Region:Middle East

Author(s):Dev

Product Code:KRAC1186

Pages:98

Published On:December 2025

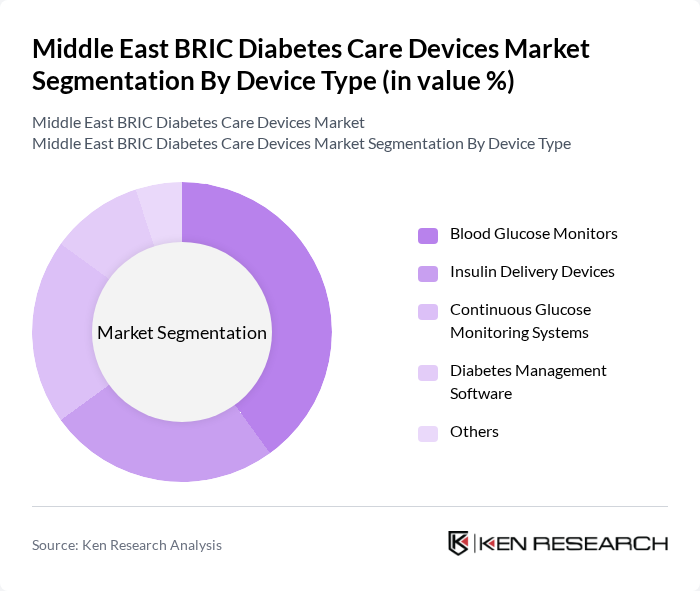

By Device Type:The market for diabetes care devices is segmented into various device types, including Blood Glucose Monitors, Insulin Delivery Devices, Continuous Glucose Monitoring Systems, Diabetes Management Software, and Others. Among these, Blood Glucose Monitors are the most widely used due to their essential role in daily diabetes management. The increasing prevalence of diabetes has led to a surge in demand for these devices, as they provide immediate feedback to patients regarding their glucose levels, thus facilitating better disease management.

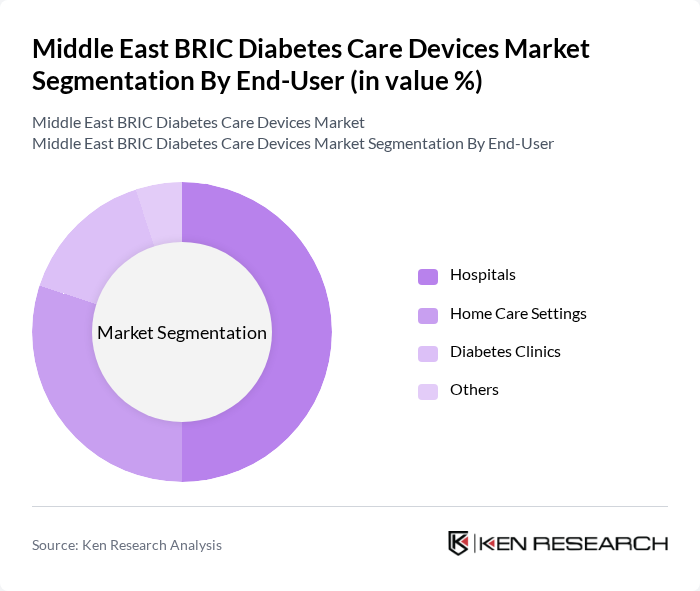

By End-User:The diabetes care devices market is also segmented by end-user, which includes Hospitals, Home Care Settings, Diabetes Clinics, and Others. Hospitals are the leading end-users due to their capacity to provide comprehensive diabetes management services, including access to advanced technologies and healthcare professionals. The growing number of diabetes cases has led to increased hospital admissions, further driving the demand for diabetes care devices in these settings.

The Middle East BRIC Diabetes Care Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Medtronic, Roche Diabetes Care, Johnson & Johnson, Novo Nordisk, Sanofi, Bayer AG, Dexcom, Ascensia Diabetes Care, Insulet Corporation, Ypsomed, B. Braun Melsungen AG, Acon Laboratories, LifeScan, Glooko contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East BRIC diabetes care devices market is poised for significant transformation, driven by advancements in technology and increasing healthcare investments. The integration of AI and telehealth solutions will enhance diabetes management, enabling personalized care and improved patient outcomes. Additionally, the expansion of smart hospitals and IoT devices will facilitate better connectivity and data sharing, further optimizing diabetes care. These trends indicate a promising landscape for innovation and growth in the diabetes care sector.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Blood Glucose Monitors Insulin Delivery Devices Continuous Glucose Monitoring Systems Diabetes Management Software Others |

| By End-User | Hospitals Home Care Settings Diabetes Clinics Others |

| By Distribution Channel | Online Retail Pharmacies Hospitals Direct Sales Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Age Group | Children Adults Elderly Others |

| By Income Level | Low-Income Middle-Income High-Income Others |

| By Technology Adoption | Traditional Devices Smart Devices Wearable Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 150 | Endocrinologists, Diabetes Educators |

| Medical Device Distributors | 100 | Sales Managers, Product Managers |

| Diabetes Patients | 200 | Type 1 and Type 2 Diabetes Patients |

| Healthcare Policy Makers | 80 | Health Ministry Officials, Public Health Experts |

| Market Analysts | 50 | Healthcare Market Analysts, Research Consultants |

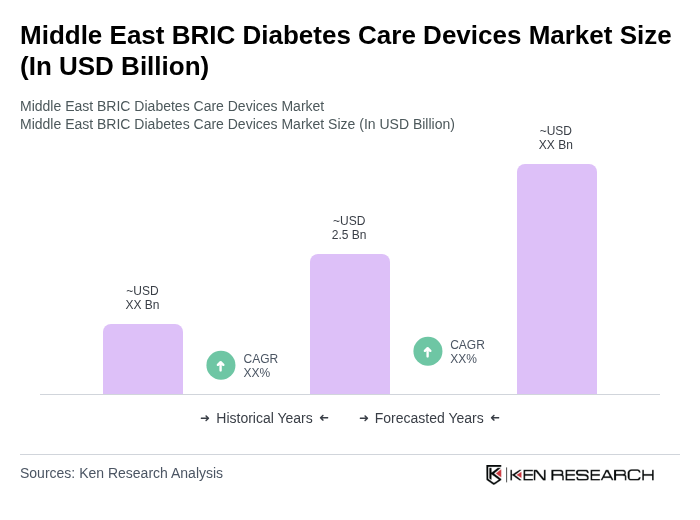

The Middle East BRIC Diabetes Care Devices Market is valued at approximately USD 2.5 billion. This valuation reflects the increasing prevalence of diabetes and the adoption of advanced technologies in diabetes management across the region.