Region:Global

Author(s):Geetanshi

Product Code:KRAD5917

Pages:80

Published On:December 2025

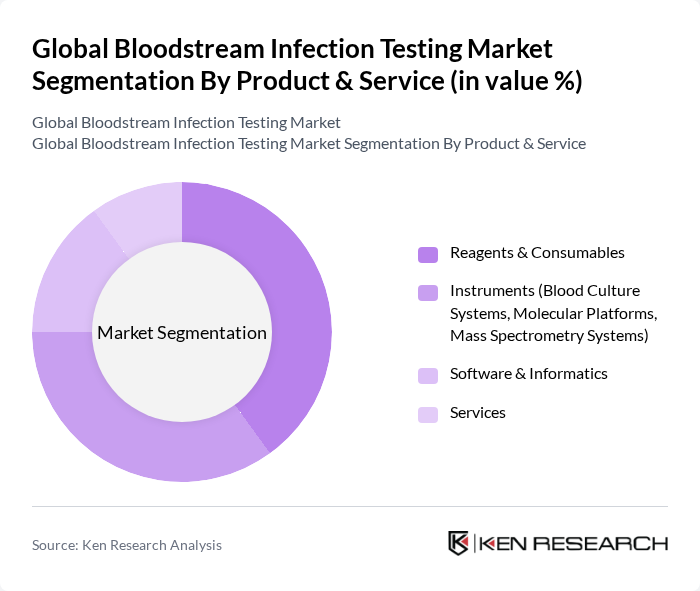

By Product & Service:The product and service segment encompasses various offerings essential for bloodstream infection testing. The subsegments include reagents and consumables, which are critical for conducting tests and represent a recurring revenue stream due to routine blood culture and molecular testing; instruments such as automated blood culture systems, continuous-monitoring incubators, molecular platforms, and mass spectrometry systems (e.g., MALDI-TOF) that facilitate accurate and rapid organism identification; software and informatics solutions that support data integration, antimicrobial stewardship workflows, and connectivity with laboratory information systems; and services that include instrument maintenance, managed laboratory services, and training that support testing processes and optimize laboratory performance.

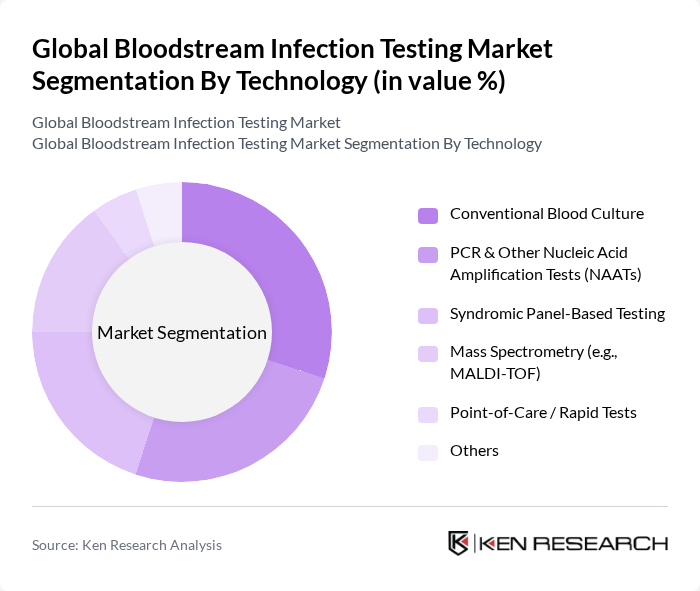

By Technology:This segment includes various technologies utilized in bloodstream infection testing. The subsegments consist of conventional blood culture methods, which remain the gold standard for detecting viable microorganisms and performing antimicrobial susceptibility testing; PCR and other nucleic acid amplification tests (NAATs) that provide rapid, targeted detection of common bloodstream pathogens and resistance genes directly from positive blood cultures or whole blood; syndromic panel-based testing that enables simultaneous detection of multiple bacteria, fungi, and resistance markers from a single sample to accelerate clinical decision-making; mass spectrometry techniques like MALDI-TOF, which offer rapid organism identification from positive cultures with high accuracy and lower per-test cost; point-of-care/rapid tests that offer immediate or near-immediate results in emergency and critical-care settings; and other emerging technologies such as next-generation sequencing and digital PCR that are being explored for comprehensive pathogen and resistance profiling.

The Global Bloodstream Infection Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Becton, Dickinson and Company, bioMérieux SA, Cepheid (a Danaher company), F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc., Bruker Corporation, Accelerate Diagnostics, Inc., Beckman Coulter, Inc. (a Danaher company), Luminex Corporation (a DiaSorin company), DiaSorin S.p.A., Siemens Healthineers AG, Qiagen N.V., Seegene Inc., Bio-Rad Laboratories, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bloodstream infection testing market is poised for significant transformation, driven by technological advancements and a growing emphasis on personalized medicine. As healthcare systems increasingly adopt AI-driven diagnostic tools, the accuracy and efficiency of testing will improve. Additionally, the expansion of telemedicine and remote diagnostics will facilitate broader access to testing, particularly in underserved regions, enhancing early detection and treatment capabilities for bloodstream infections.

| Segment | Sub-Segments |

|---|---|

| By Product & Service | Reagents & Consumables Instruments (Blood Culture Systems, Molecular Platforms, Mass Spectrometry Systems) Software & Informatics Services |

| By Technology | Conventional Blood Culture PCR & Other Nucleic Acid Amplification Tests (NAATs) Syndromic Panel-Based Testing Mass Spectrometry (e.g., MALDI-TOF) Point-of-Care / Rapid Tests Others |

| By Pathogen Type | Bacterial Infections Fungal Infections Mycobacterial Infections Others |

| By End-User | Hospitals Diagnostic & Reference Laboratories Academic & Research Institutions Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Laboratories | 120 | Laboratory Managers, Clinical Pathologists |

| Infectious Disease Clinics | 90 | Infectious Disease Specialists, Nurse Practitioners |

| Public Health Organizations | 70 | Epidemiologists, Public Health Officials |

| Diagnostic Equipment Manufacturers | 60 | Product Managers, R&D Directors |

| Healthcare Policy Makers | 50 | Health Economists, Policy Analysts |

The Global Bloodstream Infection Testing Market is valued at approximately USD 1.2 billion, driven by the increasing prevalence of bloodstream infections, advancements in diagnostic technologies, and the demand for rapid testing solutions to improve patient outcomes.