Region:Global

Author(s):Geetanshi

Product Code:KRAD0110

Pages:86

Published On:August 2025

By Type:The confectionery market is segmented into Chocolate Confectionery, Sugar Confectionery, Gum & Mints, Bakery Confectionery, Functional/Medicated Confectionery, Snack Bars, Seasonal Confectionery, Premium Confectionery, and Others. Chocolate Confectionery remains the leading segment, driven by its enduring popularity, versatility in formats (bars, truffles, seasonal gifts), and the growing demand for premium, artisanal, and ethically sourced chocolates. Functional/Medicated Confectionery is also gaining traction, with consumers seeking added health benefits such as vitamins, probiotics, and energy-boosting ingredients .

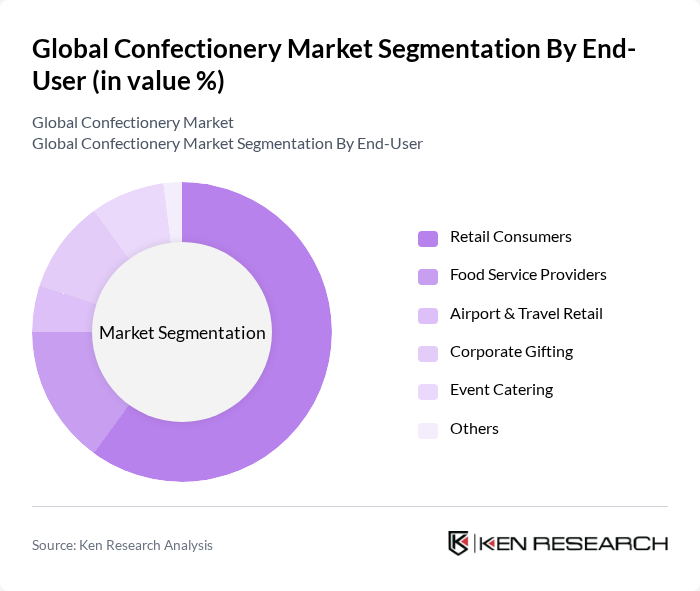

By End-User:The market is segmented by end-user into Retail Consumers, Food Service Providers, Airport & Travel Retail, Corporate Gifting, Event Catering, and Others. Retail Consumers continue to dominate, fueled by impulse buying, the broad availability of confectionery in supermarkets, convenience stores, and online platforms, and the increasing trend of gifting confectionery during festivals and special occasions. Food service and travel retail channels are also expanding as confectionery brands target new consumption occasions .

The Global Confectionery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mars, Incorporated, Mondelez International, Inc., Nestlé S.A., Ferrero Group, The Hershey Company, Lindt & Sprüngli AG, General Mills, Inc., Perfetti Van Melle, Haribo GmbH & Co. KG, Pladis Global, Barry Callebaut AG, Tootsie Roll Industries, Inc., Ghirardelli Chocolate Company, Jelly Belly Candy Company, Cargill, Incorporated, Lotte Confectionery Co., Ltd., Meiji Holdings Co., Ltd., Orion Corporation, Arcor S.A.I.C., Cloetta AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the confectionery market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are increasingly adopting eco-friendly practices, including sustainable sourcing and packaging. Additionally, the integration of technology in product development is expected to enhance innovation, leading to the introduction of unique flavors and healthier options. These trends will likely shape the market landscape, fostering growth and diversification in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Chocolate Confectionery Sugar Confectionery Gum & Mints Bakery Confectionery Functional/Medicated Confectionery Snack Bars Seasonal Confectionery Premium Confectionery Others |

| By End-User | Retail Consumers Food Service Providers Airport & Travel Retail Corporate Gifting Event Catering Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Specialty Stores Food Service Outlets Others |

| By Packaging Type | Rigid Packaging Flexible Packaging Bulk Packaging Gift Packaging Others |

| By Flavor | Chocolate Fruit Mint & Peppermint Nut Coffee Spicy Others |

| By Price Range | Economy Mid-Range Premium Luxury Others |

| By Occasion | Everyday Consumption Gifting Celebrations Seasonal Events Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chocolate Confectionery Market | 120 | Product Managers, Brand Strategists |

| Sugar Confectionery Segment | 90 | Retail Buyers, Category Managers |

| Gum and Mints Sector | 60 | Marketing Directors, Sales Executives |

| Health-Conscious Confectionery Products | 50 | Nutritionists, Health Product Developers |

| Emerging Markets Confectionery Trends | 70 | Market Analysts, Regional Sales Managers |

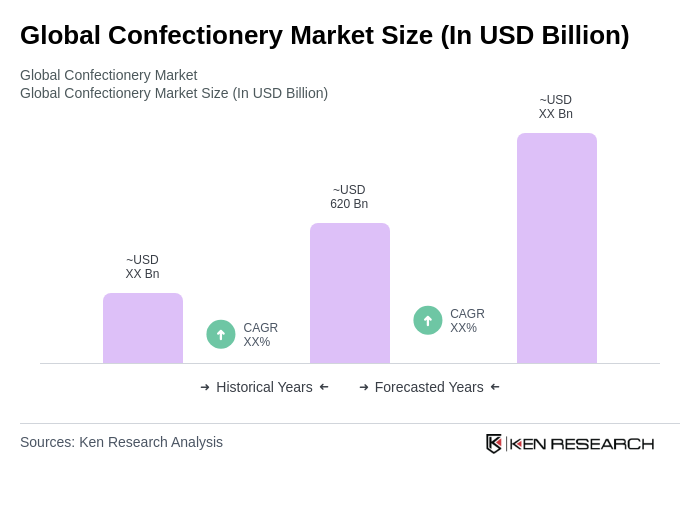

The Global Confectionery Market is valued at approximately USD 620 billion, reflecting a significant growth trend driven by consumer demand for indulgent treats, product innovation, and the expansion of distribution channels, both traditional and online.