Region:Global

Author(s):Rebecca

Product Code:KRAC8391

Pages:85

Published On:November 2025

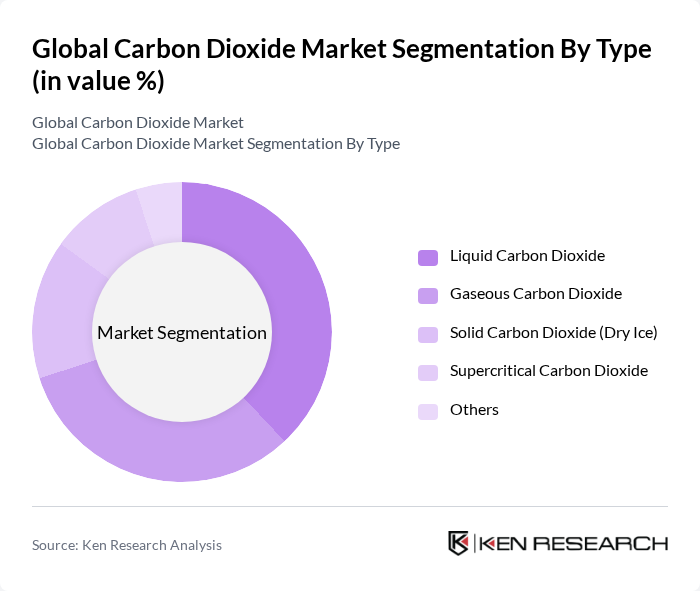

By Type:The market is segmented into various types of carbon dioxide, including Liquid Carbon Dioxide, Gaseous Carbon Dioxide, Solid Carbon Dioxide (Dry Ice), Supercritical Carbon Dioxide, and Others. Liquid Carbon Dioxide is a leading subsegment due to its extensive use in the food and beverage industry for carbonation and preservation. Gaseous Carbon Dioxide is primarily utilized in industrial applications such as welding and chemical manufacturing, while Solid Carbon Dioxide (dry ice) is significant in shipping and logistics for temperature-sensitive products .

By End-User:The market is segmented by end-user industries, including Food and Beverage, Chemical Manufacturing, Oil and Gas, Metal Processing, Healthcare and Medical, Firefighting, Rubber and Plastics, Water Treatment, and Others. The Food and Beverage sector is the dominant end-user, driven by the high demand for carbon dioxide in carbonated drinks and food preservation. Chemical Manufacturing utilizes carbon dioxide in processes such as urea and chemical production. The Oil and Gas industry is increasingly adopting carbon dioxide for enhanced oil recovery, further boosting its market presence .

The Global Carbon Dioxide Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Linde plc, Messer Group GmbH, Air Liquide S.A., Praxair Technology, Inc. (now part of Linde plc), Taiyo Nippon Sanso Corporation, Gulf Cryo, Matheson Tri-Gas, Inc., Reliant Gases, Ltd., SICGIL India Limited, Continental Carbonic Products, Inc., Air Water Inc., Carbon Clean Solutions Limited, Aker Solutions ASA, Mitsubishi Heavy Industries, Ltd., BASF SE, Siemens AG, CarbonCure Technologies Inc., Climeworks AG, Global CCS Institute contribute to innovation, geographic expansion, and service delivery in this space.

The future of the carbon dioxide market is poised for significant transformation, driven by technological advancements and increasing regulatory pressures. As industries adopt carbon capture and storage solutions, the market is expected to witness a surge in innovative applications. Furthermore, the integration of carbon dioxide into various sectors, including renewable energy and manufacturing, will enhance its value as a resource. The focus on sustainability will continue to shape investment strategies, fostering a more resilient and environmentally responsible market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Carbon Dioxide Gaseous Carbon Dioxide Solid Carbon Dioxide (Dry Ice) Supercritical Carbon Dioxide Others |

| By End-User | Food and Beverage Chemical Manufacturing Oil and Gas Metal Processing Healthcare and Medical Firefighting Rubber and Plastics Water Treatment Others |

| By Application | Enhanced Oil Recovery (EOR) Carbonated Beverages Refrigeration and Cooling Welding and Metal Fabrication Greenhouse Enrichment Medical and Pharmaceutical Fire Suppression Rubber and Plastics Production Others |

| By Source | Natural Sources Industrial Processes (e.g., Ammonia, Ethylene Oxide, Hydrogen Production) Captured CO2 (Carbon Capture and Storage/Utilization) Bio-based Sources Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Emission Trading Schemes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Carbon Capture Technology Providers | 60 | Technical Directors, R&D Managers |

| Industrial Emission Sources | 50 | Environmental Compliance Officers, Operations Managers |

| Government Regulatory Bodies | 40 | Policy Analysts, Environmental Regulators |

| Carbon Trading Platforms | 40 | Market Analysts, Business Development Managers |

| Research Institutions Focused on Climate Change | 40 | Climate Scientists, Research Directors |

The Global Carbon Dioxide Market is valued at approximately USD 10 billion, driven by increasing demand across various sectors such as food and beverage, healthcare, and enhanced oil recovery, along with advancements in carbon capture technologies.