Region:Global

Author(s):Geetanshi

Product Code:KRAD6008

Pages:100

Published On:December 2025

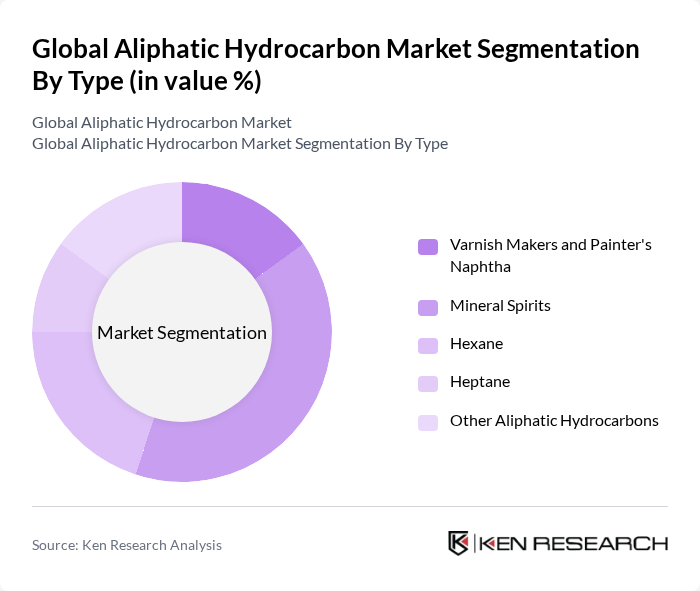

By Type:The aliphatic hydrocarbon market is segmented into various types, including Varnish Makers and Painter's Naphtha, Mineral Spirits, Hexane, Heptane, and Other Aliphatic Hydrocarbons. Among these, Mineral Spirits (also referred to as white spirits) and Varnish Makers and Painter's Naphtha are among the most widely used solvent types in paints and coatings, metalworking fluids, and cleaning formulations, owing to their good solvency for resins, controlled evaporation rates, and relatively low cost compared with oxygenated solvents. In parallel, n-hexane and n-heptane are increasingly in demand for high-purity applications, including polymerization, specialty chemical synthesis, and adhesive and sealant formulations, where tighter boiling ranges and low aromatic content are critical quality parameters.

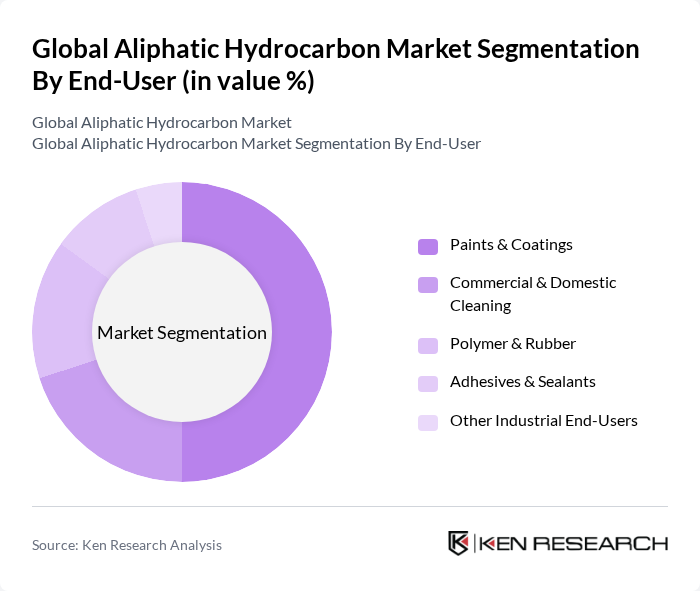

By End-User:The end-user segmentation of the aliphatic hydrocarbon market includes Paints & Coatings, Commercial & Domestic Cleaning, Polymer & Rubber, Adhesives & Sealants, and Other Industrial End-Users. The Paints & Coatings segment is the most significant, supported by expanding construction, infrastructure renovation, automotive OEM and refinish activities, and industrial maintenance, where aliphatic hydrocarbons are used as diluents, viscosity modifiers, and carriers in alkyd, polyurethane, and other solvent-borne systems. Commercial & Domestic Cleaning, along with Adhesives & Sealants and Polymer & Rubber processing, represent additional key demand centers as formulators seek low-odor, low-aromatic, and consistent-quality hydrocarbon solvents for degreasing, surface preparation, contact adhesives, and elastomer compounding.

The Global Aliphatic Hydrocarbon Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Corporation, Shell plc, Chevron Corporation, BP p.l.c., TotalEnergies SE, LyondellBasell Industries N.V., Sasol Limited, INEOS Group Holdings S.A., Calumet Specialty Products Partners, L.P., HCS Group GmbH (Haltermann Carless), Gadiv Petrochemical Industries Ltd., Pure Chemicals Co., Kandla Energy & Chemicals Ltd., Ganga Rasaynie Pvt. Ltd., Repsol S.A. contribute to innovation, geographic expansion, and service delivery in this space, with many of these companies offering extensive portfolios of aliphatic hydrocarbon solvents, thinners, and specialty dearomatized grades tailored for coatings, adhesives, automotive, and industrial cleaning applications.

The future of the aliphatic hydrocarbon market appears promising, driven by a shift towards sustainable practices and increased investment in research and development. As industries adapt to environmental regulations, the focus on eco-friendly products will likely enhance market growth. Additionally, digital transformation in operations is expected to streamline processes, improve efficiency, and reduce costs, positioning companies favorably in a competitive landscape. The integration of innovative technologies will further support the market's evolution, ensuring resilience against challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Varnish Makers and Painter's Naphtha Mineral Spirits Hexane Heptane Other Aliphatic Hydrocarbons |

| By End-User | Paints & Coatings Commercial & Domestic Cleaning Polymer & Rubber Adhesives & Sealants Other Industrial End-Users |

| By Application | Solvents & Thinners Diluents for Paints & Inks Degreasing & Cleaning Agents Adhesive Formulations Other Specialty Applications |

| By Source | Petroleum-derived Aliphatic Hydrocarbons Natural Gas-derived Aliphatic Hydrocarbons Bio-based Aliphatic Hydrocarbons Others |

| By Distribution Channel | Direct Sales to Industrial Customers Specialty Chemical Distributors Online/Broker-mediated Sales Others |

| By Geography | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Regulatory Compliance | VOC Emission Standards Compliance Environmental & REACH Regulations Occupational Health & Safety Standards Other Regional Regulatory Frameworks |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aliphatic Hydrocarbon Production | 120 | Production Managers, Chemical Engineers |

| Market Demand Analysis | 90 | Market Analysts, Business Development Managers |

| Regulatory Compliance Insights | 70 | Compliance Officers, Environmental Managers |

| Application Development in Solvents | 80 | Product Development Managers, R&D Scientists |

| End-User Sector Feedback | 100 | Procurement Officers, Supply Chain Managers |

The Global Aliphatic Hydrocarbon Market was valued at approximately USD 4 billion, based on a five-year historical analysis. This valuation reflects the increasing demand for solvents across various applications, including paints, coatings, and industrial processes.