Region:Global

Author(s):Shubham

Product Code:KRAA1831

Pages:83

Published On:August 2025

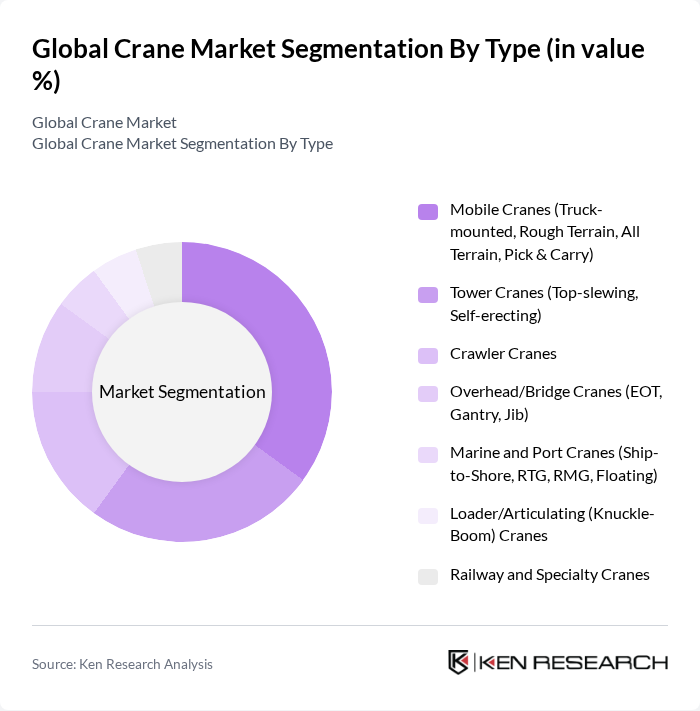

By Type:The crane market is segmented into various types, including mobile cranes, tower cranes, crawler cranes, overhead/bridge cranes, marine and port cranes, loader/articulating cranes, and railway and specialty cranes. Among these, mobile cranes, particularly truck-mounted and all-terrain types, dominate the market due to their versatility and rapid setup across construction and industrial sites; Asia Pacific’s high infrastructure spend further reinforces mobile crane demand.

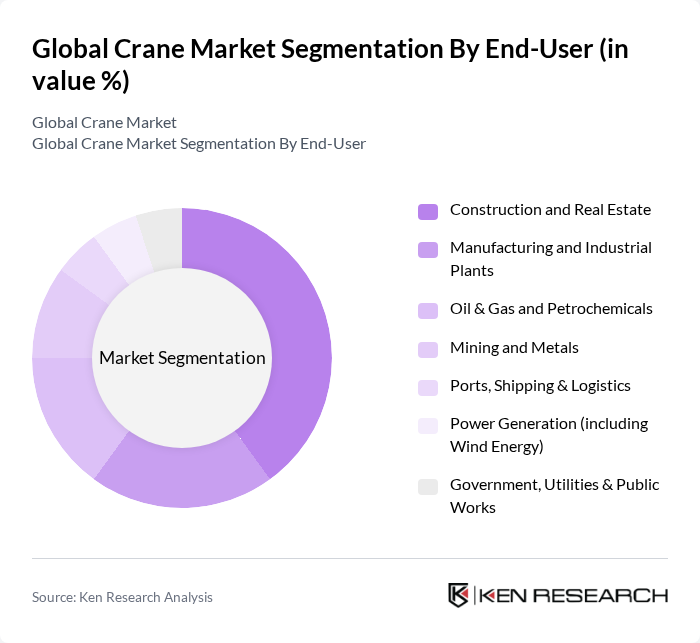

By End-User:The crane market is also segmented by end-user industries, including construction and real estate, manufacturing and industrial plants, oil & gas and petrochemicals, mining and metals, ports, shipping & logistics, power generation, and government utilities. The construction and real estate sector is the largest end-user, supported by ongoing urbanization, transport and energy infrastructure build-outs, and industrial capacity additions in Asia Pacific; ports and logistics demand is additionally influenced by container handling modernization.

The Global Crane Market is characterized by a dynamic mix of regional and international players. Leading participants such as Liebherr Group, Tadano Ltd., The Manitowoc Company, Inc., Konecranes Plc, Terex Corporation, SANY Group, XCMG Group, Zoomlion Heavy Industry Science & Technology Co., Ltd., Cargotec Corporation (Hiab, Kalmar), Palfinger AG, Kato Works Co., Ltd., Kobelco Construction Machinery Co., Ltd., Sumitomo Heavy Industries (HSC Cranes), Sennebogen Maschinenfabrik GmbH, Mammoet (Mammoet Holding B.V.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the crane market appears promising, driven by ongoing infrastructure projects and technological advancements. As urbanization accelerates, the demand for efficient lifting solutions will continue to rise. Furthermore, the integration of smart technologies and a shift towards sustainable practices will likely reshape operational standards. Companies that adapt to these trends and invest in innovative solutions will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Cranes (Truck-mounted, Rough Terrain, All Terrain, Pick & Carry) Tower Cranes (Top-slewing, Self-erecting) Crawler Cranes Overhead/Bridge Cranes (EOT, Gantry, Jib) Marine and Port Cranes (Ship-to-Shore, RTG, RMG, Floating) Loader/Articulating (Knuckle-Boom) Cranes Railway and Specialty Cranes |

| By End-User | Construction and Real Estate Manufacturing and Industrial Plants Oil & Gas and Petrochemicals Mining and Metals Ports, Shipping & Logistics Power Generation (including Wind Energy) Government, Utilities & Public Works |

| By Application | Heavy Lifting and Erection (e.g., wind turbines, bridges) Material Handling and Assembly Building Construction (residential/commercial) Infrastructure (roads, rails, metros, airports) Demolition and Recovery Marine/Port Operations |

| By Sales Channel | Direct OEM Sales Authorized Distributors/Dealers Online/Marketplace Rental and Leasing Services Auctions/Secondary Market |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Oceania |

| By Price Range | Entry-Level/Low Capacity Mid-Range High Capacity/Premium |

| By Financing Options | Purchase (Cash/Loan) Operating Lease Rental (Short- and Long-term) Vendor/OEM Financing and Leasing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Project Management | 140 | Project Managers, Site Supervisors |

| Crane Rental Services | 100 | Rental Managers, Sales Directors |

| Heavy Equipment Maintenance | 80 | Maintenance Supervisors, Equipment Technicians |

| Infrastructure Development | 70 | Urban Planners, Civil Engineers |

| Crane Technology Innovation | 60 | R&D Managers, Product Development Engineers |

The Global Crane Market is valued at approximately USD 54 billion, reflecting sustained demand across construction, industrial, and infrastructure segments. This valuation is based on a five-year historical analysis and aligns with multiple industry trackers.