Region:Global

Author(s):Geetanshi

Product Code:KRAA9046

Pages:84

Published On:November 2025

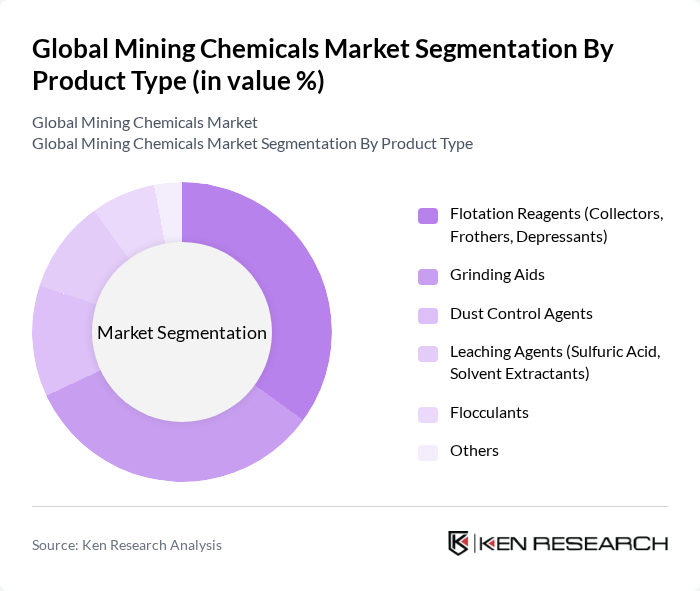

By Product Type:The product type segmentation includes various categories of chemicals used in mining processes. The dominant sub-segment is Flotation Reagents, which are essential for the separation of valuable minerals from ores. This is followed by Grinding Aids, which enhance the efficiency of grinding processes and hold a significant share due to their role in ore processing. Dust Control Agents are increasingly important for environmental compliance, especially in regions with stringent air quality standards. Leaching Agents, particularly sulfuric acid and solvent extractants, are vital for extracting metals from ores. Flocculants are gaining traction for their effectiveness in solid-liquid separation, while other chemicals play niche roles in specific applications.

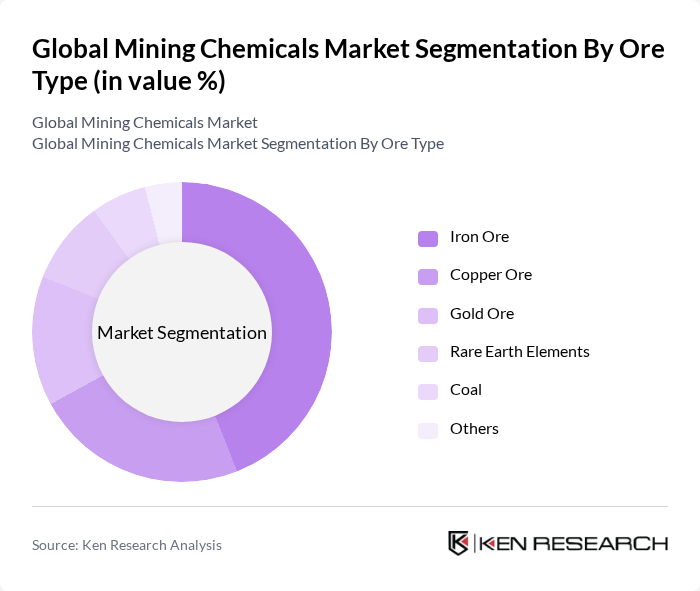

By Ore Type:This segmentation focuses on the types of ores processed using mining chemicals. Iron ore is the leading sub-segment, driven by its extensive use in steel production and infrastructure development. Copper ore follows closely, supported by the growing demand for copper in electrical and renewable energy applications. Gold ore remains significant due to its high value and investment appeal. Rare Earth Elements are gaining attention due to their critical role in advanced technologies and clean energy. Coal, although facing challenges from decarbonization trends, still represents a substantial market. Other ores contribute to niche applications in the mining sector.

The Global Mining Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Clariant AG, Solvay S.A., Kemira Oyj, SNF Floerger, Orica Limited, Dow Chemical Company, Ecolab Inc., Huntsman Corporation, AkzoNobel N.V., FLSmidth & Co. A/S, Imerys S.A., Sika AG, Albemarle Corporation, and Cytec Industries Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mining chemicals market appears promising, driven by a growing focus on sustainability and technological advancements. As mining companies increasingly adopt eco-friendly practices, the demand for innovative, biodegradable chemicals is expected to rise significantly. Additionally, the integration of automation and data analytics in mining operations will enhance efficiency and reduce costs, further propelling market growth. The Asia-Pacific region, in particular, is poised for substantial expansion, driven by increased mining activities and investments in advanced technologies.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Flotation Reagents (Collectors, Frothers, Depressants) Grinding Aids Dust Control Agents Leaching Agents (Sulfuric Acid, Solvent Extractants) Flocculants Others |

| By Ore Type | Iron Ore Copper Ore Gold Ore Rare Earth Elements Coal Others |

| By Region | Asia-Pacific (China, India, Australia, Japan) North America (United States, Canada) Europe Latin America Middle East & Africa |

| By Application | Mineral Processing Explosives and Drilling Hydrometallurgy Pyrometallurgy Others |

| By Chemical Composition | Organic Chemicals Inorganic Chemicals Biodegradable Chemicals Others |

| By Functionality | Performance Enhancers Process Aids Specialty Chemicals Others |

| By Distribution Channel | Direct Sales Distributors and Resellers Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mining Chemicals for Metal Extraction | 120 | Mining Engineers, Chemical Process Managers |

| Mineral Processing Chemicals | 100 | Operations Managers, Product Development Specialists |

| Environmental Compliance Chemicals | 80 | Environmental Managers, Compliance Officers |

| Explosives and Emulsifiers | 70 | Procurement Managers, Safety Officers |

| Flotation Agents and Reagents | 90 | Research Scientists, Technical Sales Representatives |

The Global Mining Chemicals Market is valued at approximately USD 12 billion, driven by increasing demand for minerals and metals from sectors like construction, electronics, and renewable energy, along with advancements in mining technologies and eco-friendly chemical formulations.