Region:Global

Author(s):Geetanshi

Product Code:KRAC8297

Pages:87

Published On:November 2025

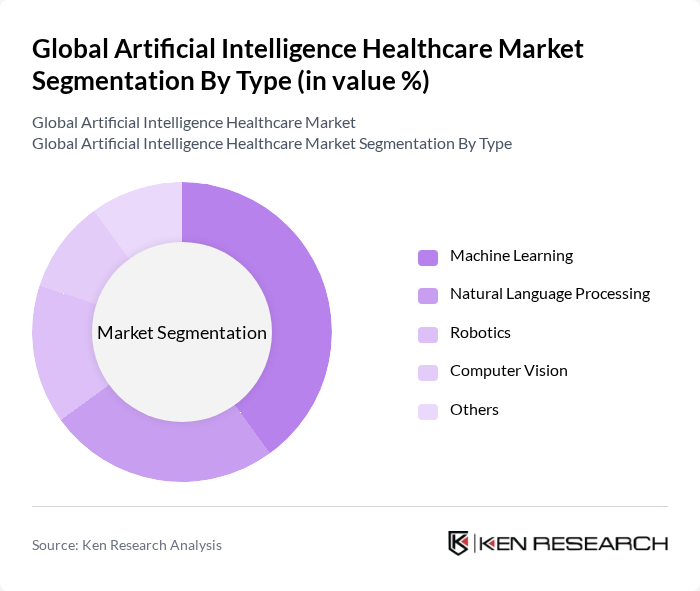

By Type:The market is segmented into various types, including Machine Learning, Natural Language Processing, Robotics, Computer Vision, and Others. Among these, Machine Learning is the leading sub-segment, driven by its ability to analyze vast amounts of data and provide predictive analytics, which is crucial for personalized medicine and operational efficiency in healthcare settings. The growing demand for data-driven decision-making in healthcare is propelling the adoption of Machine Learning technologies.

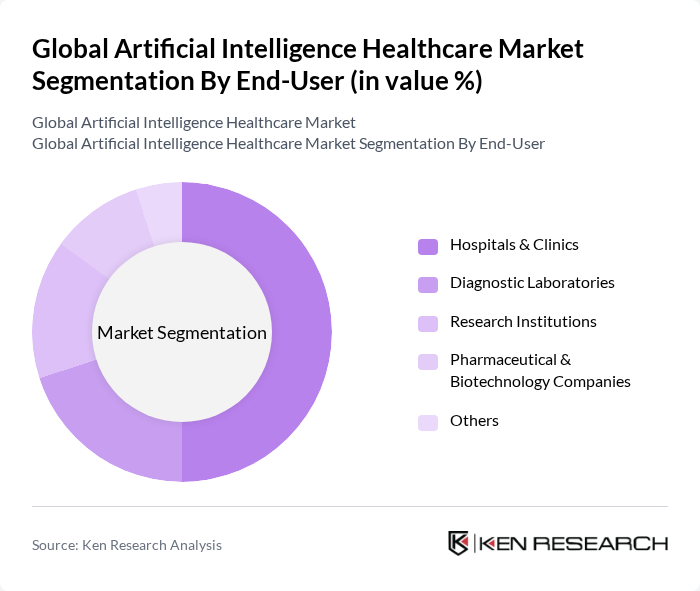

By End-User:The market is categorized into Hospitals & Clinics, Diagnostic Laboratories, Research Institutions, Pharmaceutical & Biotechnology Companies, and Others. Hospitals & Clinics represent the largest segment, as they are increasingly adopting AI technologies to enhance patient care, streamline operations, and improve diagnostic accuracy. The growing focus on patient-centered care and operational efficiency is driving the demand for AI solutions in this sector.

The Global Artificial Intelligence Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Watson Health, Google Health (Google Cloud Healthcare), Siemens Healthineers, Philips Healthcare, GE Healthcare, Microsoft Healthcare (Microsoft Cloud for Healthcare), Cerner Corporation (Oracle Health), Optum (UnitedHealth Group), NVIDIA Corporation, Medtronic, Zebra Medical Vision, Tempus Labs, Aidoc, PathAI, Babylon Health, Butterfly Network, Owkin, Insilico Medicine, Recursion Pharmaceuticals, DeepMind Health (Google DeepMind) contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in healthcare is poised for transformative growth, driven by continuous technological advancements and increasing integration into clinical workflows. As healthcare providers increasingly adopt AI solutions, we can expect enhanced patient outcomes and operational efficiencies. The focus will likely shift towards developing more sophisticated AI tools that can seamlessly integrate with existing systems, ensuring compliance with regulatory standards while addressing data privacy concerns. This evolution will create a more robust healthcare ecosystem, fostering innovation and improved patient care.

| Segment | Sub-Segments |

|---|---|

| By Type | Machine Learning Natural Language Processing Robotics Computer Vision Others |

| By End-User | Hospitals & Clinics Diagnostic Laboratories Research Institutions Pharmaceutical & Biotechnology Companies Others |

| By Application | Clinical Decision Support Patient Management Medical Imaging Analysis Drug Discovery Pharmacy Management Data Management & Analytics Administrative Functions Others |

| By Deployment Mode | On-Premise Cloud-Based Hybrid Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Machine Learning Deep Learning Natural Language Processing Computer Vision Generative AI Context-Aware Computing Others |

| By Investment Source | Venture Capital Private Equity Government Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI in Diagnostic Imaging | 80 | Radiologists, Imaging Center Directors |

| AI for Patient Management Systems | 60 | Healthcare IT Managers, Clinical Operations Directors |

| AI in Drug Discovery | 40 | Pharmaceutical Researchers, R&D Managers |

| AI in Telemedicine | 50 | Telehealth Coordinators, Healthcare Providers |

| AI for Predictive Analytics in Healthcare | 45 | Data Scientists, Health Informatics Specialists |

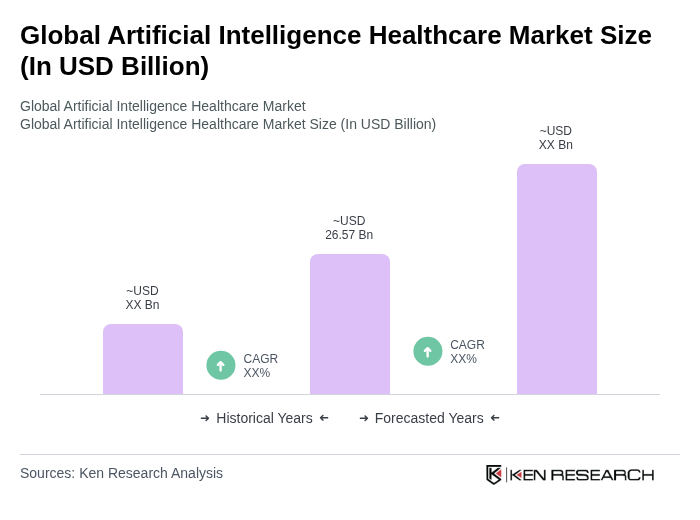

The Global Artificial Intelligence Healthcare Market is valued at approximately USD 26.57 billion, reflecting significant growth driven by the adoption of AI technologies aimed at improving patient outcomes and operational efficiency in healthcare systems worldwide.