Region:Global

Author(s):Rebecca

Product Code:KRAA2874

Pages:82

Published On:August 2025

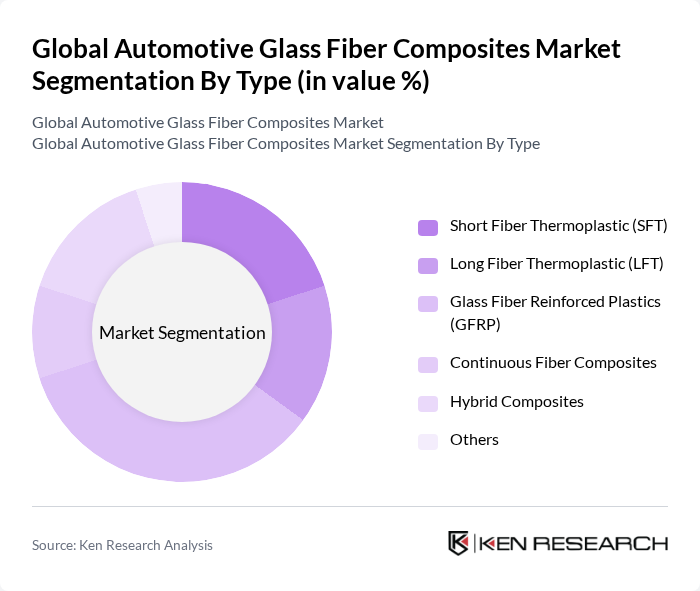

By Type:The market is segmented into various types of glass fiber composites, each catering to different applications and consumer needs. The dominant sub-segment is Glass Fiber Reinforced Plastics (GFRP), which is widely used due to its excellent strength-to-weight ratio and versatility in manufacturing processes. Short Fiber Thermoplastic (SFT) and Long Fiber Thermoplastic (LFT) are also gaining traction, particularly in applications requiring rapid production and high durability. The demand for Continuous Fiber Composites and Hybrid Composites is increasing as manufacturers seek innovative solutions for enhanced performance. The glass fiber segment remains the largest by volume and value, supported by its cost-effectiveness and broad applicability in both conventional and electric vehicles .

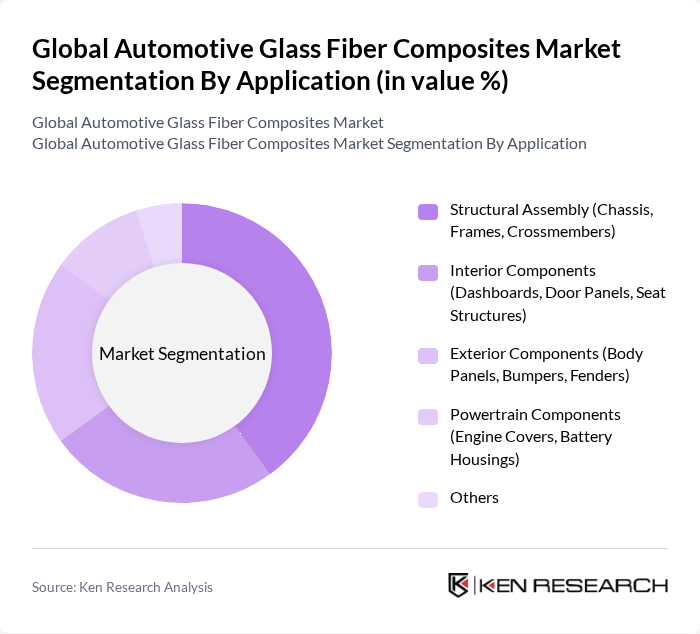

By Application:The applications of glass fiber composites in the automotive sector are diverse, with Structural Assembly leading the market due to its critical role in vehicle safety and integrity. Interior Components are also significant, driven by consumer preferences for lightweight and durable materials. The demand for Exterior Components is growing as manufacturers focus on aesthetics and performance. Powertrain Components are increasingly utilizing glass fiber composites to enhance efficiency and reduce weight, while other applications continue to expand as technology advances. The adoption of these composites in electric vehicles and commercial vehicles is accelerating, reflecting broader industry trends toward lightweighting and sustainability .

The Global Automotive Glass Fiber Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as Owens Corning, BASF SE, Hexcel Corporation, Teijin Limited, SGL Carbon SE, Mitsubishi Chemical Corporation, Jushi Group Co., Ltd., Saint-Gobain, Solvay S.A., AGY Holding Corp., 3B - The Fibreglass Company (Braj Binani Group), Veplas Group, SAERTEX GmbH & Co. KG, Jiangsu Changhai Composite Materials Co., Ltd., Asahi Fiber Glass Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive glass fiber composites market appears promising, driven by technological advancements and increasing environmental awareness. As manufacturers invest in innovative composite applications, the integration of smart technologies is expected to enhance product performance and safety. Additionally, the growing focus on sustainability will likely lead to the development of bio-based composites, further expanding the market's potential. These trends indicate a dynamic shift towards more efficient and eco-friendly automotive solutions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Short Fiber Thermoplastic (SFT) Long Fiber Thermoplastic (LFT) Glass Fiber Reinforced Plastics (GFRP) Continuous Fiber Composites Hybrid Composites Others |

| By Application | Structural Assembly (Chassis, Frames, Crossmembers) Interior Components (Dashboards, Door Panels, Seat Structures) Exterior Components (Body Panels, Bumpers, Fenders) Powertrain Components (Engine Covers, Battery Housings) Others |

| By End-User | Passenger Vehicles Commercial Vehicles Electric Vehicles Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEMs | 120 | Product Development Managers, Material Engineers |

| Composite Material Suppliers | 90 | Sales Directors, Technical Support Engineers |

| Automotive Aftermarket | 70 | Procurement Managers, Quality Assurance Specialists |

| Research Institutions | 50 | Research Scientists, Industry Analysts |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Global Automotive Glass Fiber Composites Market is valued at approximately USD 11 billion, driven by the increasing demand for lightweight materials that enhance fuel efficiency and reduce emissions in the automotive sector.