Region:Global

Author(s):Shubham

Product Code:KRAA8737

Pages:81

Published On:November 2025

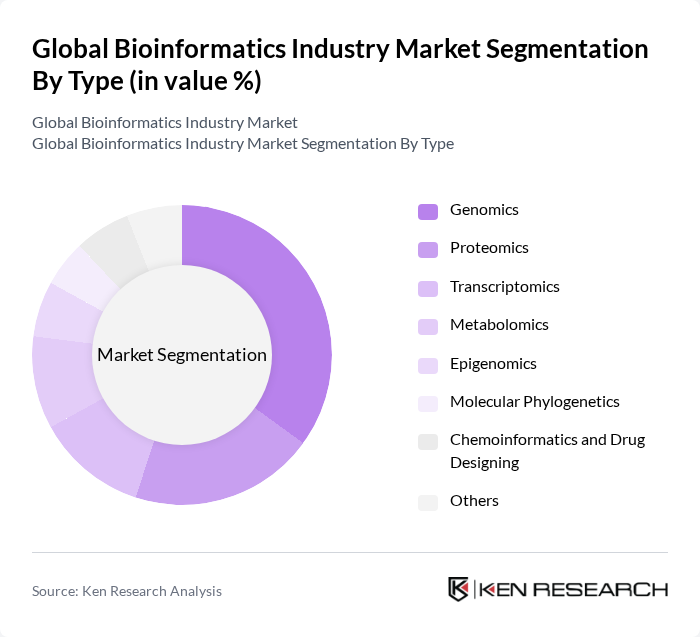

By Type:The bioinformatics market is segmented into various types, including genomics, proteomics, transcriptomics, metabolomics, epigenomics, molecular phylogenetics, chemoinformatics and drug designing, and others. Among these, genomics is the leading segment, driven by the increasing demand for genomic data analysis in personalized medicine and drug discovery. The rise in genetic disorders and the need for targeted therapies have further fueled the growth of this segment. Genomics and transcriptomics together account for the largest share, reflecting their foundational role in drug discovery and clinical reporting.

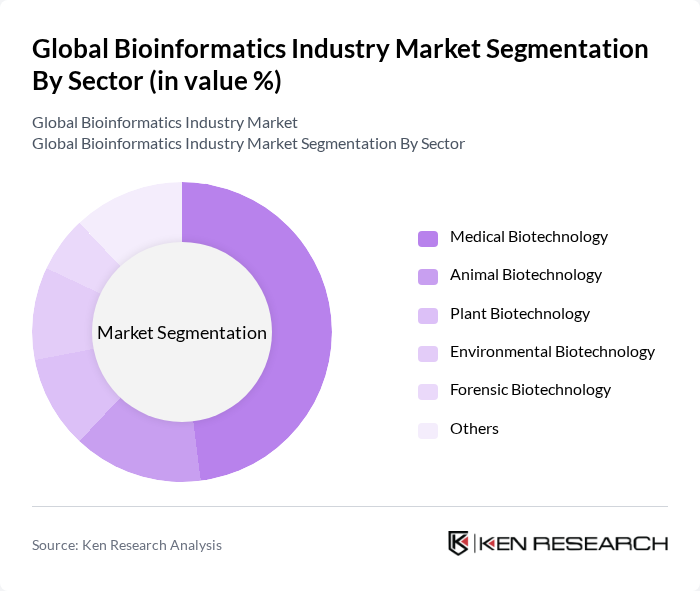

By Sector:The bioinformatics market is categorized into medical biotechnology, animal biotechnology, plant biotechnology, environmental biotechnology, forensic biotechnology, and others. Medical biotechnology is the dominant sector, primarily due to the increasing focus on drug discovery and development, as well as the growing prevalence of chronic diseases that require innovative therapeutic solutions. The integration of bioinformatics in clinical research has also enhanced its significance in this sector.

The Global Bioinformatics Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Illumina, Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., QIAGEN N.V., Bio-Rad Laboratories, Inc., PerkinElmer, Inc., BGI Group, Roche Holding AG, Genomatix Software GmbH, GENEWIZ, Inc., Eurofins Scientific SE, HudsonAlpha Institute for Biotechnology, Seven Bridges Genomics, DNASTAR, Inc., CLC bio (a QIAGEN Company), Partek Incorporated, Dassault Systèmes (BIOVIA), Geneious (Biomatters Ltd.), DNAnexus Inc., Strand Life Sciences Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The bioinformatics industry is poised for transformative growth, driven by technological advancements and increasing integration of artificial intelligence. As organizations prioritize data-driven decision-making, the demand for sophisticated bioinformatics tools will rise. Furthermore, the expansion of cloud-based solutions will enhance accessibility and collaboration among researchers. The focus on real-time data processing will also facilitate quicker insights, enabling faster advancements in personalized medicine and genomic research, ultimately shaping the future landscape of healthcare.

| Segment | Sub-Segments |

|---|---|

| By Type | Genomics Proteomics Transcriptomics Metabolomics Epigenomics Molecular Phylogenetics Chemoinformatics and Drug Designing Others |

| By Sector | Medical Biotechnology Animal Biotechnology Plant Biotechnology Environmental Biotechnology Forensic Biotechnology Others |

| By End-User | Academic & Research Institutes Pharmaceutical & Biotechnology Companies Clinical & Diagnostic Laboratories Contract Research Organizations (CROs) Agri-Genomic & Environmental Testing Firms Healthcare Providers Others |

| By Application | Drug Discovery Disease Diagnosis Clinical Research Precision Medicine Agricultural Biotechnology Others |

| By Technology | Sequencing Technologies Microarray Technologies Data Analysis Software Cloud Computing Solutions AI-Driven Analytics Platforms Others |

| By Service Type | Data Analysis Services Software Development Services Consulting Services Bioinformatics Services Outsourcing Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, U.K., Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Investment Source | Private Investments Government Funding Venture Capital Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Genomics Research Institutions | 60 | Research Scientists, Lab Managers |

| Pharmaceutical Companies | 50 | Drug Development Managers, Bioinformatics Analysts |

| Healthcare Providers | 40 | Clinical Researchers, Medical Directors |

| Bioinformatics Software Vendors | 40 | Product Managers, Technical Support Leads |

| Academic Institutions | 50 | Professors, Graduate Students in Bioinformatics |

The Global Bioinformatics Industry Market is valued at approximately USD 25 billion, driven by advancements in genomic research, personalized medicine, and the adoption of cloud-based solutions. This valuation is based on a comprehensive five-year historical analysis.