Region:Global

Author(s):Shubham

Product Code:KRAA3105

Pages:95

Published On:August 2025

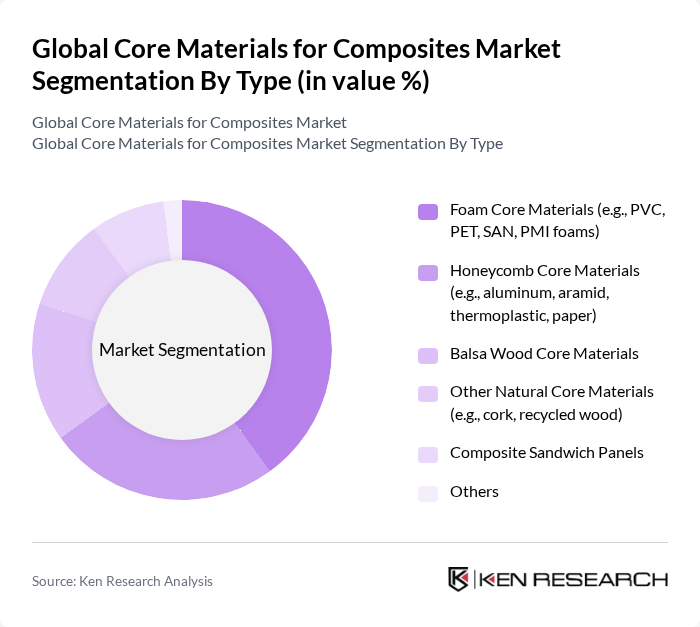

By Type:The core materials for composites are categorized into foam core materials, honeycomb core materials, balsa wood core materials, other natural core materials, composite sandwich panels, and others. Foam core materials, such as PVC and PET, are the leading segment due to their lightweight properties, versatility, and strong performance in thermal insulation and structural applications. These materials are extensively used in aerospace, wind energy, and automotive industries for their high strength-to-weight ratio and durability .

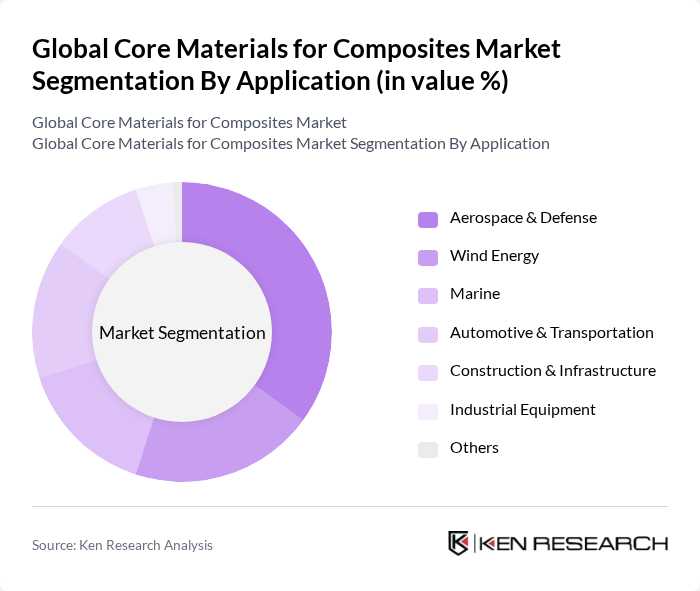

By Application:Core materials for composites are used across aerospace & defense, wind energy, marine, automotive & transportation, construction & infrastructure, industrial equipment, and other sectors. The aerospace & defense segment is the largest application area, driven by the need for lightweight, high-strength materials to improve fuel efficiency and performance. Wind energy is another key sector, with growing demand for composite materials in turbine blades and related infrastructure, supported by global investments in renewable energy .

The Global Core Materials for Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hexcel Corporation, Gurit Holding AG, Armacell International S.A., 3A Composites GmbH, BASF SE, Solvay S.A., Owens Corning, Mitsubishi Chemical Corporation, Sika AG, Toray Industries, Inc., Huntsman Corporation, Teijin Limited, 3M Company, DuPont de Nemours, Inc., Covestro AG, Diab International AB, Euro-Composites S.A., Plascore, Inc., Evonik Industries AG, and SABIC contribute to innovation, geographic expansion, and service delivery in this space.

The future of core materials for composites in None appears promising, driven by technological advancements and increasing environmental awareness. As industries shift towards sustainable practices, the demand for bio-based composites is expected to rise significantly. Additionally, the integration of smart technologies into composite materials will likely enhance their functionality, making them more appealing to manufacturers. Overall, the market is poised for growth, with innovations paving the way for new applications and increased adoption across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Foam Core Materials (e.g., PVC, PET, SAN, PMI foams) Honeycomb Core Materials (e.g., aluminum, aramid, thermoplastic, paper) Balsa Wood Core Materials Other Natural Core Materials (e.g., cork, recycled wood) Composite Sandwich Panels Others |

| By Application | Aerospace & Defense Wind Energy Marine Automotive & Transportation Construction & Infrastructure Industrial Equipment Others |

| By End-User | OEMs (Original Equipment Manufacturers) Tier 1 & Tier 2 Suppliers Distributors & Traders Fabricators & Processors Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Material Source | Virgin Materials Recycled Materials Bio-based Materials Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| By Product Form | Sheets Rolls Blocks Custom Shapes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Composite Materials | 100 | Materials Engineers, Procurement Managers |

| Automotive Composite Applications | 80 | Product Development Engineers, Supply Chain Managers |

| Construction and Infrastructure Composites | 70 | Project Managers, Structural Engineers |

| Marine Composite Materials | 60 | Design Engineers, Manufacturing Managers |

| Wind Energy Composite Solutions | 90 | Renewable Energy Specialists, R&D Managers |

The Global Core Materials for Composites Market is valued at approximately USD 4.2 billion, driven by the demand for lightweight and high-strength materials across various sectors, including aerospace, automotive, and construction.