Region:Global

Author(s):Geetanshi

Product Code:KRAA2812

Pages:93

Published On:August 2025

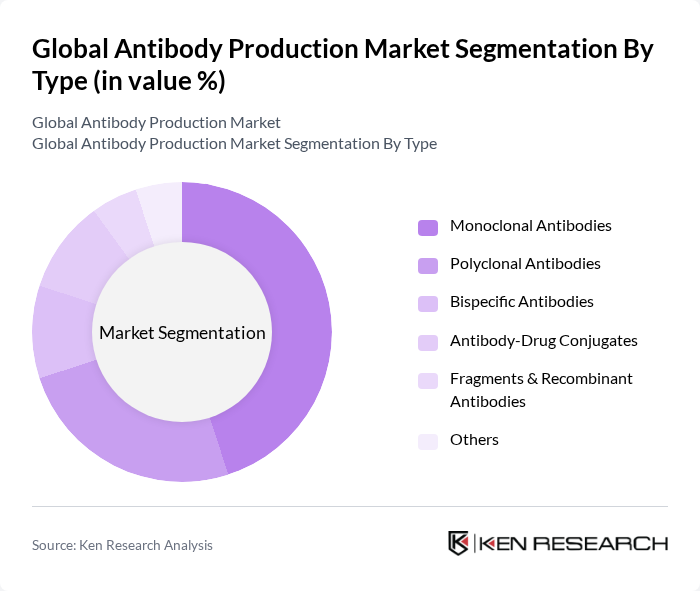

By Type:The antibody production market is segmented into various types, including Monoclonal Antibodies, Polyclonal Antibodies, Bispecific Antibodies, Antibody-Drug Conjugates, Fragments & Recombinant Antibodies, and Others. Among these, Monoclonal Antibodies are the most dominant due to their specificity and effectiveness in targeting diseases, particularly in oncology and autoimmune disorders. The increasing adoption of monoclonal antibodies in therapeutic applications is driven by their ability to provide targeted treatment with fewer side effects compared to traditional therapies. Bispecific antibodies are also gaining traction due to their ability to bind two distinct targets simultaneously, improving therapeutic efficacy .

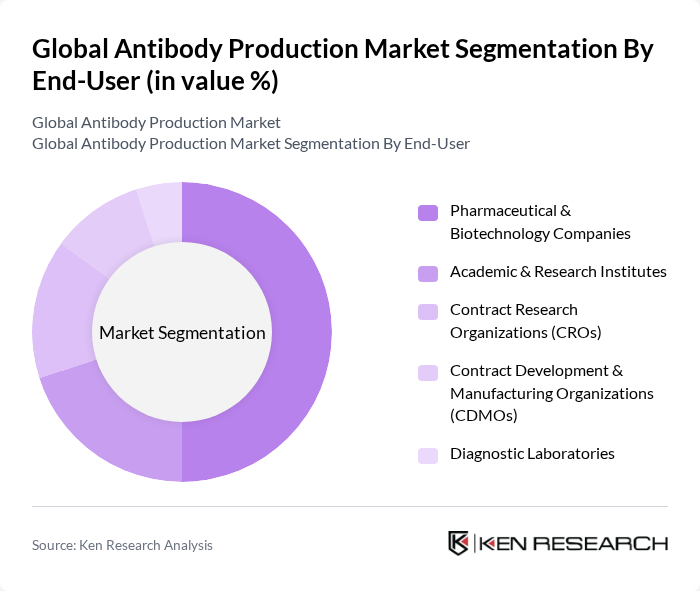

By End-User:The market is also segmented by end-users, which include Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Contract Research Organizations (CROs), Contract Development & Manufacturing Organizations (CDMOs), and Diagnostic Laboratories. Pharmaceutical & Biotechnology Companies hold the largest share due to their extensive use of antibodies in drug development and therapeutic applications. The increasing number of collaborations between these companies and research institutions further drives the demand for antibody production. Outsourcing to CDMOs is also rising, driven by the need for flexible capacity and specialist expertise .

The Global Antibody Production Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amgen Inc., Genentech, Inc. (Roche Group), AbbVie Inc., Johnson & Johnson, Merck & Co., Inc., Pfizer Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, Regeneron Pharmaceuticals, Inc., Sanofi S.A., Takeda Pharmaceutical Company Limited, Novartis AG, GSK plc, Biogen Inc., Astellas Pharma Inc., Thermo Fisher Scientific Inc., Lonza Group AG, Samsung Biologics Co., Ltd., WuXi Biologics (Cayman) Inc., Bio-Rad Laboratories, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the antibody production market appears promising, driven by ongoing innovations and a growing focus on personalized medicine. As the prevalence of chronic diseases continues to rise, the demand for effective antibody therapies will likely increase. Additionally, advancements in biopharmaceutical technologies and the integration of artificial intelligence in drug discovery are expected to streamline production processes, reduce costs, and enhance the efficacy of treatments, positioning the market for significant growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Monoclonal Antibodies Polyclonal Antibodies Bispecific Antibodies Antibody-Drug Conjugates Fragments & Recombinant Antibodies Others |

| By End-User | Pharmaceutical & Biotechnology Companies Academic & Research Institutes Contract Research Organizations (CROs) Contract Development & Manufacturing Organizations (CDMOs) Diagnostic Laboratories |

| By Application | Therapeutics Diagnostics Research and Development Others |

| By Production Method | Cell Culture (Mammalian, Microbial) Transgenic Animals & Plants Recombinant DNA Technology Hybridoma Technology Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopharmaceutical Companies | 100 | R&D Directors, Production Managers |

| Contract Manufacturing Organizations (CMOs) | 60 | Operations Managers, Quality Control Specialists |

| Regulatory Bodies | 40 | Regulatory Affairs Managers, Compliance Officers |

| Research Institutions | 50 | Lead Researchers, Lab Managers |

| Healthcare Providers | 50 | Oncologists, Immunologists |

The Global Antibody Production Market is valued at approximately USD 19 billion, reflecting significant growth driven by the rising prevalence of chronic diseases, advancements in biotechnology, and increasing demand for personalized medicine.