Region:Global

Author(s):Shubham

Product Code:KRAA3143

Pages:100

Published On:August 2025

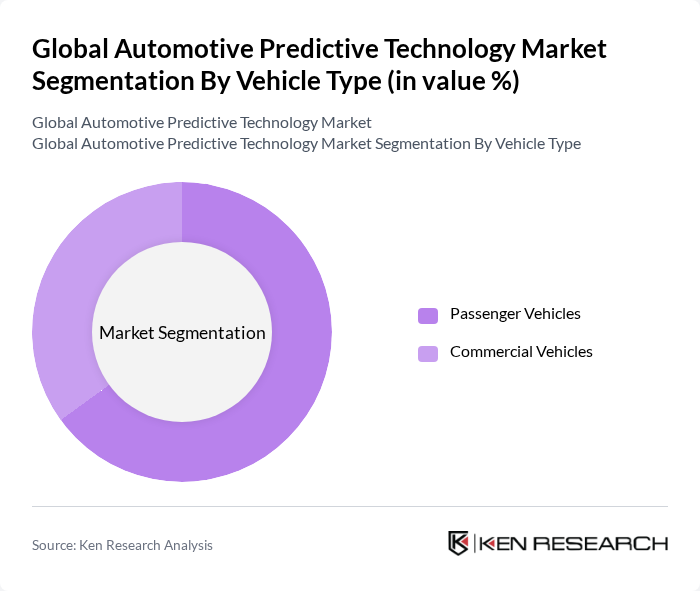

By Vehicle Type:The vehicle type segmentation includes passenger vehicles and commercial vehicles.Passenger vehiclesdominate the market due to increasing consumer preference for personal mobility solutions, the growing trend of connected cars, and the integration of predictive maintenance and safety features. The rise in disposable income and urbanization has led to a surge in passenger vehicle sales, further driving the demand for predictive technologies.Commercial vehicles, while growing, are primarily influenced by fleet management needs, logistics optimization, and the adoption of predictive analytics to reduce operational costs and improve uptime .

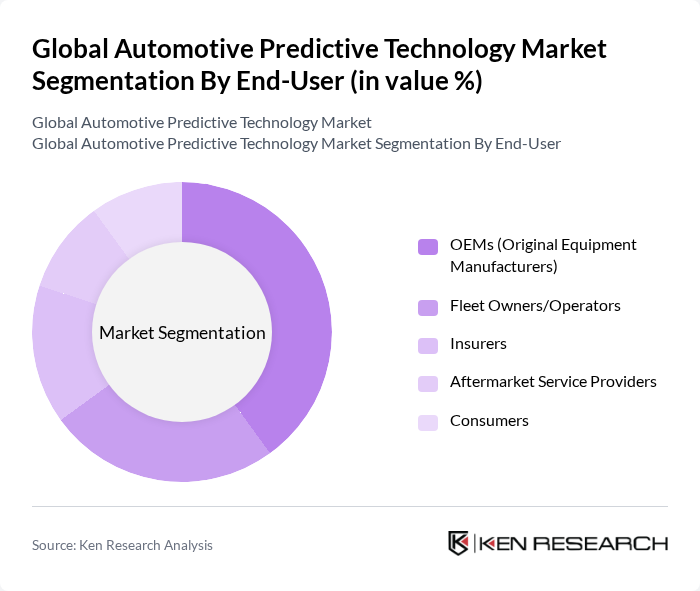

By End-User:This segmentation includes OEMs (Original Equipment Manufacturers), fleet owners/operators, insurers, aftermarket service providers, and consumers.OEMsare the leading segment, driven by the integration of predictive technologies in new vehicle models to enhance safety, performance, and compliance with regulatory requirements.Fleet owners/operatorsare also significant, leveraging predictive analytics for maintenance, operational efficiency, and cost reduction.Insurersare increasingly adopting these technologies to assess risk and optimize premiums, whileaftermarket service providersandconsumersare gradually embracing predictive solutions for improved vehicle reliability and personalized services .

The Global Automotive Predictive Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Siemens AG, Bosch Mobility Solutions, Microsoft Corporation, SAP SE, Oracle Corporation, Continental AG, Denso Corporation, Harman International, Qualcomm Technologies, Inc., Tesla, Inc., Ford Motor Company, General Motors Company, Toyota Motor Corporation, Volvo Group, ZF Friedrichshafen AG, Aptiv PLC, Valeo SA, NXP Semiconductors N.V., Panasonic Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive predictive technology market is poised for significant transformation, driven by technological advancements and regulatory changes. As governments worldwide implement stricter safety standards and promote electric vehicle adoption, manufacturers are increasingly investing in innovative solutions. The integration of AI and machine learning will enhance predictive capabilities, while the development of smart city infrastructure will create synergies that further drive market growth. This evolving landscape presents both challenges and opportunities for stakeholders in the automotive sector.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Passenger Vehicles Commercial Vehicles |

| By End-User | OEMs (Original Equipment Manufacturers) Fleet Owners/Operators Insurers Aftermarket Service Providers Consumers |

| By Application | Predictive Maintenance Vehicle Health Monitoring Safety & Security Predictive Smart Parking Driving Pattern Analysis Insurance Telematics Others |

| By Component | Hardware Software Services |

| By Hardware Type | ADAS (Advanced Driver-Assistance Systems) On-Board Diagnostics (OBD) Telematics Other Hardware Types |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Geography | North America Europe Asia-Pacific Rest of the World |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Predictive Maintenance Solutions | 100 | Maintenance Managers, Fleet Operators |

| Autonomous Vehicle Technologies | 80 | R&D Engineers, Product Managers |

| Connected Vehicle Systems | 90 | IT Managers, Connectivity Specialists |

| Data Analytics in Automotive | 60 | Data Analysts, Business Intelligence Managers |

| Consumer Insights on Predictive Tech | 70 | Marketing Managers, Customer Experience Leads |

The Global Automotive Predictive Technology Market is valued at approximately USD 74 billion, driven by advancements in IoT, AI, and big data analytics that enhance vehicle performance and safety, as well as the growing demand for connected vehicles and predictive maintenance solutions.