Region:Global

Author(s):Dev

Product Code:KRAA2476

Pages:90

Published On:August 2025

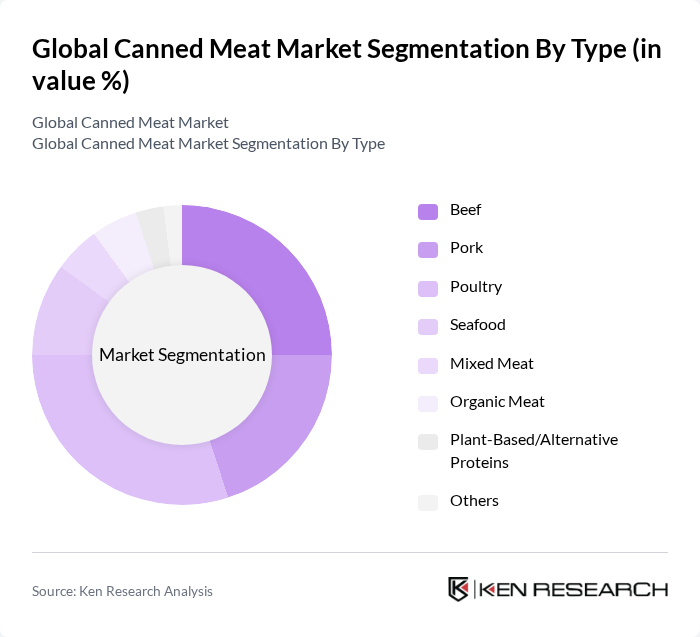

By Type:The canned meat market is segmented into various types, including Beef, Pork, Poultry, Seafood, Mixed Meat, Organic Meat, Plant-Based/Alternative Proteins, and Others. Each type caters to different consumer preferences and dietary needs, influencing market dynamics significantly. The market is witnessing a growing share for organic and plant-based options, reflecting increased health and sustainability awareness among consumers .

The Poultry segment is currently dominating the market due to its versatility, affordability, and consumer preference for leaner meat options. Increasing health consciousness has led to a shift towards poultry products, which are perceived as healthier alternatives compared to red meats. The convenience of canned poultry products aligns well with the growing trend of ready-to-eat meals, further driving its popularity. Additionally, the introduction of low-sodium and preservative-free poultry options is attracting health-focused consumers .

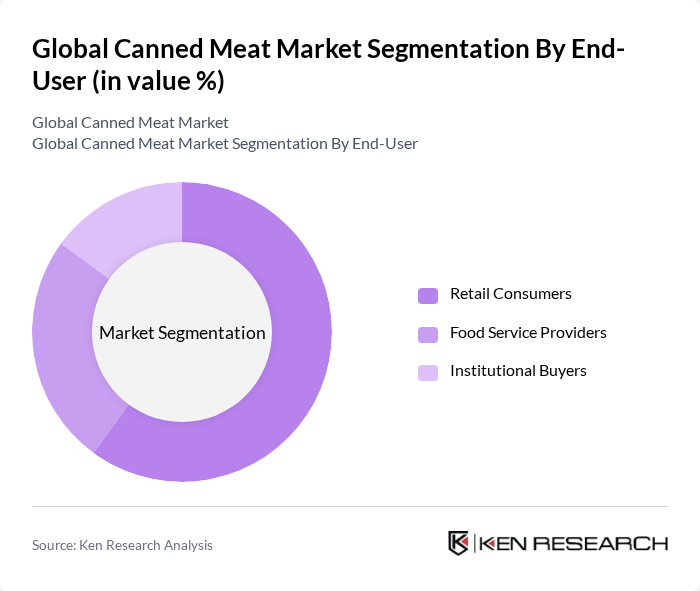

By End-User:The market is segmented into Retail Consumers, Food Service Providers, and Institutional Buyers (e.g., military, hospitals, schools). Each end-user category has distinct requirements and purchasing behaviors that influence the overall market landscape. Retail and food service channels are expanding rapidly, supported by the growth of e-commerce and online grocery platforms .

Retail Consumers represent the largest segment in the canned meat market, driven by the increasing demand for convenient meal solutions and the growing trend of home cooking. The rise in e-commerce and online grocery shopping has facilitated access to a variety of canned meat products, making it easier for consumers to purchase their preferred items. Food Service Providers follow closely, as they require bulk supplies for restaurants and catering services, while Institutional Buyers account for a smaller share due to their specific procurement processes .

The Global Canned Meat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hormel Foods Corporation, Conagra Brands, Inc., Tyson Foods, Inc., Campbell Soup Company, Nestlé S.A., Del Monte Foods, Inc., Danish Crown A/S, JBS S.A., Smithfield Foods, Inc., Maple Leaf Foods Inc., BRF S.A., Zwanenberg Food Group B.V., Keystone Meats, Pronas, China Kuyu Industrial Co., Ltd., Bejing Yuanyoung Hongxing Food Co., Ltd., Wild Planet Foods, Inc., Oceans Secret, Cargill, Inc., Unilever PLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the canned meat market in None appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, companies are likely to adopt eco-friendly practices in sourcing and packaging. Additionally, the growth of online retail channels will facilitate wider distribution, making canned meat products more accessible. Innovations in product offerings, such as organic and gourmet options, will cater to health-conscious consumers, further enhancing market potential in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Beef Pork Poultry Seafood Mixed Meat Organic Meat Plant-Based/Alternative Proteins Others |

| By End-User | Retail Consumers Food Service Providers Institutional Buyers (e.g., military, hospitals, schools) |

| By Packaging Type | Metal Cans Pouches Glass Jars Cartons |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Specialty Stores Direct-to-Consumer/E-commerce |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Russia, etc.) Asia-Pacific (China, Japan, India, Australia, Southeast Asia, etc.) Latin America (Brazil, Argentina, etc.) Middle East & Africa (South Africa, Saudi Arabia, UAE, etc.) |

| By Product Form | Chunk Slices Diced Minced/Shredded Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Canned Meat Sales | 100 | Store Managers, Category Buyers |

| Food Service Industry Insights | 80 | Restaurant Owners, Catering Managers |

| Consumer Preferences in Canned Meat | 120 | Household Decision Makers, Health-Conscious Consumers |

| Export Market Dynamics | 60 | Export Managers, Trade Analysts |

| Market Trends in Emerging Economies | 90 | Market Researchers, Economic Development Officers |

The Global Canned Meat Market is valued at approximately USD 32.5 billion, reflecting a significant growth trend driven by increasing consumer demand for convenient, long-shelf-life food products and the rising popularity of ready-to-eat meals.