solutions), Philips Healthcare (Philips eICU and Acute Telehealth), Cerner Corporation (Oracle Health) – Telehealth and Acute Care, GlobalMed, InTouch Health (Teladoc Health InTouch), Amwell Hospital and Acute Care Solutions, Epic Systems Corporation (Telehealth and Acute Care Integration), Medtronic plc (Remote Acute Cardiac Monitoring and Telemetry), Siemens Healthineers (Acute Care Digital Health Solutions), eVisit, Inc. (Emergency and On-Demand Care Platforms), SOC Telemed Neurology and Critical Care Services, TeleSpecialists LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of acute care telemedicine appears promising, driven by technological advancements and increasing acceptance among healthcare providers. As the global population ages, the demand for remote healthcare services is expected to rise significantly. Innovations in artificial intelligence and machine learning will enhance diagnostic capabilities, while partnerships with insurance providers will facilitate broader access to telehealth services. Additionally, the focus on mental health services will create new avenues for telemedicine growth, addressing the rising demand for accessible mental health care solutions.

| Segment | Sub-Segments |

|---|---|

| By Delivery Mode | Clinician-to-Patient Acute Teleconsultation Clinician-to-Clinician eConsults Hub-and-Spoke Tele-ICU Command Centers Mobile App–Based Acute Care Visits Store-and-Forward Acute Diagnostics |

| By End-User | Hospitals and Health Systems Emergency Departments and Urgent Care Centers Ambulatory Surgical Centers Ambulance and Emergency Medical Services (EMS) Others |

| By Service Type | Tele-ICU (Intensive Care) Telestroke and Acute Neurology Emergency Teleconsultation Telenursing and Virtual Triage Remote Acute Patient Monitoring |

| By Technology | Telemedicine Carts and Workstations Portable and Handheld Telemedicine Systems Cloud-Based Acute Care Platforms AI-Enabled Clinical Decision Support Tools Others |

| By Clinical Application | Emergency Medicine Critical Care and ICU Management Acute Cardiology and Telestroke Acute Infectious Disease and Sepsis Management Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Policy Support | Government Reimbursement and Parity Laws Public and Private Grants for Acute Telehealth Value-Based Care and Alternative Payment Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Service Providers | 100 | CEOs, Product Managers, Technology Officers |

| Healthcare Institutions | 80 | Hospital Administrators, IT Directors, Clinical Managers |

| Patients Utilizing Telemedicine | 120 | Patients, Caregivers, Health Advocates |

| Healthcare Policy Makers | 60 | Health Economists, Policy Analysts, Regulatory Officials |

| Technology Vendors in Telehealth | 70 | Sales Executives, Product Development Managers, Support Staff |

The Global Acute Care Telemedicine Market is valued at approximately USD 27 billion, reflecting significant growth driven by the increasing demand for remote healthcare services and the rising prevalence of chronic diseases requiring urgent care.