Region:Global

Author(s):Dev

Product Code:KRAA2567

Pages:84

Published On:August 2025

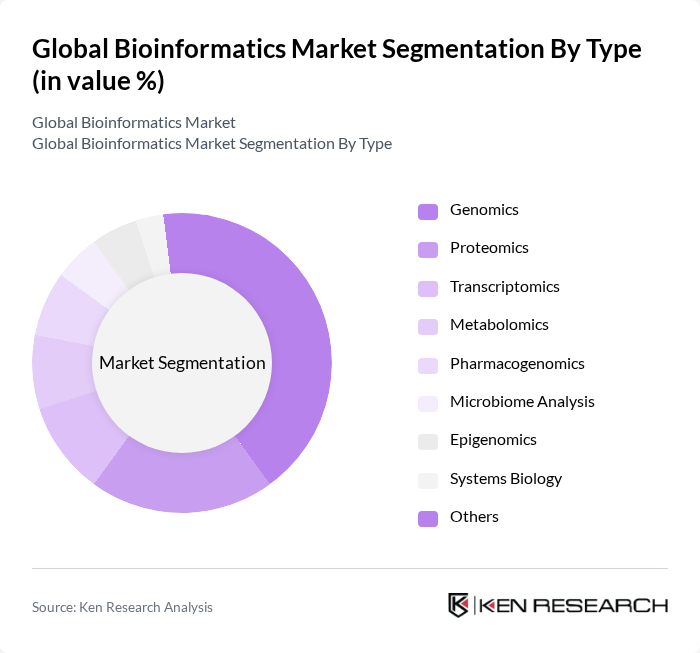

By Type:The bioinformatics market can be segmented into various types, including Genomics, Proteomics, Transcriptomics, Metabolomics, Pharmacogenomics, Microbiome Analysis, Epigenomics, Systems Biology, and Others. Among these,Genomicsis the leading sub-segment, driven by the increasing demand for genomic data in personalized medicine and drug development. The rise in genomic sequencing technologies and their decreasing costs have made genomics a focal point for research and clinical applications. The integration of AI and cloud-based platforms is further enhancing the efficiency and scalability of genomics research.

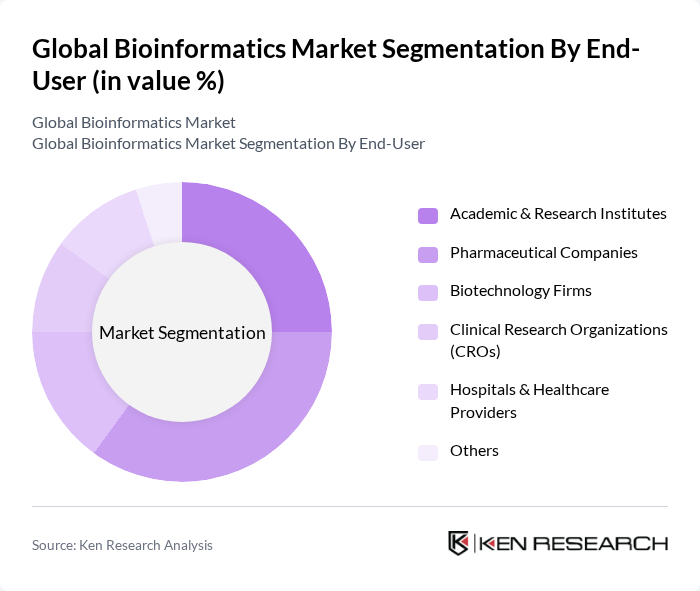

By End-User:The bioinformatics market is also segmented by end-users, which include Academic & Research Institutes, Pharmaceutical Companies, Biotechnology Firms, Clinical Research Organizations (CROs), Hospitals & Healthcare Providers, and Others.Pharmaceutical Companiesare the dominant end-user segment, as they heavily rely on bioinformatics for drug discovery, development, and clinical trials. The increasing focus on precision medicine and the need for efficient data management in drug development processes are key factors driving this segment. Collaborations between pharmaceutical firms and bioinformatics providers are expanding, enabling faster drug development and improved patient outcomes.

The Global Bioinformatics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN N.V., Bio-Rad Laboratories, Inc., PerkinElmer, Inc., BGI Genomics Co., Ltd., F. Hoffmann-La Roche AG, Siemens Healthineers AG, Genomatix Software GmbH, CLC bio (QIAGEN), Seven Bridges Genomics, Inc., DNAnexus, Inc., Eagle Genomics Ltd., Genuity Science, Eurofins Scientific SE, Geneious (Biomatters Ltd.), Partek Incorporated, IBM Life Sciences, GeneData AG contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The future of the bioinformatics market is poised for transformative growth, driven by technological advancements and increasing integration of artificial intelligence. As organizations seek to harness big data analytics, the demand for real-time data processing capabilities will rise. Furthermore, the shift towards open-source bioinformatics tools is expected to democratize access, enabling broader participation in genomic research and personalized medicine initiatives, ultimately enhancing healthcare outcomes and research efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Genomics Proteomics Transcriptomics Metabolomics Pharmacogenomics Microbiome Analysis Epigenomics Systems Biology Others |

| By End-User | Academic & Research Institutes Pharmaceutical Companies Biotechnology Firms Clinical Research Organizations (CROs) Hospitals & Healthcare Providers Others |

| By Application | Drug Discovery & Development Disease Diagnosis & Management Biomarker Discovery Precision Medicine Agriculture & Animal Research Clinical Research Others |

| By Component | Software Services Platforms & Databases Hardware Others |

| By Deployment Model | On-Premise Cloud-Based Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based One-Time License Freemium Usage-Based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Genomics Research Institutions | 100 | Geneticists, Bioinformaticians |

| Pharmaceutical Companies | 60 | R&D Managers, Clinical Researchers |

| Healthcare Providers | 50 | Healthcare Administrators, IT Managers |

| Academic Research Labs | 80 | Professors, Postdoctoral Researchers |

| Biotechnology Startups | 40 | Founders, Product Development Leads |

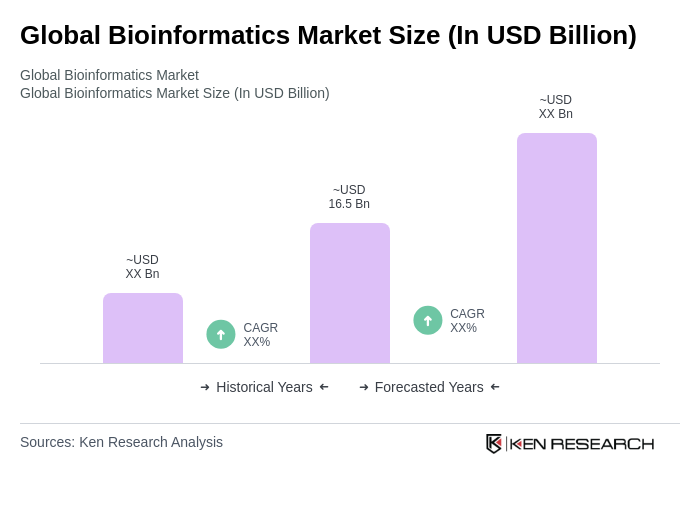

The Global Bioinformatics Market is valued at approximately USD 16.5 billion, driven by advancements in genomic research, personalized medicine, and the integration of artificial intelligence in bioinformatics tools, enhancing data analysis and interpretation capabilities.