Region:Global

Author(s):Dev

Product Code:KRAD0570

Pages:87

Published On:August 2025

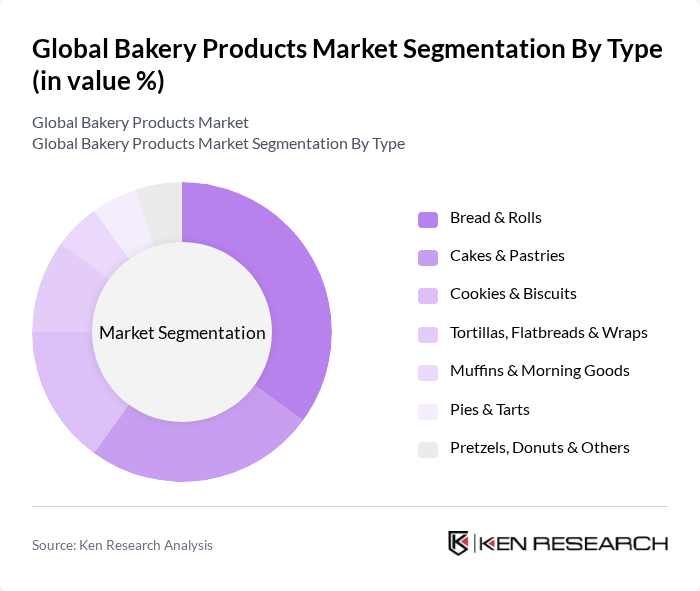

By Type:The bakery products market is segmented into various types, including bread & rolls, cakes & pastries, cookies & biscuits, tortillas, flatbreads & wraps, muffins & morning goods, pies & tarts, and pretzels, donuts & others. Each of these subsegments caters to different consumer preferences and occasions, with bread & rolls being the most consumed due to their staple nature in many diets; cakes & pastries also hold a substantial share, followed by cookies & biscuits, consistent with major market breakdowns .

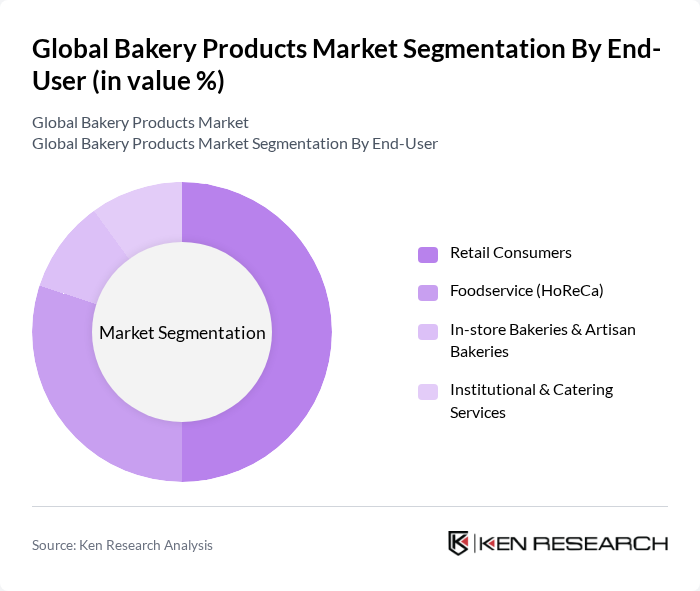

By End-User:The end-user segmentation includes retail consumers, foodservice (HoReCa), in-store bakeries & artisan bakeries, and institutional & catering services. Retail consumers dominate the market as they seek convenience and variety in their purchases, while the foodservice sector is growing due to the increasing number of cafes and restaurants offering baked goods and the expansion of quick-service and coffee chains carrying bakery items .

The Global Bakery Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Bimbo, S.A.B. de C.V., Mondel?z International, Inc., General Mills, Inc., Flowers Foods, Inc., ARYZTA AG, Associated British Foods plc (ABF) — Allied Bakeries/ABF Ingredients, Yamazaki Baking Co., Ltd., Premier Foods plc, Campbell Soup Company (Pepperidge Farm), Conagra Brands, Inc. (Marie Callender’s, Duncan Hines), Hostess Brands, Inc. (a J.M. Smucker Company), McKee Foods Corporation (Little Debbie), Barilla G. e R. Fratelli S.p.A. (Mulino Bianco, Pan di Stelle), Britannia Industries Limited, Warburtons Limited contribute to innovation, geographic expansion, and service delivery in this space .

The future of the bakery products market is poised for transformation, driven by evolving consumer preferences and technological advancements. The rise of plant-based and gluten-free products is expected to reshape product offerings, catering to health-conscious consumers. Additionally, the integration of technology in production processes will enhance efficiency and product quality. As sustainability becomes a priority, companies will increasingly adopt eco-friendly practices, ensuring compliance with environmental regulations while meeting consumer demand for transparency and ethical sourcing.

| Segment | Sub-Segments |

|---|---|

| By Type | Bread & Rolls Cakes & Pastries Cookies & Biscuits Tortillas, Flatbreads & Wraps Muffins & Morning Goods Pies & Tarts Pretzels, Donuts & Others |

| By End-User | Retail Consumers Foodservice (HoReCa) In-store Bakeries & Artisan Bakeries Institutional & Catering Services |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience/Grocery Stores Bakery/Specialty Stores & Artisanal Bakeries Online Retail & Quick Commerce Foodservice Distributors |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Premium Mid-Range Economy |

| By Packaging Type | Flexible Plastic (PE/PP) & Films Paper & Paperboard Rigid Plastic & Trays Compostable/Biodegradable Packaging |

| By Occasion | Everyday Consumption Special Occasions & Celebrations Seasonal & Festive |

| By Specialty Attribute | Gluten-free Organic & Clean Label High-fiber/Whole Grain Low/No Sugar & Low-calorie Plant-based/Vegan Fortified/Functional |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Bakery Sales | 150 | Bakery Owners, Store Managers |

| Consumer Preferences in Bakery Products | 140 | General Consumers, Health-Conscious Shoppers |

| Food Service Bakery Supply | 100 | Restaurant Owners, Catering Managers |

| Trends in Artisan Bakery Products | 80 | Artisan Bakers, Culinary Experts |

| Health and Wellness Bakery Products | 120 | Nutritionists, Health Food Retailers |

The Global Bakery Products Market is valued at approximately USD 480 billion, with estimates ranging between USD 470 billion and USD 550 billion. This valuation reflects a five-year historical analysis of market trends and consumer demand.