Region:Middle East

Author(s):Rebecca

Product Code:KRAC3196

Pages:93

Published On:October 2025

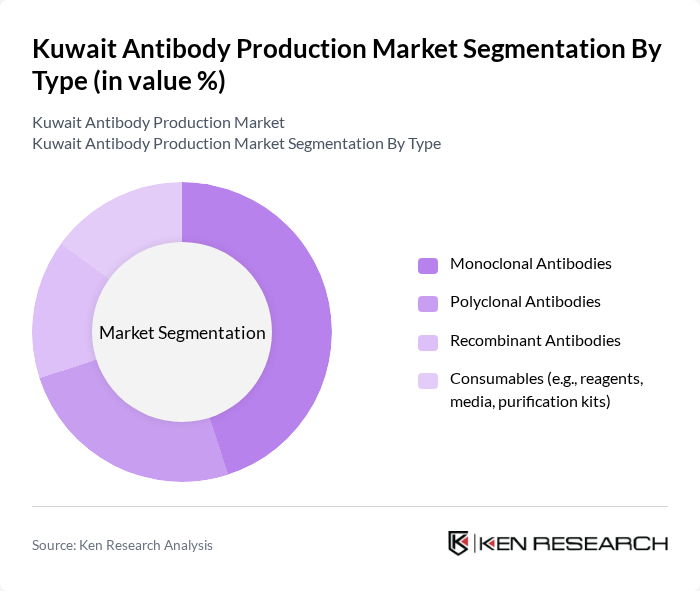

By Type:The market is segmented into Monoclonal Antibodies, Polyclonal Antibodies, Recombinant Antibodies, and Consumables (e.g., reagents, media, purification kits). Monoclonal Antibodies are the fastest-growing segment, favored for their specificity and effectiveness in treating cancers and autoimmune disorders. Their adoption in therapeutic applications is driven by superior targeting of specific antigens, government support for precision medicine initiatives, and partnerships with international pharmaceutical companies for regional manufacturing. Consumables, including reagents and purification kits, represent the largest revenue-generating product segment due to recurring demand and increased production volumes .

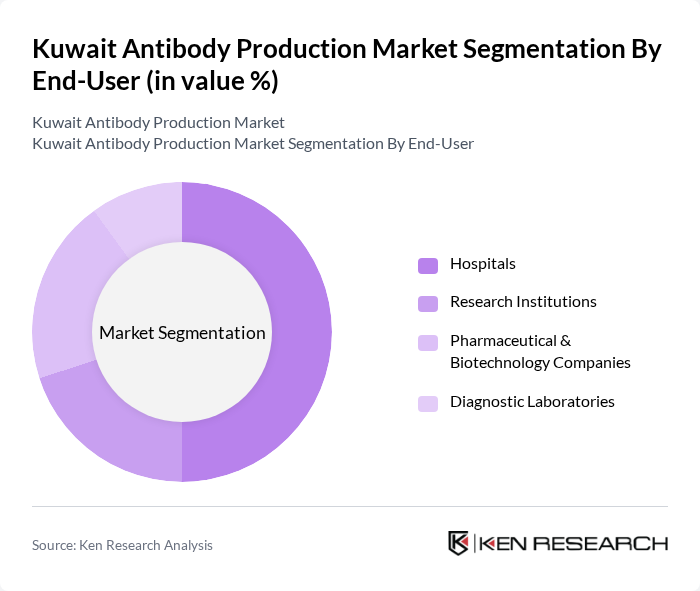

By End-User:The end-user segmentation includes Hospitals, Research Institutions, Pharmaceutical & Biotechnology Companies, and Diagnostic Laboratories. Pharmaceutical and biotechnology companies constitute the largest revenue share, driven by investments in local production capabilities to reduce costs and improve supply chain reliability. Hospitals are rapidly expanding their use of antibody products for advanced diagnostics and therapeutics, particularly in oncology and chronic disease management. Research institutions are also experiencing growth due to increased government funding for biotechnology programs and academic research .

The Kuwait Antibody Production Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific, Danaher Corporation (Cytiva), Merck KGaA, Bio-Rad Laboratories, Lonza Group, Sartorius AG, GE Healthcare, Kuwait Saudi Pharmaceutical Industries Company, Agilent Technologies, PerkinElmer, Kuwait Institute for Scientific Research, Kuwait University - Faculty of Medicine, Gulf Biotech, Al-Salam International Hospital, Kuwait Cancer Control Center contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait antibody production market appears promising, driven by increasing healthcare investments and a focus on innovative therapies. As the government prioritizes biopharmaceuticals, funding for research and development is expected to rise, fostering collaboration between local and international firms. Additionally, the integration of artificial intelligence in drug development processes is likely to enhance efficiency and reduce time-to-market for new therapies, positioning Kuwait as a competitive player in the global antibody landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Monoclonal Antibodies Polyclonal Antibodies Recombinant Antibodies Consumables (e.g., reagents, media, purification kits) |

| By End-User | Hospitals Research Institutions Pharmaceutical & Biotechnology Companies Diagnostic Laboratories |

| By Application | Therapeutics Diagnostics Research & Development Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Kuwait City & Shuwaikh Industrial Area Northern Kuwait Southern Kuwait Coastal Areas |

| By Price Range | Low Price Mid Price High Price |

| By Regulatory Compliance | FDA Approved EMA Approved Local Regulatory Approved |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopharmaceutical Manufacturing | 50 | Production Managers, Quality Assurance Officers |

| Research and Development in Antibody Production | 60 | R&D Scientists, Lab Directors |

| Healthcare Providers Utilizing Antibodies | 40 | Clinical Researchers, Medical Directors |

| Regulatory Affairs in Biotech | 45 | Regulatory Affairs Specialists, Compliance Managers |

| Market Access and Commercialization | 55 | Market Access Managers, Business Development Executives |

The Kuwait Antibody Production Market is valued at approximately USD 75 million, driven by the increasing prevalence of chronic diseases, rising investments in biotechnology, and advancements in antibody technologies.