Region:Global

Author(s):Rebecca

Product Code:KRAD7364

Pages:98

Published On:December 2025

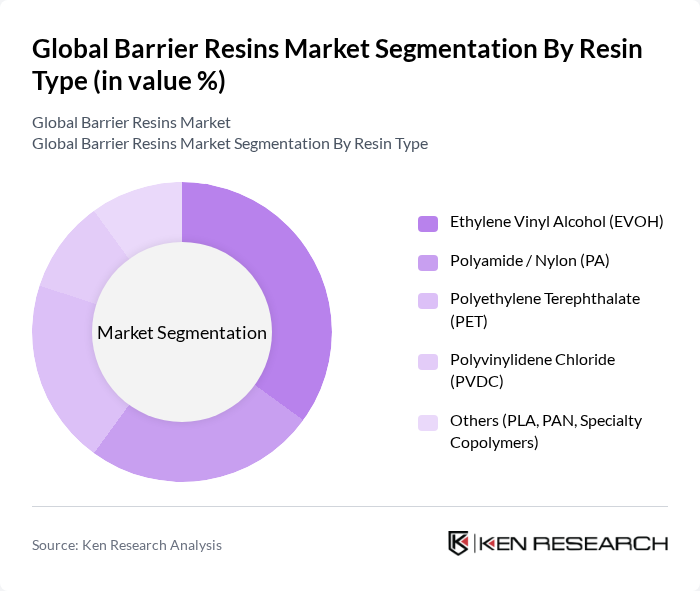

By Resin Type:

The resin type segmentation includes Ethylene Vinyl Alcohol (EVOH), Polyamide/Nylon (PA), Polyethylene Terephthalate (PET), Polyvinylidene Chloride (PVDC), and Others (PLA, PAN, Specialty Copolymers). Ethylene Vinyl Alcohol (EVOH) remains one of the most important barrier materials due to its excellent oxygen barrier properties, particularly when properly protected from moisture in multilayer structures, making it highly sought after in food, beverage, and pharmaceutical packaging. At the same time, high?barrier polyamides and PET are widely used in bottles, trays, and films for meat, dairy, beverages, and medical products, while there is a growing shift toward newer, more recyclable barrier structures and specialty copolymers to balance performance with sustainability requirements.

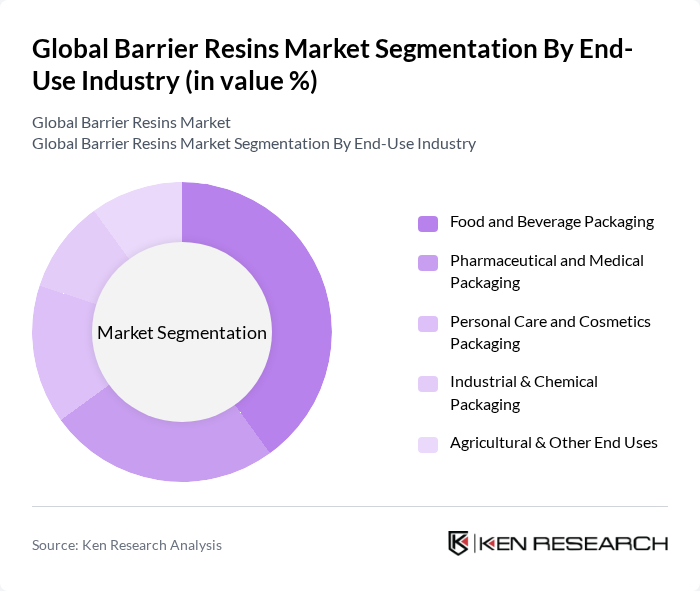

By End-Use Industry:

This segmentation includes Food and Beverage Packaging, Pharmaceutical and Medical Packaging, Personal Care and Cosmetics Packaging, Industrial & Chemical Packaging, and Agricultural & Other End Uses. Food and Beverage Packaging represents the largest end-use segment globally, supported by rising consumption of packaged, processed, and ready-to-eat foods, increasing penetration of modern retail and online grocery, and the need to minimize food waste by extending shelf life and preserving quality. Pharmaceutical and Medical Packaging is another rapidly expanding application area, using barrier resins in blisters, vials, and medical device packaging to protect sensitive drugs and biologics from oxygen, moisture, and contamination, in line with strict regulatory and sterility requirements.

The Global Barrier Resins Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuraray Co., Ltd., Asahi Kasei Corporation, Mitsubishi Gas Chemical Company, Inc., SK geo centric Co., Ltd., The Dow Chemical Company, DuPont de Nemours, Inc., SABIC, Solvay S.A., Honeywell International Inc., LyondellBasell Industries N.V., Arkema S.A., INEOS Group Holdings S.A., Evonik Industries AG, Chang Chun Petrochemical Co., Ltd., UBE Corporation contribute to innovation, geographic expansion, and service delivery in this space. These companies are actively developing advanced multilayer structures, recyclable barrier solutions, and high-performance resins tailored to the needs of food, beverage, pharmaceutical, and industrial packaging value chains.

The future of the barrier resins market is poised for transformation, driven by the increasing emphasis on sustainability and technological innovation. As consumer preferences shift towards eco-friendly packaging, manufacturers are likely to invest in biodegradable and compostable resin solutions. Additionally, advancements in smart packaging technologies will enhance product safety and shelf life, creating new opportunities for growth. The expansion into emerging markets will further bolster demand, as these regions adopt modern packaging solutions to meet evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Resin Type | Ethylene Vinyl Alcohol (EVOH) Polyamide / Nylon (PA) Polyethylene Terephthalate (PET) Polyvinylidene Chloride (PVDC) Others (PLA, PAN, Specialty Copolymers) |

| By End-Use Industry | Food and Beverage Packaging Pharmaceutical and Medical Packaging Personal Care and Cosmetics Packaging Industrial & Chemical Packaging Agricultural & Other End Uses |

| By Application | Flexible Packaging (Pouches, Films, Bags) Rigid Packaging (Bottles, Trays, Cups) Multilayer Films & Laminates Coatings & Sealants Others (Sheets, Containers) |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Distribution Channel | Direct Sales to Converters & Brand Owners Distributors / Traders Online / E-procurement Portals Integrated Supply Agreements Others |

| By Performance Property | Oxygen Barrier Moisture / Water Vapor Barrier Aroma & Flavor Barrier Chemical & Solvent Resistance UV & Light Barrier / Other Functional Properties |

| By Packaging Format | Films & Wraps Bottles & Containers Trays, Cups & Blister Packs Bags, Sacks & Pouches Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Applications | 120 | Packaging Engineers, Product Development Managers |

| Pharmaceutical Packaging Solutions | 90 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Automotive Component Manufacturing | 70 | Manufacturing Engineers, Supply Chain Managers |

| Consumer Electronics Packaging | 60 | Product Managers, Logistics Coordinators |

| Construction Material Applications | 50 | Construction Project Managers, Material Scientists |

The Global Barrier Resins Market is valued at approximately USD 14.0 billion, driven by the increasing demand for high-performance packaging solutions across various industries, including food and beverage, pharmaceuticals, and personal care.