Region:Middle East

Author(s):Dev

Product Code:KRAD7656

Pages:94

Published On:December 2025

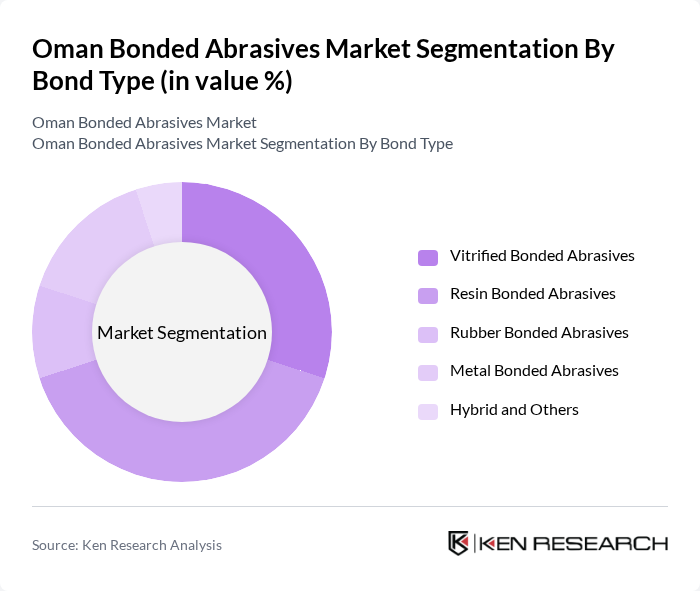

By Bond Type:The bonded abrasives market can be segmented into various bond types, including Vitrified Bonded Abrasives, Resin Bonded Abrasives, Rubber Bonded Abrasives, Metal Bonded Abrasives, and Hybrid and Others. Among these, resin bonded abrasives are gaining traction due to their versatility and effectiveness in various applications, particularly in the automotive and metal fabrication sectors. Vitrified bonded abrasives also hold a significant share due to their durability and performance in precision grinding applications.

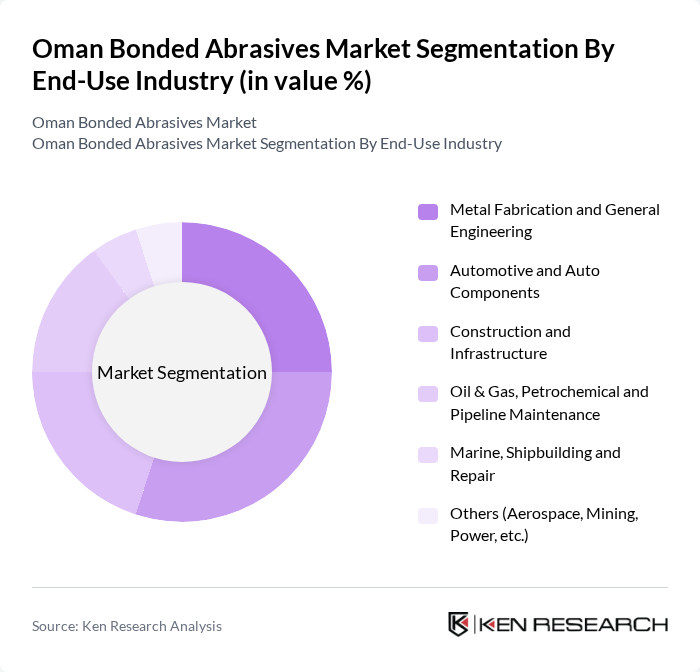

By End-Use Industry:The bonded abrasives market is segmented by end-use industries, including Metal Fabrication and General Engineering, Automotive and Auto Components, Construction and Infrastructure, Oil & Gas, Petrochemical and Pipeline Maintenance, Marine, Shipbuilding and Repair, and Others such as Aerospace and Mining. The construction and automotive sectors are the largest consumers of bonded abrasives, driven by ongoing infrastructure projects and the need for precision components in vehicles.

The Oman Bonded Abrasives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saint-Gobain Abrasives (Norton, Flexovit, Winter), 3M Abrasive Systems Division, Carborundum Universal Limited (CUMI), Tyrolit Group, Klingspor Abrasives, Pferd (August Rüggeberg GmbH & Co. KG), Mirka Ltd., sia Abrasives Industries AG, KGS Diamond Group, Dronco GmbH (Osborn / PFERD Group), ZEC S.p.A., Camel Grinding Wheels (CGW), SAK Abrasives Ltd. (Topline), Al Watania National Trading LLC (Oman – Abrasives & Industrial Supplies Distributor), Bahwan Engineering Group – Trading & Industrial Supplies (Oman Abrasives Distributor) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman bonded abrasives market is poised for significant growth, driven by increasing investments in infrastructure and technological advancements in manufacturing. As the construction and automotive sectors expand, the demand for high-quality abrasives will rise. Additionally, the shift towards sustainable practices and eco-friendly products will shape future developments. Companies that adapt to these trends and invest in innovation will likely capture a larger market share, ensuring a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Bond Type | Vitrified Bonded Abrasives Resin Bonded Abrasives Rubber Bonded Abrasives Metal Bonded Abrasives Hybrid and Others |

| By End-Use Industry | Metal Fabrication and General Engineering Automotive and Auto Components Construction and Infrastructure Oil & Gas, Petrochemical and Pipeline Maintenance Marine, Shipbuilding and Repair Others (Aerospace, Mining, Power, etc.) |

| By Application | Precision Grinding Rough Grinding and Deburring Cutting and Grooving Surface Preparation, Polishing and Finishing Others |

| By Distribution Channel | Direct Sales to OEMs and Large Fabricators Industrial Distributors and Traders Online and E-Procurement Portals Retail and Hardware Stores Others |

| By Abrasive Material | Aluminum Oxide Silicon Carbide Zirconia Alumina Diamond Cubic Boron Nitride (CBN) and Others |

| By Region | Muscat & Batinah Dhofar (incl. Salalah) Sohar & Al Buraimi Industrial Corridor Interior Governorates (Nizwa, Al Dakhiliyah, etc.) Other Ports and Free Zones (Duqm, Sur, etc.) |

| By Product Form | Grinding Wheels Cutting and Chop-Saw Wheels Mounted Points and Cones Segments, Sticks and Stones Others (Specialty and Custom Shapes) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Users | 120 | Project Managers, Site Supervisors |

| Automotive Manufacturing Sector | 90 | Production Managers, Quality Control Engineers |

| Metal Fabrication Companies | 80 | Operations Managers, Tooling Specialists |

| Retail Distributors of Abrasives | 70 | Sales Managers, Inventory Controllers |

| Research and Development Departments | 60 | R&D Managers, Product Development Engineers |

The Oman Bonded Abrasives Market is valued at approximately USD 45 million, reflecting a five-year historical analysis. This growth is driven by increasing demand from industries such as construction, automotive, and metal fabrication.