Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0150

Pages:83

Published On:August 2025

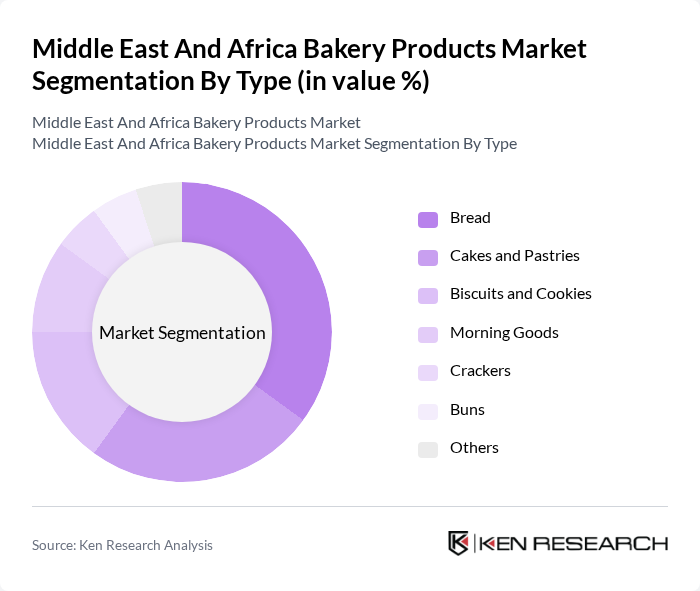

By Type:The bakery products market is segmented into bread, cakes and pastries, biscuits and cookies, morning goods, crackers, buns, and others. Bread remains the most consumed product due to its staple status in many regional diets. Cakes and pastries hold a significant share, driven by the popularity of celebrations and social gatherings. Demand for biscuits and cookies is increasing, especially among retail consumers seeking convenient snack options. The market is also witnessing growth in specialty and health-oriented bakery segments, such as gluten-free and high-protein products, reflecting broader health and wellness trends .

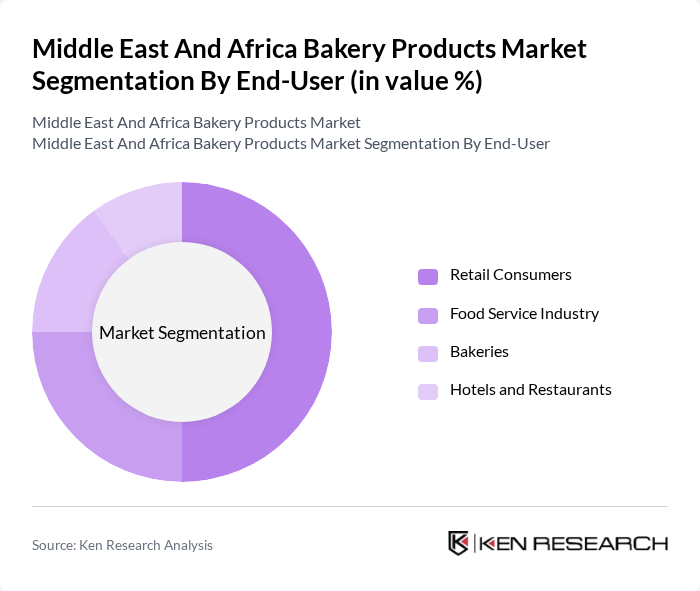

By End-User:The end-user segmentation includes retail consumers, the food service industry, bakeries, and hotels and restaurants. Retail consumers represent the largest segment, driven by the demand for convenient and ready-to-eat bakery products. The food service industry is a significant contributor, with restaurants, cafes, and quick-service outlets increasingly offering bakery items. Bakeries and hotels and restaurants play a key role in product innovation and quality, catering to diverse and evolving consumer preferences .

The Middle East And Africa Bakery Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Britannia Industries Limited, Bakemart, Modern Bakery LLC, Sunbake (Premier FMCG), Tiger Brands Limited, United Biscuits (part of pladis Global), Bimbo QSR, Aryzta AG, Lesaffre, Rich Products Corporation, General Mills, Mondelez International, Associated British Foods plc, and Premier Foods contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East and Africa bakery products market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. The rise of e-commerce platforms is expected to enhance distribution channels, making bakery products more accessible. Additionally, the increasing focus on health and wellness will likely spur innovation in product offerings, including gluten-free and organic options. As the market adapts to these trends, businesses that embrace sustainability and digital transformation will be well-positioned for growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Bread Cakes and Pastries Biscuits and Cookies Morning Goods Crackers Buns Others |

| By End-User | Retail Consumers Food Service Industry Bakeries Hotels and Restaurants |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Specialist Stores Online Retailers Other Distribution Channels |

| By Region | South Africa Saudi Arabia Egypt UAE Rest of Middle East and Africa |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Plastic Packaging Paper Packaging Glass Packaging |

| By Product Form | Fresh Frozen Packaged |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Artisan Bakery Products | 100 | Bakery Owners, Head Bakers |

| Industrial Bakery Operations | 120 | Production Managers, Quality Control Supervisors |

| Consumer Preferences in Bakery | 150 | General Consumers, Health-Conscious Shoppers |

| Retail Bakery Sales Channels | 90 | Retail Managers, Category Buyers |

| Trends in Bakery Ingredients | 80 | Ingredient Suppliers, Food Technologists |

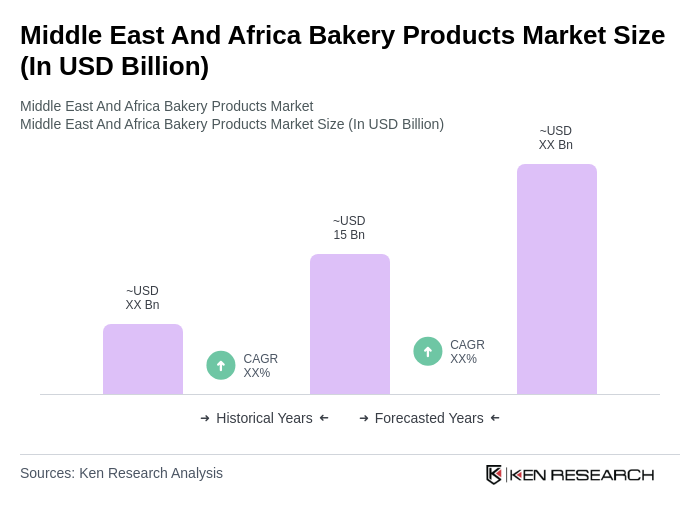

The Middle East and Africa Bakery Products Market is valued at approximately USD 15 billion, reflecting a five-year historical analysis. This growth is attributed to urbanization, rising disposable incomes, and an increasing demand for convenience foods.