Region:North America

Author(s):Geetanshi

Product Code:KRAD7279

Pages:81

Published On:December 2025

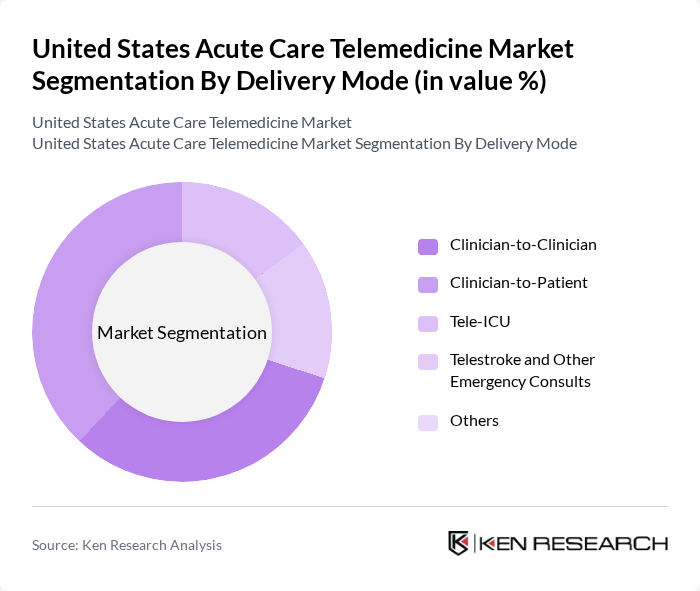

By Delivery Mode:The delivery mode segmentation includes various methods through which telemedicine services are provided. The subsegments are Clinician-to-Clinician, Clinician-to-Patient, Tele-ICU, Telestroke and Other Emergency Consults, and Others. Clinician-to-Clinician is currently the leading subsegment, driven by the increasing acceptance of virtual consultations among patients and healthcare providers. The convenience and accessibility of remote consultations have made this mode particularly popular, especially during the pandemic. Clinician-to-Patient represents the fastest-growing subsegment, fueled by advancements in user-friendly telehealth interfaces, patient engagement tools, and mobile diagnostics.

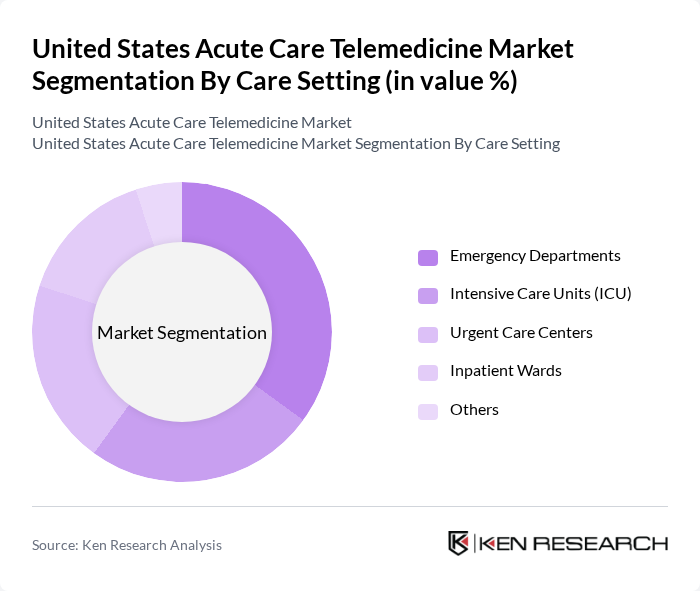

By Care Setting:The care setting segmentation encompasses various environments where telemedicine services are utilized. The subsegments include Emergency Departments, Intensive Care Units (ICU), Urgent Care Centers, Inpatient Wards, and Others. Emergency Departments are the dominant subsegment, as they require immediate access to specialist consultations and rapid decision-making, which telemedicine effectively facilitates. The integration of telemedicine in emergency settings has proven to enhance patient outcomes and streamline care delivery.

The United States Acute Care Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teladoc Health, Inc., American Well Corporation (Amwell), US Acute Care Solutions, Access TeleCare, LLC, Eagle Telemedicine, AMN Healthcare Services Inc., Vidyo, Inc. (Enghouse Video), GE HealthCare Technologies Inc., Advanced ICU Care (Acute Telemedicine for ICUs), SOC Telemed / Access TeleCare (Hospital-Based Telemedicine), AMD Global Telemedicine, Inc., RelyMD, Orbit Health, Doctor On Demand (Included Health, Inc.), US TeleInHealth and Other Emerging Acute Care Telehealth Providers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the acute care telemedicine market in the United States appears promising, driven by ongoing technological advancements and a growing acceptance of remote healthcare solutions. As healthcare providers increasingly adopt telehealth services, the integration of artificial intelligence and machine learning will enhance diagnostic accuracy and patient engagement. Additionally, the shift towards value-based care models will further incentivize the adoption of telemedicine, ensuring that patients receive high-quality care while managing costs effectively.

| Segment | Sub-Segments |

|---|---|

| By Delivery Mode | Clinician-to-Clinician Clinician-to-Patient Tele-ICU Telestroke and Other Emergency Consults Others |

| By Care Setting | Emergency Departments Intensive Care Units (ICU) Urgent Care Centers Inpatient Wards Others |

| By Clinical Application | Telestroke Telepsychiatry (Acute Behavioral Health) Telehospitalist / General Acute Care Tele-ICU and Critical Care Other Acute Specialty Consults |

| By Technology | Cloud-Based Platforms On-Premise Solutions Web & Mobile-Enabled Platforms Hardware & Endpoint Devices |

| By Hospital Size | Large Hospitals (>300 Beds) Medium Hospitals (100–300 Beds) Small Hospitals (<100 Beds) Critical Access Hospitals |

| By Payer Type | Medicare Medicaid Commercial Insurance Self-Pay / Others |

| By Payment Model | Fee-for-Service Subscription / Contract-Based Per-Encounter / Pay-Per-Use Value-Based & Risk-Sharing Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers Using Telemedicine | 120 | Doctors, Nurse Practitioners, Telehealth Coordinators |

| Telemedicine Technology Vendors | 90 | Product Managers, Sales Directors, Technical Support Leads |

| Patients Utilizing Acute Care Telemedicine | 130 | Patients, Caregivers, Health Advocates |

| Healthcare Policy Makers | 60 | Health Administrators, Policy Analysts, Regulatory Affairs Specialists |

| Insurance Providers Involved in Telemedicine | 50 | Underwriters, Claims Adjusters, Policy Development Managers |

The United States Acute Care Telemedicine Market is valued at approximately USD 10 billion, reflecting significant growth driven by increased demand for remote healthcare services, advancements in technology, and the rising prevalence of chronic diseases.