Region:Global

Author(s):Dev

Product Code:KRAC8809

Pages:85

Published On:November 2025

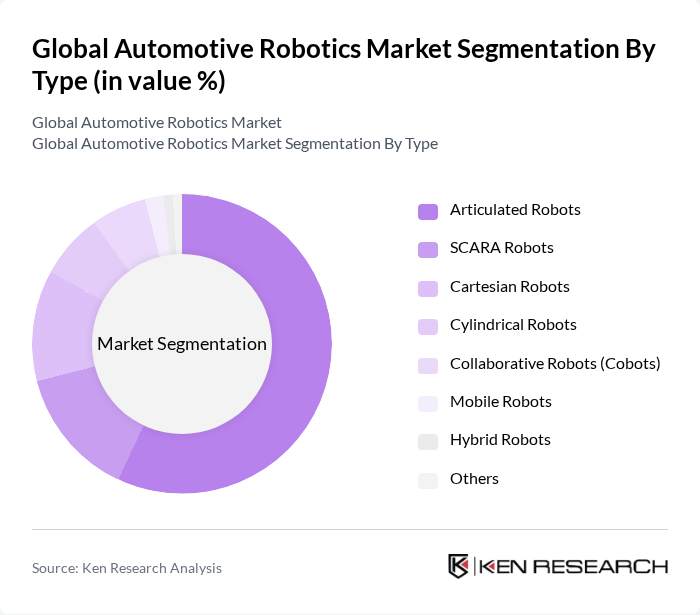

By Type:The automotive robotics market is segmented into various types, including articulated robots, SCARA robots, Cartesian robots, cylindrical robots, collaborative robots (cobots), mobile robots, hybrid robots, and others. Among these, articulated robots are the most widely used due to their versatility and ability to perform complex tasks in confined spaces. SCARA robots are also gaining traction for assembly tasks, while collaborative robots are increasingly adopted for their safety features and ease of use in human-robot collaboration. Articulated robots account for the majority share, primarily due to their dominance in welding, painting, and assembly applications .

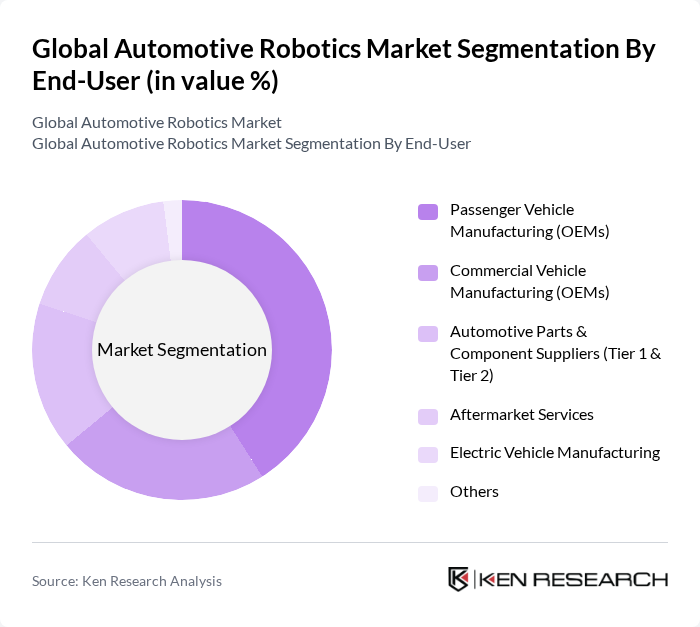

By End-User:The automotive robotics market is segmented by end-user into passenger vehicle manufacturing (OEMs), commercial vehicle manufacturing (OEMs), automotive parts & component suppliers (Tier 1 & Tier 2), aftermarket services, electric vehicle manufacturing, and others. The passenger vehicle manufacturing segment leads the market due to the high volume of production and the need for automation to enhance efficiency and reduce costs. The rise of electric vehicles is also driving growth in this segment as manufacturers seek to optimize production processes and adapt to new assembly requirements .

The Global Automotive Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Universal Robots A/S, Omron Corporation, Siemens AG, Rockwell Automation, Inc., Denso Wave Incorporated, Kawasaki Heavy Industries, Ltd., Hyundai Robotics Co., Ltd., Epson Robots (Seiko Epson Corporation), Comau S.p.A., Nachi-Fujikoshi Corp. contribute to innovation, geographic expansion, and service delivery in this space.

The automotive robotics market is poised for transformative growth, driven by technological advancements and evolving industry needs. As manufacturers increasingly adopt smart factory concepts, the integration of IoT and AI will enhance operational efficiency and data-driven decision-making. Furthermore, the rise of electric vehicle production will necessitate innovative robotic solutions, creating new avenues for growth. The focus on sustainability will also drive the development of eco-friendly robotic technologies, ensuring that the industry adapts to changing consumer preferences and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Articulated Robots SCARA Robots Cartesian Robots Cylindrical Robots Collaborative Robots (Cobots) Mobile Robots Hybrid Robots Others |

| By End-User | Passenger Vehicle Manufacturing (OEMs) Commercial Vehicle Manufacturing (OEMs) Automotive Parts & Component Suppliers (Tier 1 & Tier 2) Aftermarket Services Electric Vehicle Manufacturing Others |

| By Application | Welding (Spot & Arc) Assembly Line Automation Material Handling Painting and Coating Quality Inspection Packaging Machine Tending Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Technology | AI-Driven Robotics Machine Learning Integration Vision Systems Sensor Technologies Connectivity/IoT Integration Others |

| By Deployment Type | On-Premise Cloud-Based Hybrid Others |

| By Investment Source | Private Investments Government Funding Venture Capital Corporate Investments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Robotics | 100 | Production Managers, Robotics Engineers |

| Robotics Integration Services | 60 | System Integrators, Technical Consultants |

| Automotive Supply Chain Automation | 50 | Supply Chain Managers, Logistics Coordinators |

| Research & Development in Robotics | 40 | R&D Directors, Innovation Managers |

| End-user Adoption of Robotics | 50 | Operations Directors, Quality Assurance Managers |

The Global Automotive Robotics Market is valued at approximately USD 16 billion, driven by the increasing demand for automation in manufacturing processes, the rapid adoption of electric vehicles, and advancements in robotics technology.