Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3144

Pages:82

Published On:October 2025

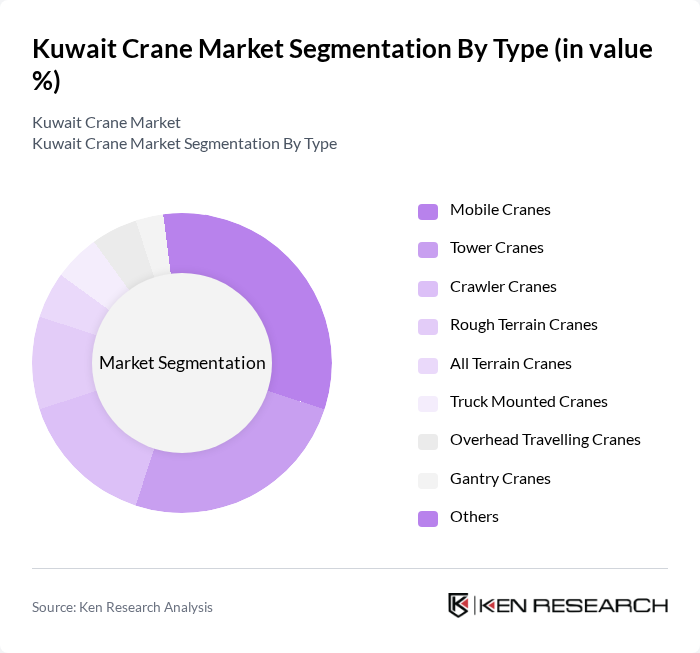

By Type:The crane market can be segmented into various types, including mobile cranes, tower cranes, crawler cranes, rough terrain cranes, all-terrain cranes, truck-mounted cranes, overhead traveling cranes, gantry cranes, and others. Each type serves specific applications and industries, with mobile cranes being particularly popular due to their versatility and ease of transport .

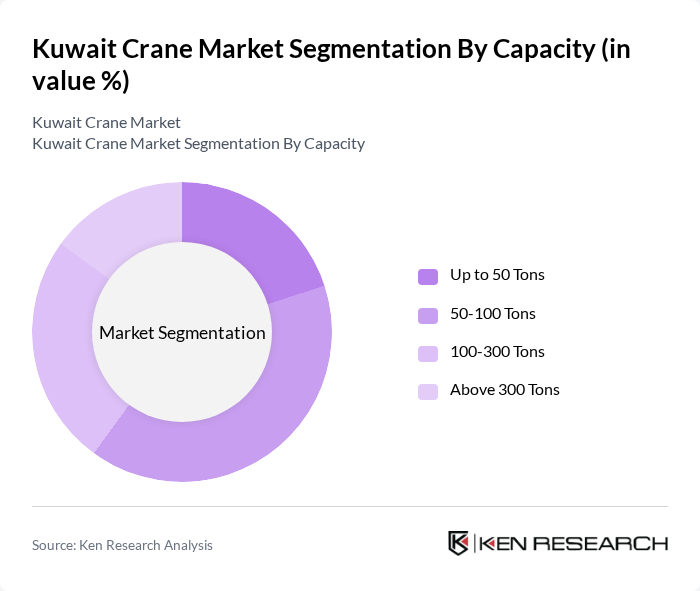

By Capacity:The crane market is also segmented by capacity, which includes categories such as up to 50 tons, 50-100 tons, 100-300 tons, and above 300 tons. The demand for cranes in the 50-100 tons range is particularly high, as they are suitable for a wide variety of construction and industrial applications .

The Kuwait Crane Market is characterized by a dynamic mix of regional and international players. Leading participants such as Liebherr Group, Konecranes Plc, Terex Corporation, Manitowoc Company, SANY Group, Zoomlion Heavy Industry Science & Technology Co. Ltd., Tadano Ltd., Al Faris Group, Mammoet Middle East, Lamprell Energy Limited, United Equipment Company (UNEC), Al Bahar (Caterpillar Dealer), Al Mulla Group, Burgan Company for Well Drilling, Trading & Maintenance, Gulf Cryo contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait crane market is poised for significant growth driven by ongoing infrastructure projects and government initiatives. As urbanization accelerates, the demand for advanced crane technologies will rise, particularly in renewable energy and logistics sectors. The integration of smart technologies and IoT in crane operations will enhance efficiency and safety. Furthermore, the shift towards electric and hybrid cranes aligns with global sustainability trends, positioning the market for innovative advancements and increased competitiveness in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Cranes Tower Cranes Crawler Cranes Rough Terrain Cranes All Terrain Cranes Truck Mounted Cranes Overhead Travelling Cranes Gantry Cranes Others |

| By Capacity | Up to 50 Tons 100 Tons 300 Tons Above 300 Tons |

| By End-User | Construction Oil & Gas Manufacturing Transportation & Logistics Ports & Marine Mining Utilities & Power Others |

| By Application | Heavy Lifting Material Handling Infrastructure Projects Maintenance & Installation Demolition Others |

| By Business Model | Purchase/Ownership Rental Services Leasing |

| By Sales Channel | Direct Sales (OEM) Authorized Distributors Online Platforms Rental Service Providers Aftermarket Services |

| By Technology | Conventional Cranes IoT-Enabled Smart Cranes Electric & Hybrid Cranes Automated Cranes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Project Management | 50 | Project Managers, Site Supervisors |

| Crane Rental Services | 40 | Rental Company Owners, Operations Managers |

| Infrastructure Development | 45 | Government Officials, Urban Planners |

| Crane Maintenance and Safety | 50 | Maintenance Supervisors, Safety Officers |

| Construction Equipment Suppliers | 55 | Sales Managers, Product Specialists |

The Kuwait Crane Market is valued at approximately USD 144 million, driven by significant growth in the construction sector, government investments in infrastructure, and increasing demand for cranes in various applications such as heavy lifting and material handling.