Global Air Handling Units Market Overview

- The Global Air Handling Units Market is valued at USD 13.1 billion, based on a five-year historical analysis . This growth is primarily driven by increasing demand for energy-efficient HVAC systems, rapid urbanization, and the implementation of stricter regulations regarding indoor air quality. The market is further propelled by technological advancements such as IoT integration, smart sensors, and enhanced filtration systems, which improve energy efficiency and lower operational costs .

- Key players in this market include the United States, Germany, and China, which dominate due to robust industrial sectors and significant investments in infrastructure development . The presence of leading manufacturers and a growing focus on sustainable building practices further contribute to their market leadership. These countries have established regulatory frameworks and building codes that promote the adoption of advanced air handling technologies, supporting market expansion and innovation .

- In 2023, the European Union implemented the Ecodesign Directive (Directive 2009/125/EC, as amended), issued by the European Commission. This regulation mandates that all air handling units placed on the EU market meet specific minimum energy efficiency standards, including requirements for fan efficiency, heat recovery, and overall unit performance. The directive aims to reduce energy consumption and greenhouse gas emissions, driving manufacturers to innovate and improve product efficiency. Compliance with these standards is essential for market participants to maintain competitiveness and address consumer demand for sustainable solutions .

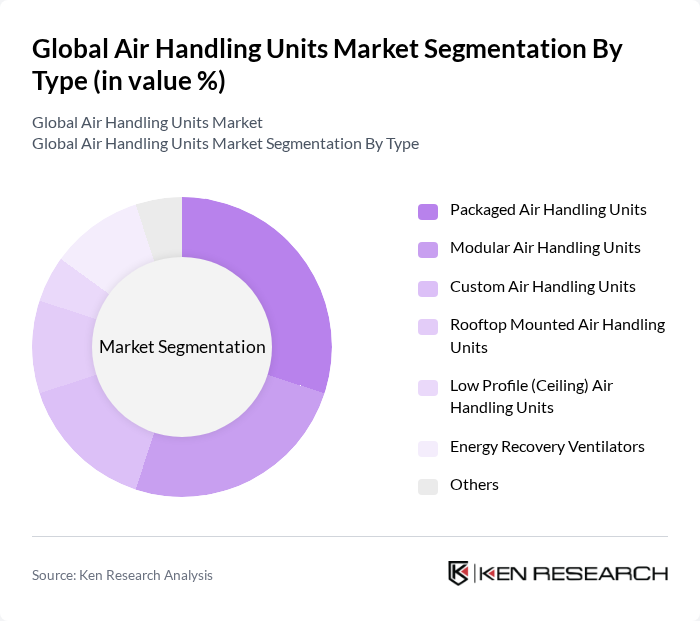

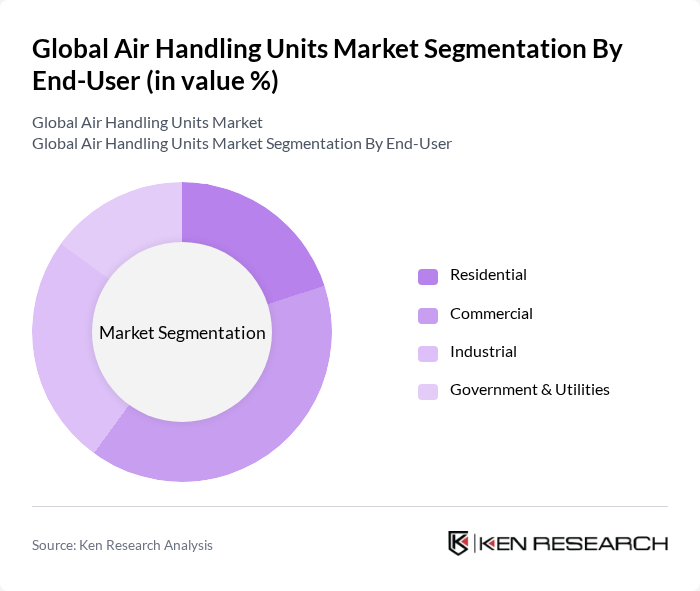

Global Air Handling Units Market Segmentation

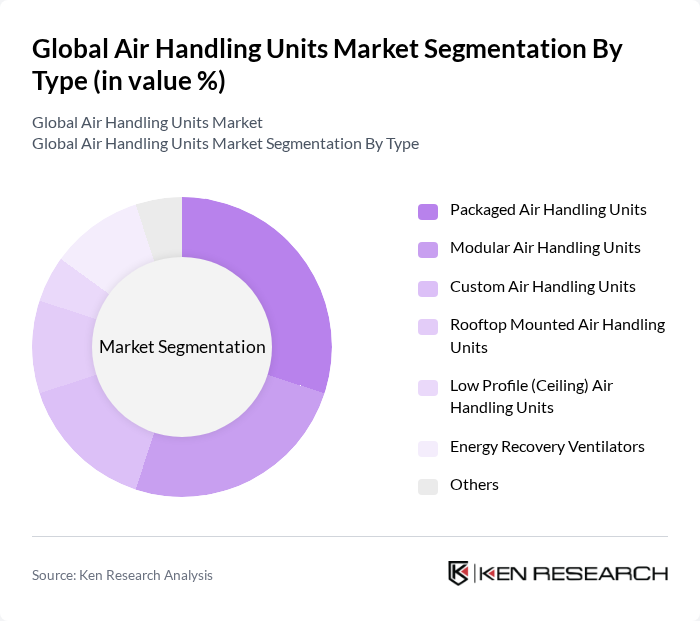

By Type:The air handling units market is segmented into Packaged Air Handling Units, Modular Air Handling Units, Custom Air Handling Units, Rooftop Mounted Air Handling Units, Low Profile (Ceiling) Air Handling Units, Energy Recovery Ventilators, and Others. Packaged Air Handling Units are gaining traction due to their compact design, integrated controls, and ease of installation, making them suitable for both residential and commercial applications. Modular Air Handling Units remain popular for their flexibility, scalability, and ability to meet diverse project requirements, especially in large-scale commercial and industrial settings .

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Commercial sector is the largest consumer of air handling units, driven by the need for efficient climate control in office buildings, shopping malls, hospitals, and hotels. The Industrial sector follows closely, as manufacturing facilities and data centers require robust air handling solutions to maintain optimal working conditions and meet regulatory requirements. The adoption of smart building technologies and energy-efficient systems is accelerating demand across all segments, with particular growth in commercial and industrial applications .

Global Air Handling Units Market Competitive Landscape

The Global Air Handling Units Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trane Technologies plc, Johnson Controls International plc, Daikin Industries, Ltd., Carrier Global Corporation, Lennox International Inc., Mitsubishi Electric Corporation, Siemens AG, Honeywell International Inc., Systemair AB, GEA Group AG, Swegon AB, TROX GmbH, AAF International (American Air Filter Company, Inc.), Panasonic Corporation, FläktGroup, Munters AB, LG Electronics Inc., Midea Group, Nortek Global HVAC, STULZ GmbH, Hastings HVAC Inc., VTS Group, Sabiana S.p.A., Evapoler Eco Cooling Solutions contribute to innovation, geographic expansion, and service delivery in this space.

Global Air Handling Units Market Industry Analysis

Growth Drivers

- Increasing Demand for Energy-Efficient Systems:The global push for energy efficiency is driving the air handling units market, with energy-efficient systems projected to reduce energy consumption by up to 30% in commercial buildings. According to the International Energy Agency, energy-efficient HVAC systems can save approximately USD 1.2 trillion globally in future. This demand is particularly strong in regions where energy costs are rising, prompting investments in advanced air handling technologies that meet stringent efficiency standards.

- Rising Construction Activities in Emerging Economies:Emerging economies, particularly in Asia-Pacific, are experiencing a construction boom, with the World Bank estimating a 6% growth in construction output in future. This surge is driven by urbanization and infrastructure development, leading to increased demand for air handling units in commercial and residential buildings. For instance, India’s construction sector is expected to reach USD 1 trillion in future, significantly boosting the air handling units market as new buildings require efficient HVAC systems.

- Stringent Government Regulations on Air Quality:Governments worldwide are implementing stricter air quality regulations, with the World Health Organization reporting that air pollution causes 7 million premature deaths annually. In response, many countries are mandating improved air quality standards in buildings, which necessitates the installation of advanced air handling units. For example, the U.S. Environmental Protection Agency has set guidelines that require enhanced ventilation systems, driving demand for compliant air handling solutions in both new and existing structures.

Market Challenges

- High Initial Investment Costs:The upfront costs associated with purchasing and installing air handling units can be a significant barrier for many businesses. For instance, the average cost of a commercial air handling unit can range from USD 5,000 to USD 20,000, depending on specifications. This high initial investment can deter small and medium-sized enterprises from upgrading their systems, particularly in regions where budget constraints are prevalent, limiting market growth potential.

- Complexity in Installation and Maintenance:The installation and maintenance of air handling units require specialized knowledge and skills, which can complicate the process. According to industry reports, improper installation can lead to a 30% decrease in system efficiency. Additionally, the need for regular maintenance can incur costs averaging USD 1,000 annually, posing challenges for facility managers who may lack the expertise or resources to ensure optimal performance, thereby affecting overall market adoption.

Global Air Handling Units Market Future Outlook

The future of the air handling units market appears promising, driven by technological advancements and increasing awareness of indoor air quality. The integration of smart technologies and IoT capabilities is expected to enhance system efficiency and user control. Furthermore, as sustainability becomes a priority, manufacturers are likely to focus on developing eco-friendly materials and solutions. This trend will not only meet regulatory demands but also cater to the growing consumer preference for sustainable building practices, ensuring a robust market trajectory.

Market Opportunities

- Growth in Smart Building Technologies:The rise of smart building technologies presents significant opportunities for air handling units. With the global smart building market projected to reach USD 1.2 trillion in future, integrating air handling units with smart systems can enhance energy management and operational efficiency, appealing to environmentally conscious consumers and businesses alike.

- Expansion of the Green Building Market:The green building market is expected to grow substantially, with the U.S. Green Building Council reporting that green building construction is projected to reach USD 1.6 trillion in future. This expansion creates opportunities for air handling units that meet LEED certification standards, as more developers seek to incorporate sustainable practices into their projects, driving demand for innovative HVAC solutions.