Region:Middle East

Author(s):Rebecca

Product Code:KRAD0316

Pages:98

Published On:August 2025

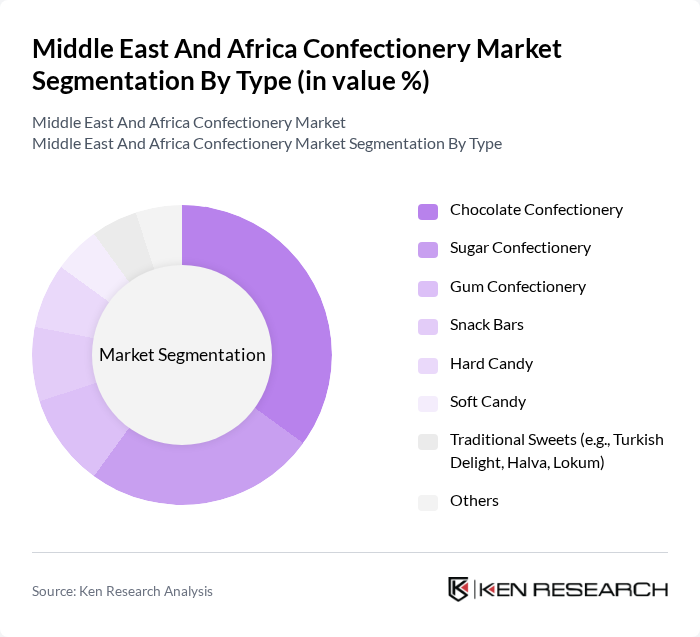

By Type:The confectionery market in the Middle East and Africa is segmented into chocolate confectionery, sugar confectionery, gum confectionery, snack bars, hard candy, soft candy, traditional sweets (such as Turkish Delight, Halva, Lokum), and others. Each of these subsegments caters to distinct consumer preferences and consumption occasions, reflecting the region's diverse tastes and cultural influences. Chocolate and sugar confectionery remain the most popular, while traditional sweets maintain strong demand, especially during festive seasons and cultural celebrations.

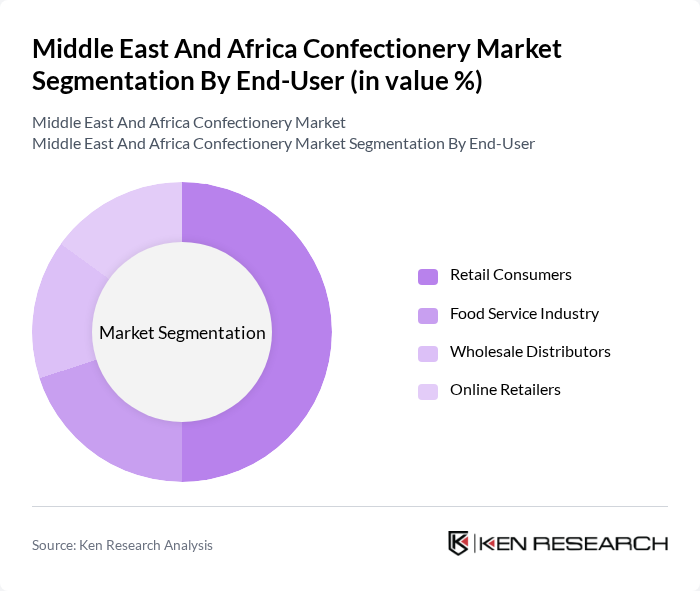

By End-User:The market is also segmented by end-user, including retail consumers, the food service industry, wholesale distributors, and online retailers. Retail consumers represent the largest segment, driven by impulse purchases and gifting occasions. The food service industry leverages confectionery for desserts and menu innovation, while wholesale distributors and online retailers are increasingly important for expanding market reach and serving both urban and rural consumers.

The Middle East And Africa Confectionery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mars, Incorporated, Mondelez International, Inc., Nestlé S.A., Ferrero S.p.A., The Hershey Company, Arcor S.A.I.C., Perfetti Van Melle Group B.V., Haribo GmbH & Co. KG, Pladis Global (Ulker), General Mills, Inc., Lindt & Sprüngli AG, Cémoi Chocolatier, Barry Callebaut AG, Cloetta AB, Tootsie Roll Industries, Inc., Dadash Baradar Co., Shirin Asal Co., Gandour, Al Nassma Chocolate LLC, and Patchi SAL contribute to innovation, geographic expansion, and service delivery in this space. These companies invest in product development, marketing, and distribution strategies tailored to regional tastes and regulatory requirements.

The Middle East and Africa confectionery market is poised for significant transformation driven by evolving consumer preferences and technological advancements. As health-conscious trends continue to rise, manufacturers are likely to innovate with healthier alternatives, including low-sugar and organic options. Additionally, the growth of e-commerce will facilitate broader market reach, allowing brands to connect with consumers directly. This dynamic environment presents opportunities for both established and emerging players to capitalize on changing consumption patterns and enhance their market presence.

| Segment | Sub-Segments |

|---|---|

| By Type | Chocolate Confectionery Sugar Confectionery Gum Confectionery Snack Bars Hard Candy Soft Candy Traditional Sweets (e.g., Turkish Delight, Halva, Lokum) Others |

| By End-User | Retail Consumers Food Service Industry Wholesale Distributors Online Retailers |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Specialty Stores E-commerce Platforms Traditional Markets & Souks |

| By Packaging Type | Flexible Packaging Rigid Packaging Bulk Packaging |

| By Flavor | Chocolate Fruit Mint Spicy Nut-based |

| By Occasion | Seasonal Events Everyday Consumption Gifting Religious Festivals (e.g., Ramadan, Eid, Christmas) |

| By Price Range | Economy Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Confectionery Sales | 100 | Store Managers, Category Buyers |

| Consumer Preferences in Confectionery | 120 | General Consumers, Trendsetters |

| Distribution Channel Insights | 80 | Distributors, Wholesalers |

| Market Entry Strategies | 60 | Business Development Managers, Market Analysts |

| Product Innovation Feedback | 60 | Product Managers, R&D Specialists |

The Middle East and Africa Confectionery Market is valued at approximately USD 5 billion, driven by factors such as increasing disposable incomes, urbanization, and a growing preference for indulgent snacks among consumers.