Region:Global

Author(s):Rebecca

Product Code:KRAA2878

Pages:89

Published On:August 2025

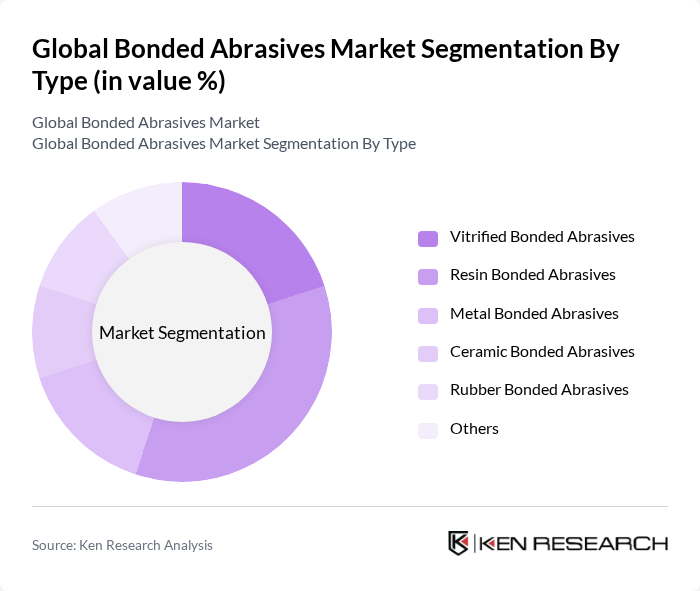

By Type:The bonded abrasives market is segmented into vitrified bonded abrasives, resin bonded abrasives, metal bonded abrasives, ceramic bonded abrasives, rubber bonded abrasives, and others. Among these, resin bonded abrasives currently lead the market due to their versatility, superior performance, and cost-effectiveness. They are widely used in the automotive and metal fabrication industries, where high precision and durability are required. The demand for resin bonded abrasives is driven by their ability to deliver excellent cutting and grinding performance, making them a preferred choice for manufacturers seeking productivity and consistency.

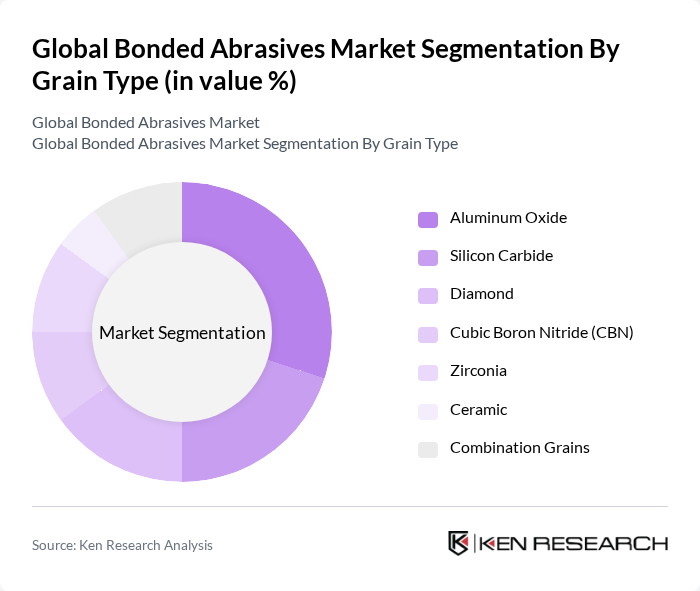

By Grain Type:The market is also segmented by grain type, including aluminum oxide, silicon carbide, diamond, cubic boron nitride (CBN), zirconia, ceramic, and combination grains. Aluminum oxide remains the most widely used grain type due to its cost-effectiveness, versatility, and durability in various applications. It is particularly favored in the metalworking and woodworking industries for its ability to produce fine finishes and withstand high-stress operations. The increasing demand for high-performance abrasives in these sectors continues to drive the growth of aluminum oxide grains in the market.

The Global Bonded Abrasives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saint-Gobain Abrasives, 3M Company, Tyrolit Group, Pferd Werkzeuge (August Rüggeberg GmbH & Co. KG), Mirka Ltd., Carborundum Universal Limited (CUMI), Sia Abrasives (Bosch Group), Klingspor AG, Dronco GmbH, Flexovit (Saint-Gobain), Camel Grinding Wheels (CGW), Abrasive Technology Inc., KGS Diamond Group, ZEC S.p.A., Osborn GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bonded abrasives market appears promising, driven by technological innovations and a growing emphasis on sustainability. As industries increasingly adopt automation and smart technologies, the demand for high-performance abrasives will rise. Additionally, the shift towards eco-friendly products will create new avenues for growth, particularly in emerging markets. Companies that invest in research and development to create sustainable solutions will likely gain a competitive edge, positioning themselves favorably in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitrified Bonded Abrasives Resin Bonded Abrasives Metal Bonded Abrasives Ceramic Bonded Abrasives Rubber Bonded Abrasives Others |

| By Grain Type | Aluminum Oxide Silicon Carbide Diamond Cubic Boron Nitride (CBN) Zirconia Ceramic Combination Grains |

| By Application | Grinding Cutting Polishing Finishing Deburring Others |

| By End-User Industry | Automotive Aerospace Metal Fabrication Construction Marine Electronics Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Wholesalers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Brand Positioning | Premium Brands Mid-Range Brands Budget Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 100 | Manufacturing Engineers, Quality Control Managers |

| Aerospace Component Manufacturing | 60 | Production Supervisors, R&D Engineers |

| Metal Fabrication Sector | 80 | Operations Managers, Tooling Specialists |

| Construction and Building Materials | 50 | Project Managers, Procurement Officers |

| Consumer Goods Manufacturing | 40 | Product Development Managers, Supply Chain Analysts |

The Global Bonded Abrasives Market is valued at approximately USD 12 billion, driven by demand from industries such as automotive, aerospace, construction, and metal fabrication, which require high-performance abrasives for various manufacturing processes.