Region:Global

Author(s):Rebecca

Product Code:KRAA2458

Pages:85

Published On:August 2025

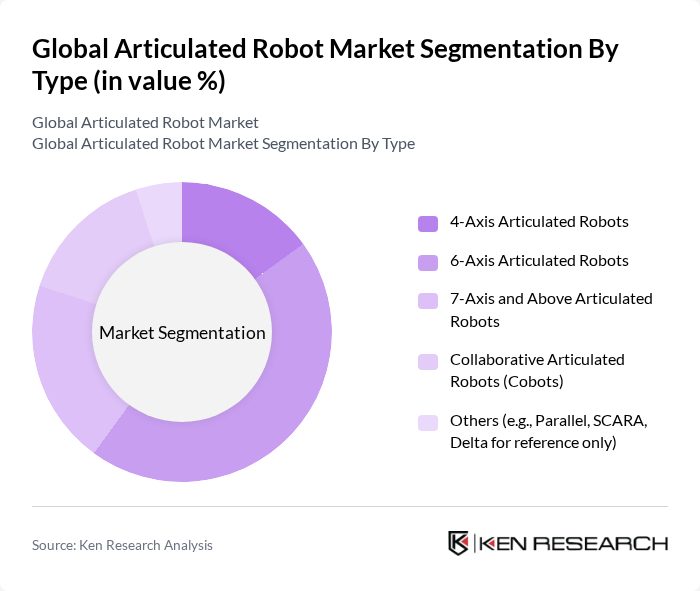

By Type:The articulated robot market is segmented into 4-Axis Articulated Robots, 6-Axis Articulated Robots, 7-Axis and Above Articulated Robots, Collaborative Articulated Robots (Cobots), and Others.6-Axis Articulated Robotshold the largest market share due to their versatility, flexibility, and ability to perform complex, multi-directional tasks. Their dominance in automotive and electronics manufacturing is driven by the need for high precision, adaptability, and efficient automation of assembly, welding, and material handling processes.

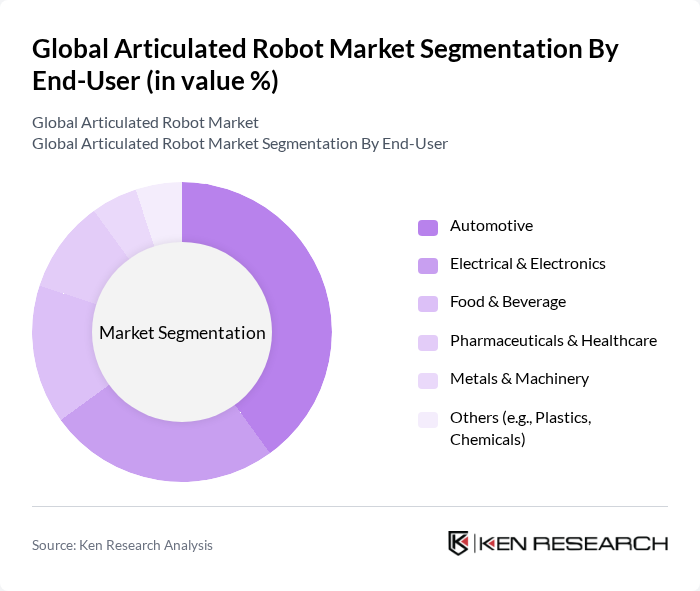

By End-User:The articulated robot market is segmented by end-user industries, including Automotive, Electrical & Electronics, Food & Beverage, Pharmaceuticals & Healthcare, Metals & Machinery, and Others. Theautomotive sectoris the leading end-user, accounting for the largest share due to extensive automation requirements for assembly, welding, and painting. Electrical & electronics follow, leveraging articulated robots for precision tasks in circuit board assembly and device manufacturing. Food & beverage, pharmaceuticals & healthcare, and metals & machinery segments are witnessing increased adoption for packaging, material handling, and quality control applications.

The Global Articulated Robot Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Universal Robots A/S, Omron Corporation, Epson Robots (Seiko Epson Corporation), Denso Corporation, Kawasaki Heavy Industries, Ltd., Stäubli Robotics, Siemens AG, Rockwell Automation, Inc., Teradyne, Inc. (including Universal Robots, MiR), Comau S.p.A., Hyundai Robotics Co., Ltd., Nachi-Fujikoshi Corp., Techman Robot Inc., Siasun Robot & Automation Co., Ltd., Shibaura Machine Co., Ltd. (formerly Toshiba Machine) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the articulated robot market appears promising, driven by technological advancements and increasing automation across various sectors. As industries continue to embrace digital transformation, the integration of artificial intelligence and machine learning into robotic systems is expected to enhance operational efficiency. Furthermore, the growing emphasis on sustainability will likely lead to innovations in energy-efficient robotic solutions, positioning articulated robots as key players in the evolving landscape of manufacturing and logistics.

| Segment | Sub-Segments |

|---|---|

| By Type | Axis Articulated Robots Axis Articulated Robots Axis and Above Articulated Robots Collaborative Articulated Robots (Cobots) Others (e.g., Parallel, SCARA, Delta for reference only) |

| By End-User | Automotive Electrical & Electronics Food & Beverage Pharmaceuticals & Healthcare Metals & Machinery Others (e.g., Plastics, Chemicals) |

| By Application | Assembly Packaging & Palletizing Material Handling Welding (Arc, Spot, Laser) Painting & Dispensing Machine Tending Others |

| By Payload Capacity | Up to 16 kg kg to 60 kg kg to 225 kg Above 225 kg |

| By Distribution Channel | Direct Sales (OEMs) Distributors/Integrators Online Sales Robots-as-a-Service (RaaS) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Industry Vertical | Automotive Manufacturing Electronics & Semiconductor Food & Beverage Processing Pharmaceuticals & Medical Devices Metals & Heavy Machinery Logistics & Warehousing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Automation | 120 | Production Managers, Automation Engineers |

| Logistics and Warehousing | 90 | Warehouse Managers, Supply Chain Analysts |

| Healthcare Robotics | 60 | Healthcare Administrators, Robotics Specialists |

| Food and Beverage Processing | 50 | Operations Managers, Quality Control Supervisors |

| Research and Development in Robotics | 40 | R&D Managers, Robotics Researchers |

The Global Articulated Robot Market is valued at approximately USD 24.5 billion, reflecting significant growth driven by increasing automation demands across various industries, including automotive, electronics, and healthcare.