Region:Asia

Author(s):Shubham

Product Code:KRAC0732

Pages:90

Published On:August 2025

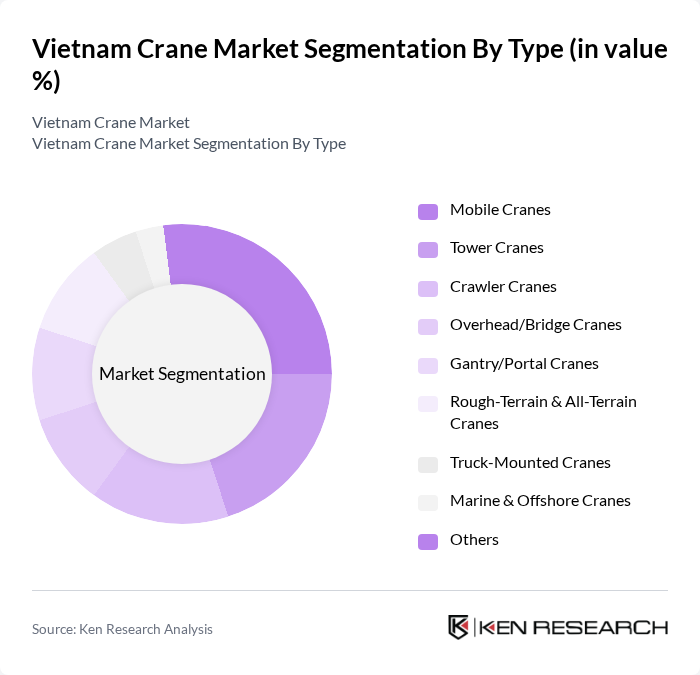

By Type:The crane market can be segmented into various types, including Mobile Cranes, Tower Cranes, Crawler Cranes, Overhead/Bridge Cranes, Gantry/Portal Cranes, Rough-Terrain & All-Terrain Cranes, Truck-Mounted Cranes, Marine & Offshore Cranes, and Others. Each type serves specific applications and industries, contributing to the overall market dynamics, with construction, port modernization, and industrial expansion sustaining demand for tower, mobile, crawler, and port-handling cranes.

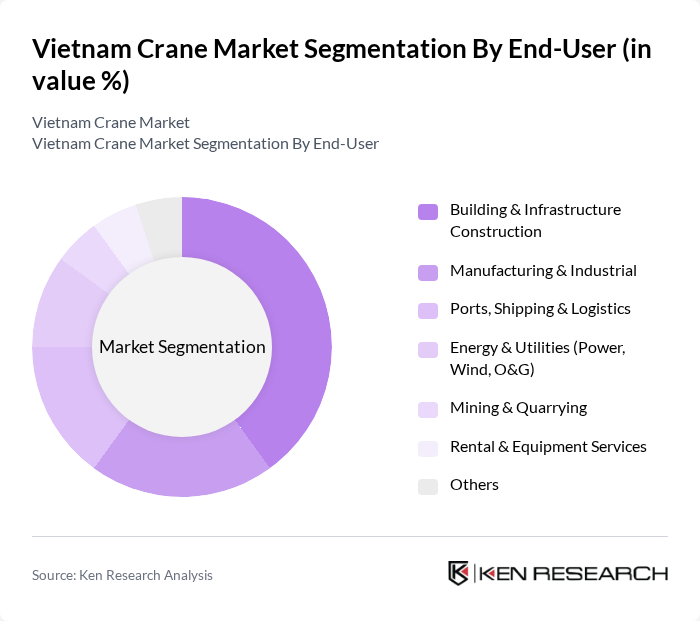

By End-User:The end-user segmentation includes Building & Infrastructure Construction, Manufacturing & Industrial, Ports, Shipping & Logistics, Energy & Utilities (Power, Wind, O&G), Mining & Quarrying, Rental & Equipment Services, and Others. Each end-user category reflects the diverse applications of cranes across various sectors, with construction and infrastructure as primary demand centers, and growing use in ports/logistics and manufacturing due to seaport upgrades and FDI-driven factory investments.

The Vietnam Crane Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tadano Ltd., Liebherr Group, The Manitowoc Company, Inc., Sumitomo Heavy Industries Construction Cranes Co., Ltd., XCMG Construction Machinery Co., Ltd., Zoomlion Heavy Industry Science & Technology Co., Ltd., SANY Group, Terex Corporation, Kato Works Co., Ltd., Konecranes Plc, Cargotec Corporation (Hiab, Kalmar), TIL Limited (Vietnam distributor/port handling partner), Doosan Bobcat/Doosan Enerbility (material handling & industrial), Hyundai Construction Equipment Co., Ltd., Liebherr-MCCtec Rostock GmbH (marine/offshore cranes) contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam crane market is poised for significant growth, driven by ongoing infrastructure projects and urbanization trends. As the government continues to invest heavily in transportation and construction, the demand for advanced crane technologies will rise. Additionally, the integration of smart technologies and automation in crane operations is expected to enhance efficiency and safety. Companies that adapt to these trends will likely capture a larger market share, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Cranes Tower Cranes Crawler Cranes Overhead/Bridge Cranes Gantry/Portal Cranes Rough-Terrain & All-Terrain Cranes Truck-Mounted Cranes Marine & Offshore Cranes Others |

| By End-User | Building & Infrastructure Construction Manufacturing & Industrial Ports, Shipping & Logistics Energy & Utilities (Power, Wind, O&G) Mining & Quarrying Rental & Equipment Services Others |

| By Application | Heavy Lifting & Erection Material Handling & Warehousing Construction Projects (Residential/Commercial) Infrastructure Projects (Transport/Ports) Maintenance, Repair & Overhaul (MRO) Others |

| By Sales Channel | Direct Sales (OEM) Authorized Distributors/Dealers Online/Inside Sales Rental & Leasing Services Others |

| By Distribution Mode | Wholesale/B2B Retail/Showroom Online Platforms/Marketplaces Direct Delivery/Project Supply Others |

| By Price Range | Low-End (Entry-Level) Mid-Range High-End/Premium Others |

| By Brand Preference | Domestic & Regional Brands International Brands Emerging/Chinese Brands Others |

| By Mobility | Mobile Static/Fixed |

| By Lifting Capacity | Light-Duty (<10 t) Medium-Duty (10–50 t) Heavy-Duty (50–150 t) Super-Heavy (>150 t) |

| By Region (Vietnam) | Red River Delta Southeast Mekong River Delta South Central Coast Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Project Managers | 120 | Project Managers, Site Engineers |

| Crane Rental Companies | 90 | Rental Managers, Operations Directors |

| Manufacturers of Crane Equipment | 70 | Sales Managers, Product Development Heads |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Officers |

| Construction Equipment Distributors | 60 | Distribution Managers, Sales Representatives |

The Vietnam Crane Market is valued at approximately USD 490 million, reflecting significant growth driven by the expansion of construction and infrastructure sectors, along with increased foreign direct investment in manufacturing.